Remembering the customer churn the global financial crisis caused, wealth managers should take the ten year anniversary of the collapse of Lehman Brothers as an occasion to connect with their customers and wealth management trends.

The 2008 crisis has led to significant churn in the industry as wealth managers – at least in part – have taken the blame for lost portfolio value.

The fundamental trust between investors and advisers frayed, and a decade on, wealth managers are still working to rebuild it.

Whether or when another crisis will shake markets remains debatable. Yet, the S&P 500 index’ last low was in March 2009, making it the longest bull run in history. This suggests that we are in for a significant correction at least.

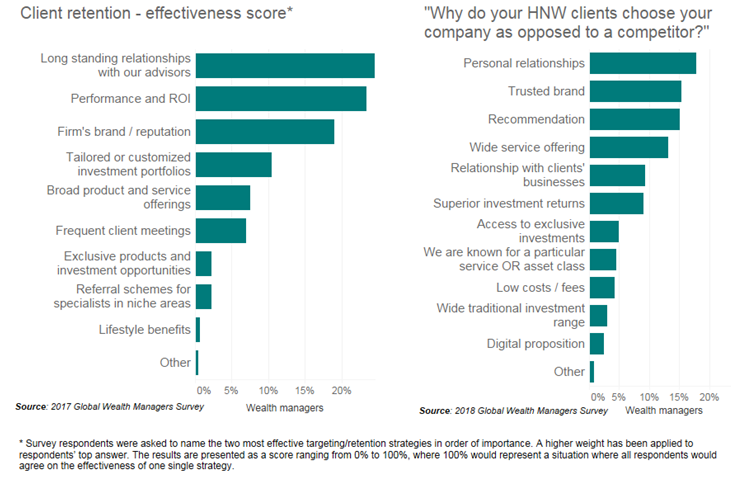

Given that a good return on investment continues to be one of the most effective retention tools, according to the GlobalData 2017 Global Wealth Managers Survey, clients are – once again – likely to jump ship and switch providers should the returns they have grown accustomed to not eventuate.

Wealth management trends:

Communication with clients is key

To counteract this, communication is key. Clients who understand the effects that external forces have on portfolio performance, and who believe that their adviser is actively monitoring the situation, are less likely to blame their wealth manager should returns fail to impress.

This means wealth managers who proactively reach out to clients are less likely to lose clients to competitors should markets turn sour.

Furthermore, brand building on a corporate level has to become more important.

Clients put trust in a brand

Data from our 2018 Global Wealth Managers Survey shows that a trusted brand is one of the top reasons why HNW investors chose their wealth manager over a competitor.

Providers whose brand is able to convey an image of strength and integrity in times of crisis will be able weather the storm more effectively and not only benefit from higher retention rates but customer inflows from those wealth managers not so diligent.

Indeed, data from the survey further shows that a greater proportion of wealth managers regard a financial crisis as an opportunity as opposed to a threat. At any rate, it will be those wealth managers able to make the best out of a bad situation and seize the opportunity that do not only focus on damage control once the sentiment turns, but those that pursue a proactive communication strategy and make brand building an ongoing priority.