- Europe-based wealth professionals based across 12 countries affirm “quality of service” as the most important criteria in selecting a preferred Wealth Assurance provider, also known as Unit-Linked life insurance or Private Placement Life Insurance (PPLI).

- The “ability to manage complex cases” ranked first when the same wealth professionals were asked what criteria would further enhance partnership satisfaction with Unit-Linked life insurance providers.

- Overall, there is a clear and significant demand for more holistic digital offerings.

For UK-based wealth professionals “technical expertise/ knowledge” is the most important criterion when selecting their preferred Unit-Linked life insurance provider according to the European Wealth Assurance Report from Lombard International Group, a market-leading provider of insurance-based wealth, estate and succession planning solutions for high net worth individuals, families and institutions. This is followed by “fast and efficient partner services” and “good relationships and communications with the insurance company’s team”.

This inaugural report, carried out in association with Accenture Luxembourg, offers an in-depth pan-European analysis of Unit-Linked life insurance, also known as PPLI or Wealth Assurance. Multifaceted, the Wealth Assurance industry is comprised of a variety of carriers, based out of a number of different jurisdictions around the world. These range from Unit-Linked life insurance pure players to larger multi-segment insurance companies with some focusing on a specific number of markets and others providing greater global reach.

Click here to learn more and explore The European Wealth Assurance Report.

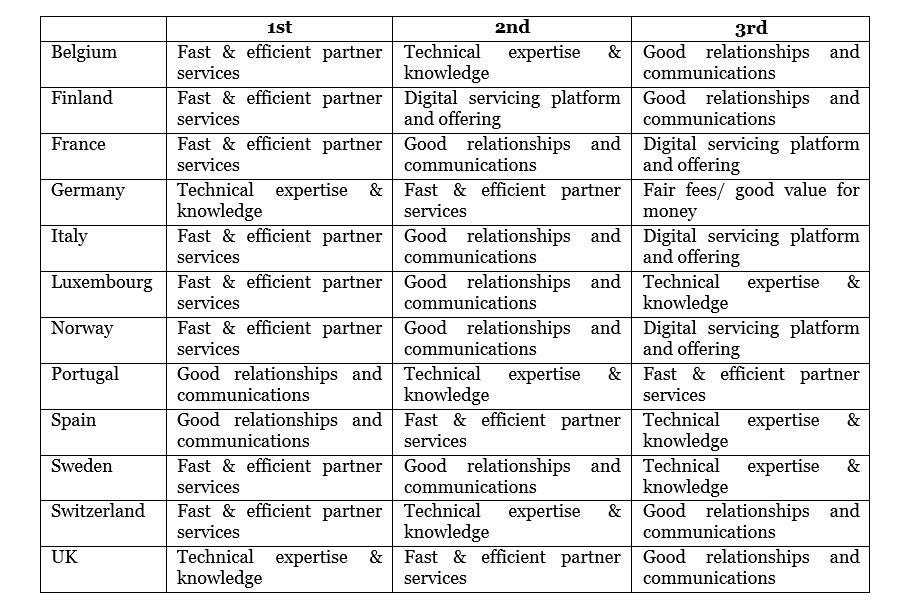

Looking at the wider landscape across Europe (see detailed chart below), it is “quality of service” that is by far the most important criterion when it comes to choosing a preferred provider. “Good relationships and communications”, followed by “technical expertise and knowledge” are second and third respectively.

Family Officers and Independent Asset Managers both selected “technical expertise/ knowledge” as their second most important criterion, with “good relationships and communications with the insurance company’s team” in third.

Jurgen Vanhoenacker, Executive Director, Business Development and Wealth Structuring commented: “Within such a dynamic market, expertise, service and operational excellence are key differentiators for wealth solutions providers when it comes to building strong and sustainable relationships with their partners and clients over the long term. The demand for efficient and tailored service is clearly evidenced by the wealth professional respondents who took our European survey. A client-centric mindset, as well as continued investment in innovation, talent and digital infrastructure are the foundations of a sound approach to service excellence.”

The findings of the survey also offer unique insight into the areas that providers should be improving on according to wealth management professionals. When asked about criteria that would enhance partnership satisfaction towards their unit-linked life insurance providers, the most important was an “ability to manage complex cases”, followed by “greater detail on the breakdown of fees charged to clients”, then “support on regulatory affairs”.

Independent Asset Managers position the “greater detail on the breakdown of fees charged to clients” as the most important criterion, followed by the “ability to manage complex cases” and “respect of deadlines”. Notably, “improving the speed of operational processes” is identified as a much higher priority by them than the sample average. This is similar among insurance brokers too, who also rank this criterion fifth.

It is evident that there is a significant demand for a more holistic digital offering. Wealth professionals, in general, across all countries, collectively ranked “digital servicing platform and offering on digital channels” as their fourth most important criterion. However, a number of specific markets stand out in their eagerness to drive the digital agenda. For example, Finland-based professionals ranked this criterion second, while those in France, Italy and Norway also find themselves as digital progressives placing the criterion third.

Wealth professionals’ top criteria per country for selection of Unit-Linked life insurer

Click here to learn more and explore The European Wealth Assurance Report.

METHODOLOGY

The survey was translated and distributed in seven different languages and sent to active wealth professionals across Europe. Composed of 24 questions and divided into 3 sections, the survey aimed to anonymously collect, analyse, and detail views and opinions to provide an overview of how insurance-based wealth planning solutions are perceived, used and considered across Europe, now and in the future.

The survey, carried out in partnership with Accenture Luxembourg, was in the field between 15 September 2020 and 31 October 2020, generating a sample size of 677 across 12 jurisdictions. As respondents were given the opportunity to skip some questions, the number of answers vary across the survey.

The top 5 geographical locations were Luxembourg (21%), Switzerland (15.3%), France (14.2%), Italy (13.8%) and Germany (9.4%). This resulting footprint is consistent with Lombard International Group’s footprint and network of trusted partners in Europe, which includes private bankers, independent wealth and financial advisers, insurance brokers, family officers, independent asset managers, and tax lawyers serving the needs of high net worth clients and families.

N.B. In those questions where respondents were asked to rank choices, a scale was offered, with 1 being the most important and 10 being the least important.