Baby boomers and older consumers may not be as digitally-savvy as the younger generations, but they still want digital investment services GlobalData finds.

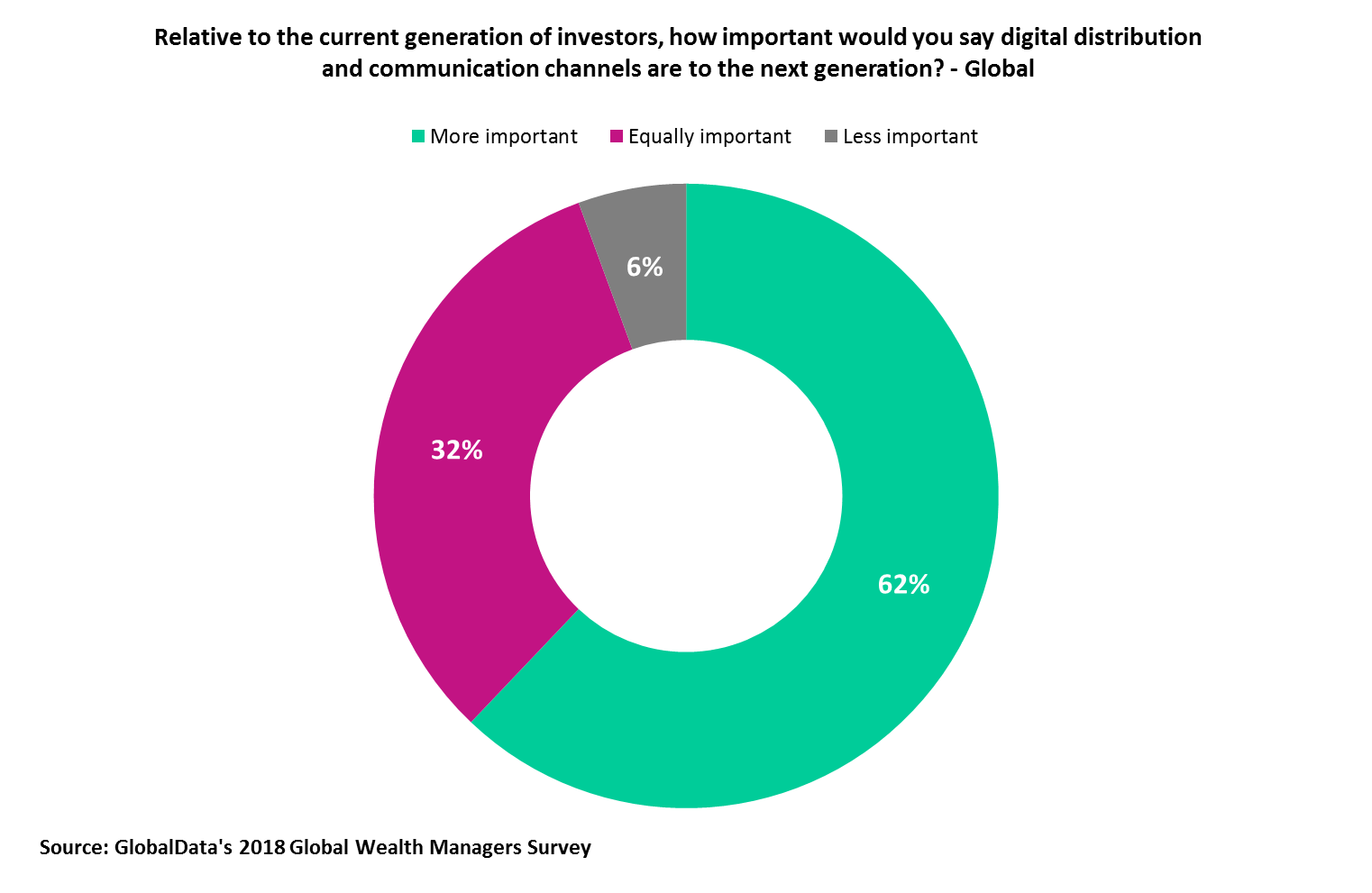

According to GlobalData’s 2018 Global Wealth Managers Survey, the majority of wealth managers believe that digital services are more important to the next generation of clients than the current investor base.

However, 32% of wealth managers believe it is equally important to all generations, which shows that targeting digital services exclusively at the younger demographic will be self-defeating for wealth managers.

Not being as digitally-savvy as the younger generations is different to being digitally inept, particularly in today’s world. Digital investment products that are presented to older clients need to be explained at a level they understand, whether they are an expert or beginner. One size does not fit all here, and care needs to be taken that apps and websites are tailored to offer a great user experience.

Not being as digitally-savvy as the younger generations is different to being digitally inept, particularly in today’s world. Digital investment products that are presented to older clients need to be explained at a level they understand, whether they are an expert or beginner. One size does not fit all here, and care needs to be taken that apps and websites are tailored to offer a great user experience.

One example is UK fintech Evalue, which recently launched a robo-advisor specifically for clients approaching retirement age. Customers have the choice of receiving automated, hybrid, or pure face-to-face financial advice, accommodating a range of digital comfort levels. This fits with trends we have seen globally among mass affluent baby boomers and the older generations, who are increasingly using online methods when communicating with their advisors.

It is fair to say that every generation will welcome a good and intuitive user experience, whether it is digital or not. It is incumbent on wealth managers to provide this. As technology infiltrates the wealth industry, in order to gain engagement from all clientele and maximize business volumes, wealth managers must cater to the diverse levels of digital proficiency among wealthy individuals.