Technology has made a noteworthy impact in the wealth space. An omnichannel approach is no longer optional as investors expect a seamless investment approach spanning digital and traditional channels, says GlobalData.

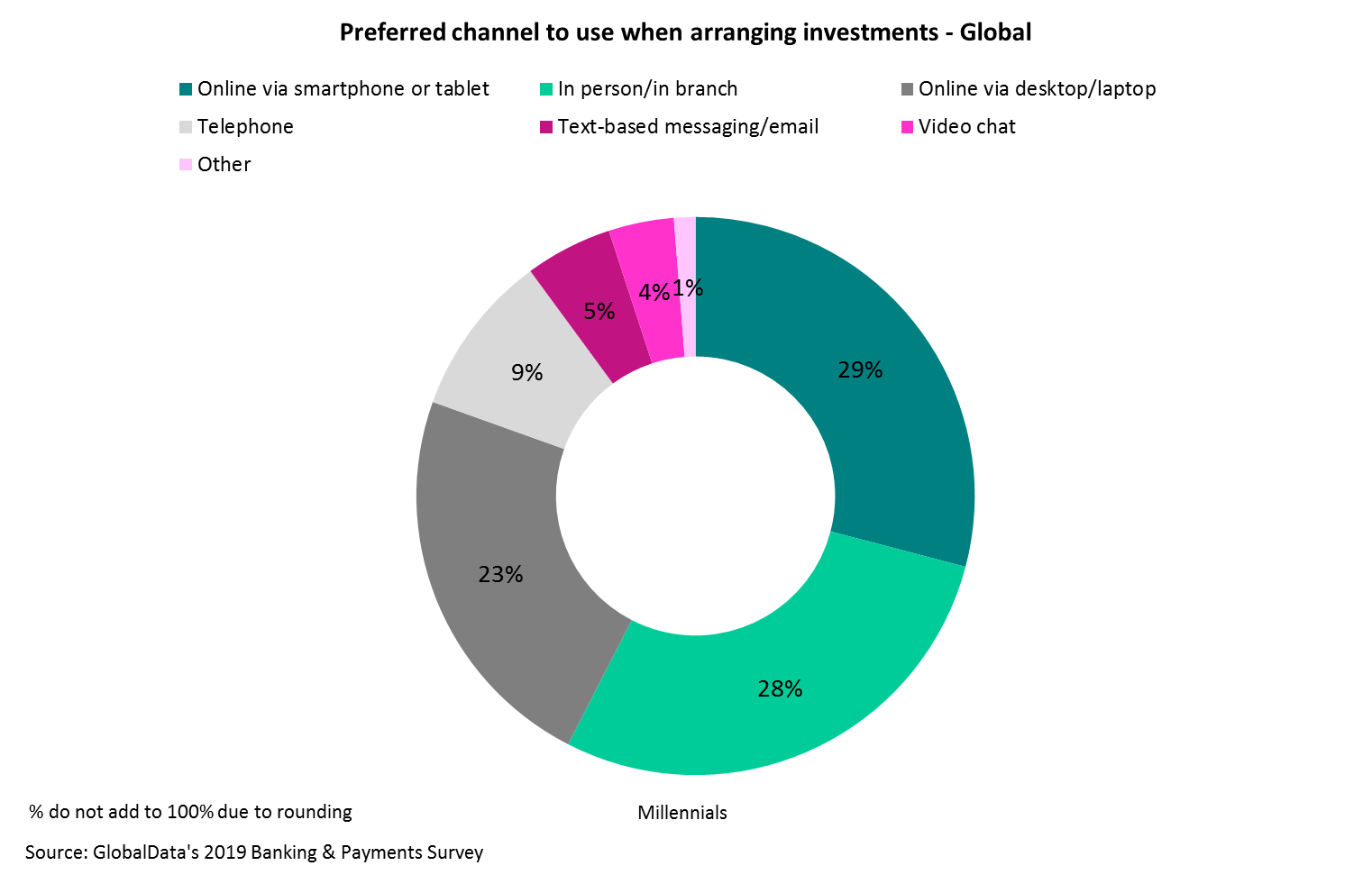

As per GlobalData’s 2019 Banking and Payments Survey, 29% of global mass and emerging affluent investors prefer arranging their investments online, particularly through their phone or tablet, rather than on a desktop. This means wealth managers need to provide a well-functioning, user-friendly mobile app or platform for consumers to use.

Several digital channels have emerged across the industry in the past decade or so, courtesy of both incumbents and new starters, so the industry is rightfully embracing the channels that customers require. However, it is now at the stage where doing so is becoming a must as millennials are about to take over as the largest economically active cohort.

Several digital channels have emerged across the industry in the past decade or so, courtesy of both incumbents and new starters, so the industry is rightfully embracing the channels that customers require. However, it is now at the stage where doing so is becoming a must as millennials are about to take over as the largest economically active cohort.

Yet, whilst digital channels are growing in their usage, they will not replace face-to-face communication just yet. A significant proportion (28%) of millennial investors still demand human interaction when arranging investments, so market players will need to provide customers with the best of both worlds.

In order for wealth managers to retain wealth and continue growing assets under management, all boxes should be ticked regarding the desires of the millennial and younger generation. Focusing on one type of service will be a risk and could see inheritors turn to those that provide more choice.

Over the coming 10 years, $8.6tn of global high-net-worth wealth will change hands. The next generation has communicated a strong demand for digital channels, amongst other products and services that their parents may not have desired. Meeting this demand will be critical for sustainability.