With Trump getting ready for his inauguration today (January 20), the world is waiting to see what effect this will have on global markets. Is there going to be monumental change or slight adjustments? PBI asked the experts.

Many are expecting the focus to be on tariffs, but the US dollar and equities are set to grow as a result of Trump’s presidency. The second Trump administration could have a number of impacts on global markets post-inauguration, but what is most likely?

Cathie Wood, CEO, ARK Invest

The Trump Administration is likely to have a highly positive impact on the US equity market during the next year and beyond. In fact, President Trump often references economic activity, employment, and the stock market as gauges of government policy success, and he has stated that his goal is to lead one of the most successful administrations in history.

Believing that taxes and regulation have stifled smaller businesses—the backbone of employment in the US—the Trump Administration is likely to convince Congress not only to preserve the tax cuts scheduled to expire by year-end, but also to cut other business and individual tax rates and deregulate industries in which large corporations have armed lobbyists and benefitted from “regulatory capture” at the expense of small- to midsized companies.

As a result, the bull market in equities is likely to broaden out from just a few cash-rich, large cap stocks to a broad swath of stocks that have been hampered by the supply shocks, the record-breaking burst in interest rates, and the rolling recession that have characterised the last four years.

While a broad-based expansion is likely to curb the Federal deficit as a percent of GDP, DOGE—the Department of Government Efficiency—could change the deficits trajectory more fundamentally and convincingly. Elon Musk has stated that government spending is taxation: to pay for spending, taxes must increase today, in the future, or through inflation, the most regressive tax of all. One of ARK’s core principles is that crafting a winning solution requires us to discern the problem with precision. The prospect of lower deficits should allay fears in the bond market, helping to relieve pressure on the 10-year Treasury bond yield and bring it to a level determined more purely by real GDP growth and inflation.

In the context of stronger and broader-based growth, the biggest surprise could be lower-than-expected inflation. The consensus view today is that rapid real growth will cause inflation; we believe that history suggests otherwise. From the beginning of the Reagan Revolution in the early eighties until the end of the tech and telecom bubble, inflation fell in tandem with rapid real growth.

Why? Disciplined monetary policy and fiscal policy, rising productivity growth associated with the explosive growth of personal computers, and the strength of the dollar all worked in tandem to drive inflation down.

In our view, those four variables are moving in the same direction today as they were moving during the eighties, perhaps more dramatically. The technology revolution promises to keep monetary policy honest—think bitcoin and other crypto assets. DOGE and deregulation should inspire animal spirits in the private world to compete more aggressively against large companies that have been protected by regulation and other government intervention. Indeed, deregulation should cause a resurgence in mergers and acquisitions (M&A), reintroducing into the equity market “price discovery” as strategic buyers target innovative companies that have been starved for capital by overly zealous antitrust regulators. The emergence and convergence of breakthrough technologies like artificial intelligence, robots, energy storage, blockchain technology, and multiomics sequencing are likely to drive sustained productivity gains—in both the private and the public sectors—to unprecedented levels.

Furthermore, in response to an increase in the return on capital in the US relative to that in other countries, the US dollar should continue to strengthen. Indeed, as the odds of a Trump victory improved last year, the US dollar gained momentum.

Uncertainty during the transition could add to the wall of worry that has kept the markets on edge recently. Will tariffs trigger another bout with inflation? We think not: instead, those tariffs should be selective and incremental, their discrete effects ultimately displaced overwhelmingly by tax cuts, deregulation, and dollar appreciation. Indeed, we believe the market is likely to discount a successful Trump Administration, which could turn out to be one of the most successful administrations since the Reagan Revolution.

Konstantin Oldenburger, market analyst, CMC Markets

Shortly before the swearing-in of Donald Trump as the 47th president of the United States of America, the indices on Wall Street and in Frankfurt are jumping – fear and caution don’t look like this. The DAX rose to over 20,900 points, adding around 1,000 points or five per cent to its gain in the first two weeks of the year. Not a bad result for a market whose economy could soon be targeted by punitive tariffs and other adversities.

No one knows today how Trump, who calls himself the ‘man of tariffs’, will implement his trade strategy. His plan is to use tariffs to punish both opponents and allies for what he considers to be unfair trade practices and to generate additional revenue. Ultimately, however, they are more likely to create an effective means of exerting pressure in negotiations.

Looking at the stock market, however, it seems that investors are not particularly bothered by this, despite some initial uncertainty. Rather, hopes are being raised that there could be significantly better cooperation, particularly with China. In combination with the now more likely interest rate cuts by the Fed, this would of course be positive for the stock market, which explains the current rally in the DAX, but also in the US indices.

This, in turn, could help to boost the global economy and also to normalise the US trade deficit to some extent. So once again, the lesson to be learnt is not to take every step or every statement at face value as an investor, but to wait for the actual decisions.

Daniel Casali, chief investment strategist, Evelyn Partners

When you consider the impact on markets of potential policy changes from the incoming US president, the game of ‘Top Trumps’ could be an apt way to determine how investors should navigate the months ahead under the new US premier. First released more than 40 years ago, Top Trumps uses cards that contain a list of numerical data based on various themes, such as cars, boats and aircraft. The aim of the game is to beat your opponent’s card by comparing values and using probabilities.

Investors can take a similar approach in using financial and economic metrics to find the Top Trump market opportunities as Donald Trump takes office to become the 47th US President. Considering the post-pandemic recovery dynamics of the last few years, 2025 will see relatively solid global economic growth, policy easing and further technological innovation.

On growth, Bloomberg’s survey of economists forecast global real Gross Domestic Product (GDP) to expand by 3% in 2025, roughly in line with the long-term average. Leading the way is the US economy, where president-elect Trump is likely to bring in tax cuts and introduce significant deregulation.

While the start to the year was marked by a sell-off in Treasuries and UK gilts, better-than-expected inflation data on both sides of the pond has led to a rally in bonds on the day. The UK inflation data for December came in lower than forecast at 2.5%, and while the US monthly rate was in line with expectations, rising to 2.9% in December, the core number, which strips out more volatile items such as food and energy, came in slightly lower than expected. This may bode well for further rate cuts from both the Federal Reserve and the Bank of England in the coming months.

Vince Truong, American financial adviser and partner, GSB

We’re already seeing what the impact of the Trump administration will have on global markets. US equities are a whirlpool sucking assets away from other countries as market participants largely expect pro-growth policies in the US. This is one among other reasons why US equities outperformed last year, and especially post-election.

Moreover, the US Dollar is strengthening as assets move into the US and trade in the US. It’s also in anticipation of potentially higher tariffs, leading to higher inflation, leading to higher interest rates and thus a strong dollar. So, the market is frontrunning these events.

For the US economy, in the near term, Trump’s policies on lower corporate and individual taxes is pro-growth and should strengthen companies and households, especially those with assets, provided that the tariff policies are not too jarring or disruptive.

The impact of higher tariffs on the investment markets will depend on how gradual and surgical they are. If they’re a sudden sledgehammer, that will have at least a short-term negative impact, likely causing a dip or correction (5-10% drop). But if they are surgical, measured and gradual, then the impact should be nominal. As we don’t know the nature of the tariffs it would be best to temper excitement during what will be a period of short-term volatility to better assess what actually gets enacted.

Susannah Streeter, head of money and markets, Hargreaves Lansdown

Some of the turmoil we’ve already seen on financial markets is likely to continue as speculation swirls about Donald Trump’s trade policies once he’s back in the White House. There’s inevitably a lot of focus on what the impact could be for the global economy when higher tariffs are introduced. UK investors should brace for some volatile patterns of trading on the financial markets.

However, it’s important to remember that investing takes endurance and patience and that the stock market has historically risen over the long term. However, it’s never been a perfect line upwards. There have been and will continue to be plenty of ups and downs along the way. Investors should remember that it’s time in the market, rather than timing the market that can make all the difference to the success of an investment portfolio. If you take a look at the FTSE All Share, which includes the FTSE 100 – FTSE 250 and FTSE small cap index and is considered to be best performance measure of the London equity market. Over the last ten years it’s had lots of bumps in the road. However, studies show that in 91% of 10-year periods in the last 123 years equities have outperformed cash.

Trump’s plans raise inflationary risks around the world

US exporters are likely to be hit by higher tit-for-tat duties in return if Trump introduces widespread tariffs. It’s likely that fresh round of trade wars will be inflationary as the higher tariffs feed through to higher prices for goods in American shops. This, in turn, may add to clamour for higher wages. Already concerns that this will drastically limit the Federal Reserve’s capacity to bring reduce interest rate has rattled bond markets, pushing up government borrowing costs.

If widespread tariffs are introduced, the mighty dollar could strengthen further, which risks importing inflation to other countries, including the UK. Many imports used in an array of goods which are bought on wholesale markets are priced in dollars , which will be more expensive if the greenback takes on more muscle. This could push up the prices of an array of some products on the shelves. If countries hit back with tariffs on imports from the US, that could also push up consumer prices. The risks of that happening in the UK are low, particularly given that Britain’s trade with America is focused on services, where tariffs are unlikely to be imposed.

Interest rate decisions could be affected at the Bank of England

Policymakers at the Bank of England will be assessing the potential inflationary risks ahead which a new Trump presidency is likely to bring. Government borrowing costs have risen due to spikes in gilt yields, as interest rates are expected to stay higher for longer, putting the Treasury in a tight spot.

However, if Rachel Reeves is forced to bring in spending cuts or further tax rises, or if there are other detrimental effects of Trump’s tariffs to UK output, it may prompt the Bank of England to cut interest rates a little faster this year, than financial markets are predicting. There is also a chance that tariffs are not as punitive as the markets currently expect. If the polices are more targeted, inflationary risks could subside in the US and further cuts could be priced in, which would help calm the bond markets.

As far as mortgage rates are concerned there has already been a very small rise in the rates being offered, following the drama in the bond markets. There is a risk they could rise a little further from here amid the uncertainty, but once the Bank of England start cutting rates again, they are likely to fall back. The better savings rates being offered may also hang around for a big longer, but there are also set to disappear once policymakers vote for a rate reduction, so it’s worth locking into a good deal sooner rather than later.

Impact on equity portfolios

Trump’s tariffs may help manufacturers focused on the US domestic market, such as car makers General Motors and Ford. Tariffs on big Chinese e-commerce players would also be a benefit to Amazon but also retailers with a big online presence like Walmart. Smaller US companies may also be beneficiaries, as they benefit from US supply chains being beefed up.

If the Fed, as expected, goes slow with rate cuts, the elevated interest rate environment may prove beneficial to the US financial sector, as it would boost net-interest margins, and bring in more money, with banks like Wells Fargo, Bank of America, as well as smaller lenders potential beneficiaries. Trump is also expected to be keen for more de-regulation in the financial sector, having already presided over a loosening of standards when it came to maintaining specific levels of capital. This may make it easier for banks to loan out more money in the short term – but could lay the sector open to more risks longer term, particularly in the advent of another financial shock to the system.

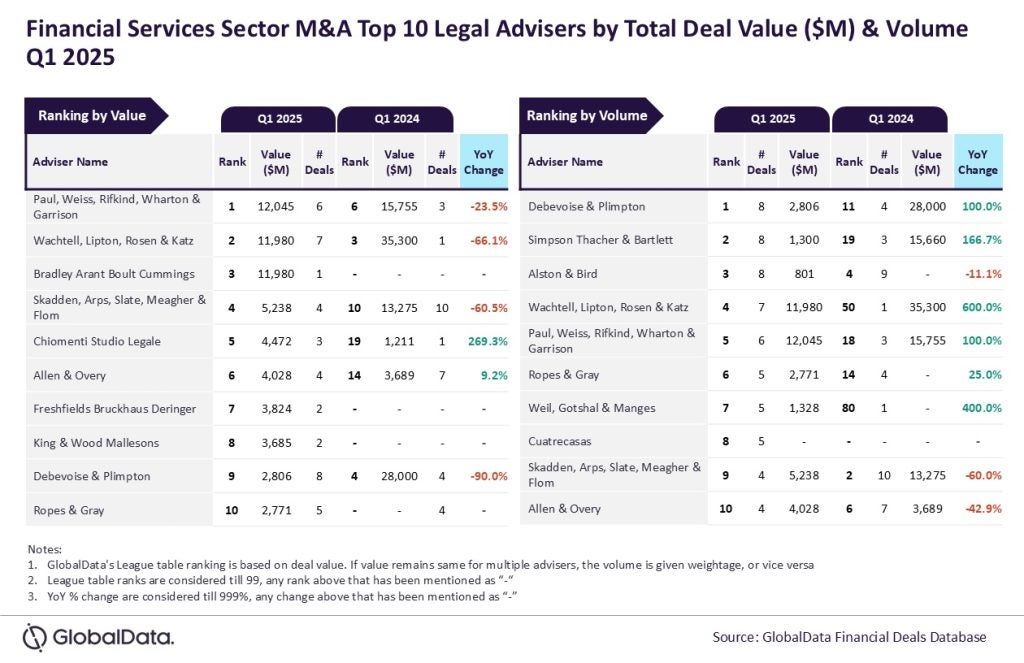

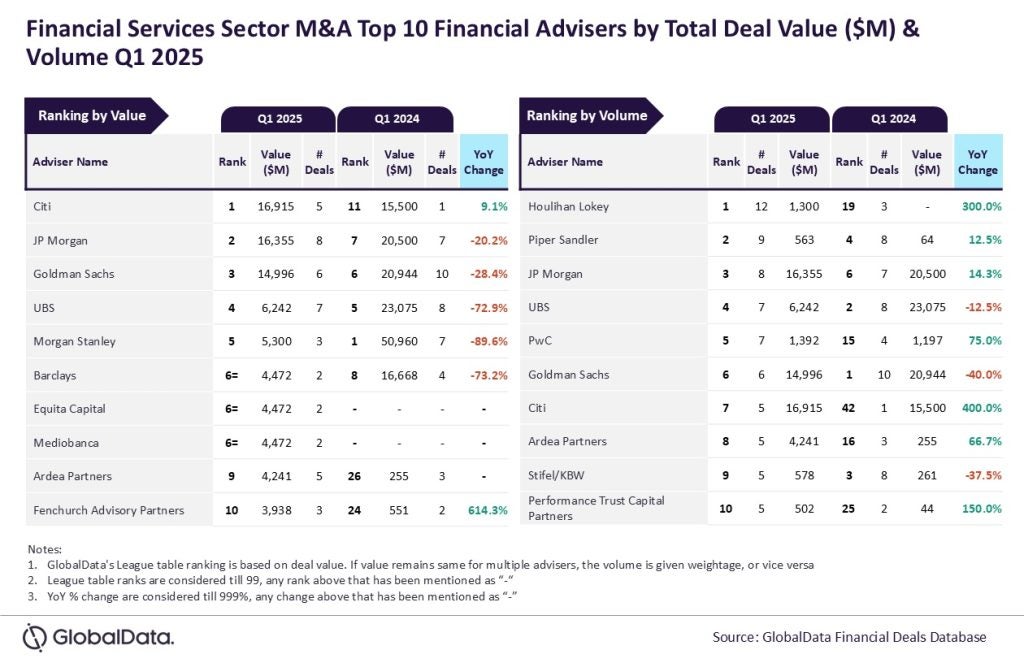

If Trump comes to power on a pro-business anti-regulation platform, there may be less rigorous enforcement of anti-trust rules which could lead to an upswing of M&A activity. This could benefit the major investment banks like Goldman Sachs and JP Morgan who are involved in dealmaking.

Companies operating in the gig economy have been under pressure during the Biden administration, with new rules put forward to make it more difficult for companies to classify workers as independent contractors rather than employees. Lighter touch regulation of the labour market under a Trump administration could benefit companies like Uber and Doordash, which are reliant on armies of the self-employed.

The main worry gripping the bond market is that a big swathe of US tariffs will stoke the embers of inflation and fan consumer prices. This has the potential to tie the Fed’s hands and limit interest rate cuts in the US even further this year. This is weighing on growth stocks, such as technology companies in particular, given that a higher rate environment pushes down the value of their future earnings. These concerns have been weighing on the so called Magnificent Seven companies on Wall Street, , but if Trump’s tariffs are less onerous and don’t lift consumer prices as much as forecast, there could be a rebound in the technology sector.

US drilling could help push down oil prices

Given the ‘America First’ mantra, another Trump Presidency is likely to place emphasis on energy independence and continue the increased pace of drilling permits, which has taken place under the Biden administration. Trump has vowed to accelerate the production of fossil fuels and roll back some of Biden’s greener policies in the inflation reduction act. The perception that Trump will be more pro-oil is set to boost the fortunes of the big energy giants like Exxon Mobil. The super-major is deeply involved in all stage of the energy lifecycle, from exploration to refinery and sales. Oilfield services supplier Schlumberger and equipment provider Baker Hughes should also be well placed to benefit if drilling picks up again.

Prices at the pumps risk been creeping up again after gains in crude oil due to fresh supply concerns prompted tougher sanctions on Russia. However, if the US produces more oil, it would boost supplies on world markets and potentially help lower prices. This is unlikely to happen in the short term, and energy companies may still be cautious about ramping up production, keen to ensure there’s the right balance of oil on world markets to stay profitable.

President Trump has been critical about the way NATO has been funded and has demanded other members start allocating much bigger parts of their budgets to defence. If he comes to power, it’s likely these calls will intensify and, unless they are met, there is the risk that the core commitment to the principle of collective security could be diluted. It’s likely that defence spending will be increased across the NATO alliance, which is set to benefit companies with ongoing military contracts. Listed aerospace stocks are among those that might benefit from a fresh round of investment into bolstering armed forces.

Gold prices set to stay elevated

Trump returns to the White Houe as geopolitical risks remain high in the Middle East and the Russia/Ukraine situation is still unresolved. In times of uncertainty one investment which tends to do well is gold which has had a stellar run in 2024. While returns may not continue at this pace, the uncertain outlook, combined with increased buying from central banks, particularly in emerging markets, means that the commodity could continue to enjoy support.

Bond prices under pressure

Bond prices have come under pressure, and may continue to do so, but bond investors should not panic. Investment objectives should usually focus on longer-term objectives, and shorter-term volatility is to be expected. However, it’s worth investors reviewing where they’re invested and whether the split between shares and bonds is still what they want, given their objectives.

Rebalancing is a good investment habit to get into as it forces investors to sell things that have done well and buy those that have haven’t. That can seem illogical on the face of it. But it’s rare for something that has performed strongly to continue to perform strongly, especially over the long term.

You might think that yields could go higher, and you might want to try to time the peak in yields. That’s difficult to do and markets can move quickly, so it could backfire if yields suddenly reverse their current trend. Tactical changes to an investment portfolio, in the hope of a short-term profit, are almost certainly better to left to the professionals. Investors should consider holding multi-asset investment funds as part of their portfolio for this purpose.

Daniele Antonucci, chief investment officer, Quintet Private Bank

Tariffs could be enacted as soon as today, with Donald Trump expected to sign executive orders after taking office. We think tariffs are likely to be a negotiation tool rather than a goal. After all, Trump’s negotiation strategies, outlined in his book The Art of the Deal, emphasise boldness, preparation, leverage, publicity, and persistence. Moreover, with a more pro-business team than in Trump’s first term, the policy tone may be more balanced but still driven by “America First.”

Raising tariffs too quickly risks stalling growth with rising prices, countering Trump’s goals to boost growth and control inflation. The inflationary impact will depend on tariff size and scope. High US reliance on imports suggests tariffs may be inflationary. The effect could be offset if domestic industries absorb the costs. However, it’s worth noting that a strong US dollar reduces import expenses.

While tariffs may have a neutral impact on the US economy, they could strain relations with affected countries like China, Mexico, Canada, and Europe, and are likely to be negative for these economies. Due to the risk of tariff rises, we don’t hold any tactical positions in European or emerging market equities. We’ve also adjusted the protection against equity drawdowns in Europe we’ve held, to increase the reactivity to these potential negative events the European equity market faces over the short term.

From an investment perspective, we maintain an equity overweight, with a preference for US equities. Still-strong US growth supported by an AI investment cycle and the Fed rate cuts are positive catalysts. Meanwhile, risks of higher inflation made us swap shorter-dated inflation-protected bonds with longer-dated ones.

The US dollar performed well in late 2024 relative to the euro and pound sterling, thanks to the strong US economy and expectations of Trump’s election win. Markets believe his policies will boost growth, especially compared to the weaker Eurozone and UK. This has driven demand for the dollar, with many positive developments already factored in, while negative news is priced into the euro and pound sterling. As a result, a stronger dollar versus these other currencies has been a popular trade.

However, while dollar strength in the near term is our base case, the risk is that this might not last throughout 2025. We think the dollar is currently overvalued and overbought, and Trump may face challenges in fully delivering his growth and inflation promises. Even with scaled-back policies, a larger fiscal deficit is likely, which could weaken the dollar at longer horizons. If Trump fully implements his agenda, it might put even more downside pressure on the US currency.

Meanwhile, Europe’s situation could surprise us. With expectations already low, there is room for better-than-expected outcomes. In particular, the Eurozone economies are especially competitive against the strong US dollar, and the euro is near its 2022 lows despite no energy crisis. The political uncertainty in Europe may also ease. In Germany, a grand coalition could slightly relax strict fiscal rules. France’s situation is less clear, but fiscal consolidation could be delayed, supporting growth.

In short, the US dollar may stay strong in the short term but give back some value as 2025 progresses. At the same time, the euro might gain from improving conditions and reduced uncertainty. This sets the stage for a shift in currency dynamics (with the pound sterling moving more sideways at this stage). But the balance of risks remains in favour of a strong US dollar.

Nina Stanojevic, senior investment specialist, St. James’s Place

As the upcoming presidential inauguration approaches, we recognise the significance of this transition and its potential impact on the markets and economy. Despite the uncertainty surrounding the future direction of the new administration, investors should avoid making any immediate portfolio adjustments in response to this political development. Historically, markets have shown resilience across political transitions. Reacting to short-term political shifts introduces unnecessary risk and often undermines long-term returns. Investors should remain disciplined and avoid reactionary moves that could detract from sustained growth.

There are several key developments that could shape the economic and market landscape in the coming months:

- Policy Direction and Fiscal Stimulus: We’re watching for clarity on fiscal policies, infrastructure spending, and tax reforms, which could impact different market sectors and economic growth.

- Regulatory Changes: Adjustments in regulatory frameworks, especially in technology, healthcare, and energy, could create both risks and opportunities for investors.

- Global Trade Relations: Shifts in international trade policies will be critical in assessing global market dynamics and supply chain impacts.

- Economic Recovery and Inflation Trends: Post-pandemic recovery, labour market health, and inflationary pressures remain key factors in our outlook.

- Monetary Policy: The Federal Reserve’s approach to interest rates has the potential to influence market performance.

Within this environment, we see compelling opportunities in historically underperforming asset classes like small-cap stocks and emerging market equities. Small caps are trading at exceptionally low valuations, which places them in a positive position for strong rebounds. Similarly, EM equities are poised for growth, with compelling valuations supported by structural trends such as urbanisation and favourable demographics. Additionally, bonds continue to offer attractive yields and defensive qualities, serving as a vital counterbalance to equities amid market uncertainty and volatility.

As the new administration begins its term, the potential for unexpected policy shifts and geopolitical developments increases the risk of extreme market events. In this environment, broad diversification should remain a cornerstone strategy – not just for protection against volatility but also for capturing mispriced investment opportunities that support long-term growth.

Seamus Rocca, chief executive officer, Xapo Bank

As we approach President-elect Donald Trump’s inauguration, the Bitcoin community is eager to see how he delivers on his bold message from Bitcoin Nashville—that the United States should be embracing this transformative industry. Trump’s acknowledgement of Bitcoin’s potential and his calls for American leadership in the space have sparked renewed optimism across the market.

2025 is shaping up to be an exciting year for crypto, with the US facing a pivotal moment. The market is keenly watching for progress not just on regulatory clarity but also on how the administration might view Bitcoin as a strategic reserve asset. These moves could redefine the US’s position in the global digital asset landscape.

With Europe leading the way through frameworks like MiCA, the US has some catching up to do. The first 100 days of this administration will be critical in laying the groundwork for common-sense regulation that supports innovation and strengthens Bitcoin’s role in the financial ecosystem. We’re looking forward to seeing how the US can capitalise on this moment and lead the charge toward a Bitcoin-powered future.