GlobalData, a leading data and analytics company, has revealed its global league tables for financial advisers by value and volume for the first quarter of 2020, which witnessed subdued deal activity worldwide due to coronavirus (COVID-19).

Goldman Sachs tops by value

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

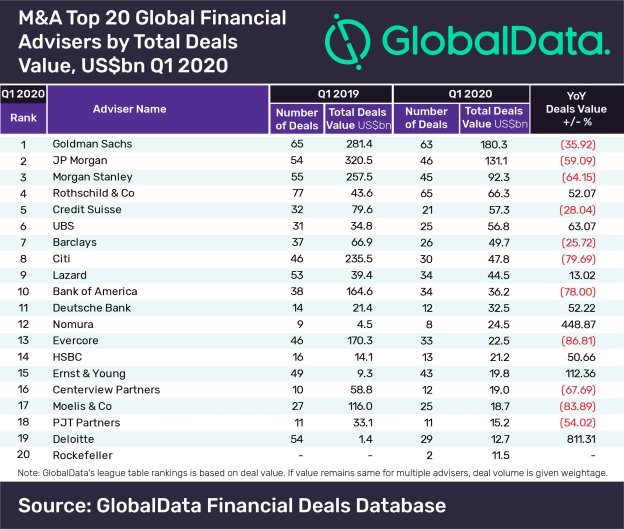

By GlobalDataGoldman Sachs has dominated the latest mergers and acquisitions (M&A) league table of the top 20 financial advisers based on deal value in Q1 2020.

The American investment bank advised on 63 deals worth $180.3bn, including the big ticket deal of Aon’s acquisition of Willis Towers Watson.

GlobalData has published a top 20 league table of financial advisers ranked according to the value of announced M&A deals globally.

JP Morgan took the second place with a total deal value of $131.1bn from 46 deals it advised during the period.

In third position was Morgan Stanley, which worked on 45 deals in Q1 2020 as against 55 in Q1 2019.

Rothschild & Co and Credit Suisse secured fourth and fifth positions, having worked on 65 deals worth $66.3bn and 21 deals worth $57.3bn, respectively.

Ravi Tokala, financial deals analyst at GlobalData, said: “Goldman Sachs and JP Morgan are the only two advisers which crossed $100bn mark in Q1 2020, in value terms, maintaining a significant lead over rest of the advisors in top 20.

“However, top three advisers Goldman Sachs, JP Morgan and Morgan Stanley saw a decrease of 35.92%, 59.09% and 64.15%, respectively, in Q1 2020 compared with Q1 2019. The subdued deal activity and market turmoil caused by COVID-19 led to decrease in number of megadeals (>$10bn) recorded in Q1 2020, only six such deals have been struck so far this year, down from nine in Q1 2019.

“Interestingly, Rothschild & Co and UBS recorded a growth of 52.07% and 63.07%, respectively in Q1 2020 over Q1 2019, with their involvement in two megadeals each.”

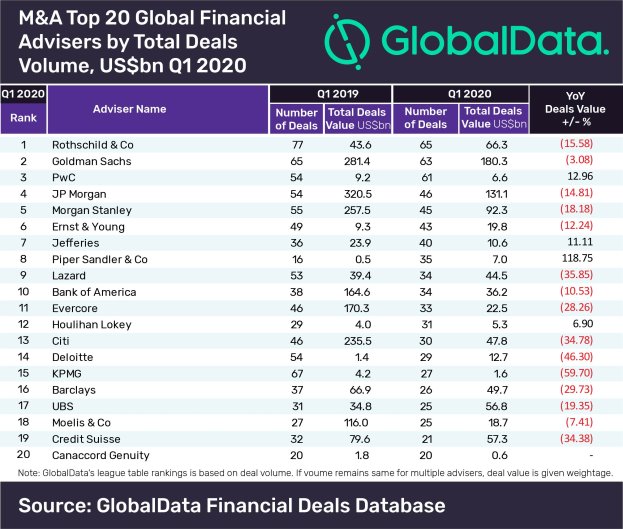

Rothschild & Co leads by volume

Rothschild & Co has dominated the M&A league table of the top 20 financial advisers based on deal volume in Q1 2020.

According to GlobalData, the UK-based investment bank advised on 65 deals worth $66.3bn, including the big ticket deal of Thyssenkrupp’s $18.7bn sale of elevators division.

Goldman Sachs stood at the second position with 63 deals worth $180.3bn. In third position was PwC, which advised on 61 deals worth $6.6bn.

JP Morgan and Morgan Stanley secured fourth and fifth positions, having worked on 46 deals worth $131.1bn and 45 deals worth $92.3bn, respectively.

Ravi Tokala said: “In terms of deal volume, Rothschild & Co emerged as the top financial adviser in Q1 2020. However, the UK based investment bank settled at 4th rank in value terms due to its involvement in only two megadeals (>US$10bn) and low-value transactions.

“15 of the top 20 advisers (by total deals volume) witnessed decline in advised deal volume in Q1 2020 compared with Q1 2019.

“The overall deal making of the top 20 financial advisors by deal count saw a decrease of 17.27% in Q1 2020, down from 886 deals in Q1 2019, which could be due to COVID-19 outbreak.”

A total of 12,605 deals were recorded globally in the first quarter of 2020, marking a 12.13% decrease from Q1 2019.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website