Any discussions about private banking hubs in Asia Pacific will inevitably gravitate towards Singapore and Hong Kong; rarely will they focus on the HNW market in New Zealand.

However, strong wealth growth, a strong economy, investors’ burgeoning appetite for planning services and novel options such as robo-advice, and the growing importance of niche segments provide ample opportunities for global wealth managers in New Zealand’s wealth market.

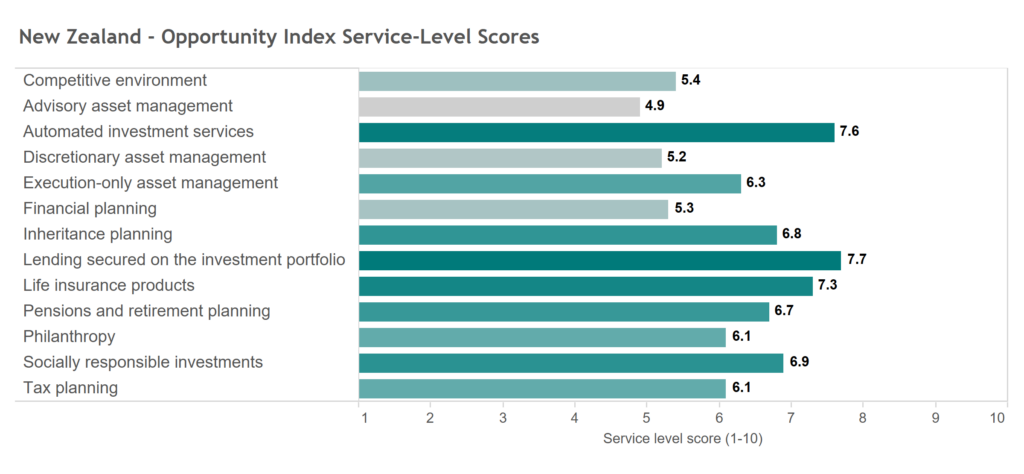

The private banking market in New Zealand is well developed, but wealth managers that are aware of the local makeup of the high net worth (HNW) market will find it to be highly profitable. Our proprietary Wealth Management Service Opportunity Index, which rates the potential for additional wealth management business across 28 markets and 10 different services, sees New Zealand come in first.

As the HNW market continues to grow at a robust rate, we expect demand for all wealth management services to increase. Over the coming four years, the number of HNW individuals is forecast to record an average annual growth rate of 6%, with another 6,000 individuals expected to qualify as HNW – an impressive number for a small, developed market.

Contributions to the national retirement scheme, KiwiSaver, continue to rise year on year, with inflows for fiscal 2019 growing by 10.1% according to Inland Revenue, boosting potential assets under management as well. This will support demand for advice and planning services as well as different types of investment mandates going forward.

According to the Index, the largest opportunity lies in automated investment services. Already strong HNW demand is expected to rise notably over the coming 12 months with a forecast +69% net increase, while the supply of robo-advisers that are suitable for HNW investors remains low. Furthermore, 69% of industry participants in New Zealand agree that a sophisticated robo-adviser proposition is a prerequisite in order to appeal to younger HNW individuals, while a negligible 1.9% disagree.

In fact, targeting the next generation of HNW investors or inheritors provides another significant opportunity, as the centre of wealth gravity in the country will shift towards the younger generations in the future. 55% of New Zealand HNW investors are above the age of 60 (compared to 48% globally).

On the one hand, this highlights the latent inheritance planning opportunity. On the other hand, it highlights the need to align one’s proposition with the service requirements of the next generation, given that 28% of HNW investors globally switch providers when inheriting. And in fact, after automated investment services and secured lending, our opportunity Index assigns the highest score to inheritance planning and socially responsible investments – a service notably more important to the next generation of HNW investors than the current.

As a wealth market, New Zealand is not a wealth manager’s traditional choice. However, providers that are able to tailor their product and services suite to the country’s changing demographics will find the opportunity to be sizeable and more lucrative than other more high-profile but competitive markets.