Morgan Stanley and DBS are among the companies best positioned to take advantage of future Covid-19 disruption in the wealth management & private banking industry, our analysis shows.

The assessment comes from GlobalData’s Thematic Research ecosystem, which ranks companies on a scale of one to five based on their likelihood to tackle challenges like Covid-19 and emerge as long-term winners of the wealth management & private banking sector.

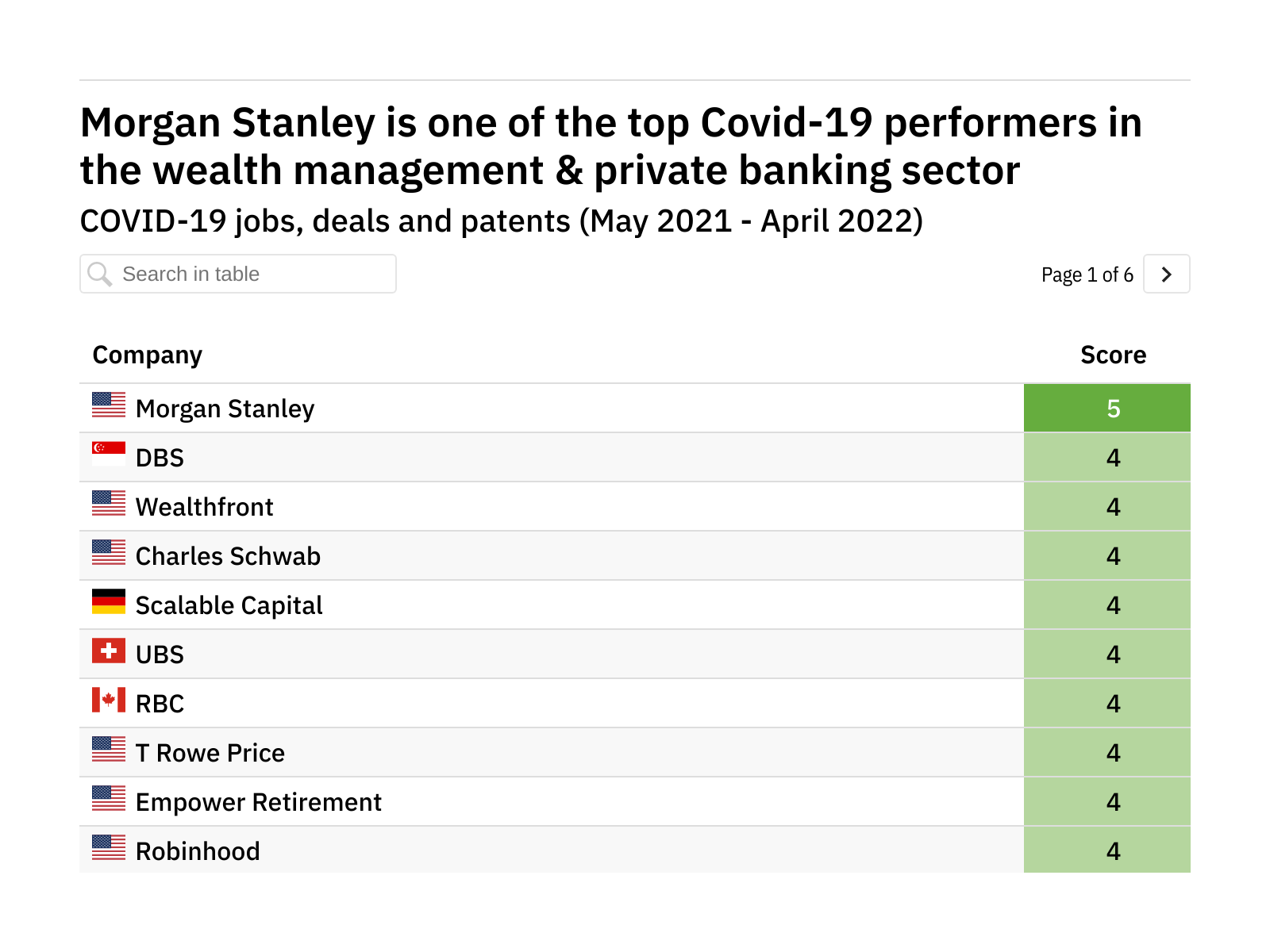

According to our analysis, Morgan Stanley is the company best positioned to benefit from investments in Covid-19, the only company with a score of five out of five in GlobalData’s Wealth Management Thematic Scorecard.

The table below shows how GlobalData analysts scored the biggest companies in the wealth management & private banking industry on their Covid-19 performance.

The final column in the table represents the overall score given to that company when it comes to their current Covid-19 position relative to their peers. A score of five indicates that a company is a dominant player in this space, while companies that score less than three are vulnerable to being left behind. These can be read fairly straightforwardly.

This article is based on GlobalData research figures as of 06 May 2022. For more up-to-date figures, check the GlobalData website.