UK’s ultra high net worth individuals (UHNWI) are turning to US real estate following a 40% surge in returns in 2012, says the Stonehage Group.

The multi-family office said US real estate represents the largest proportion of a typical UHNW family’s portfolio of its clients, accounting for between 8-10% of invested assets.

In many cases, said Stonehage, UHNWI’s exposure to US real estate is almost double than that allocated to other alternative investments such as gold or commodities, which sit at around 4% of client’s invested assets.

Historically, assets allocated to US real estate would have been near-nonexistent.

Vacant market, but prices rising

Property prices fell by around 50% in some regions of the US after 2007, when many banks and other lenders shed real estate assets, according to Stonehage investment partners chief investment officer John Veale.

"This created excess supply, and it took until early 2012 for inventory levels in many US regions to return to pre-crisis levels. We saw this as an ideal time for clients to invest," he explained.

But Stonehage said prices are now stabilizing and, in some cases, beginning to rise.

Onerous tax costs for US real estate

According to Stonehage, few UK investors have direct exposure to US real estate as tax implications are "too onerous".

Indeed, most clients chose to invest via debt markets, specifically in mortgage-backed securities.

Veale said Stonehage had generated a 40% return in 2012 from residential mortgage-backed securities, and now expects annualised returns of 10-12% over the life of the vehicle.

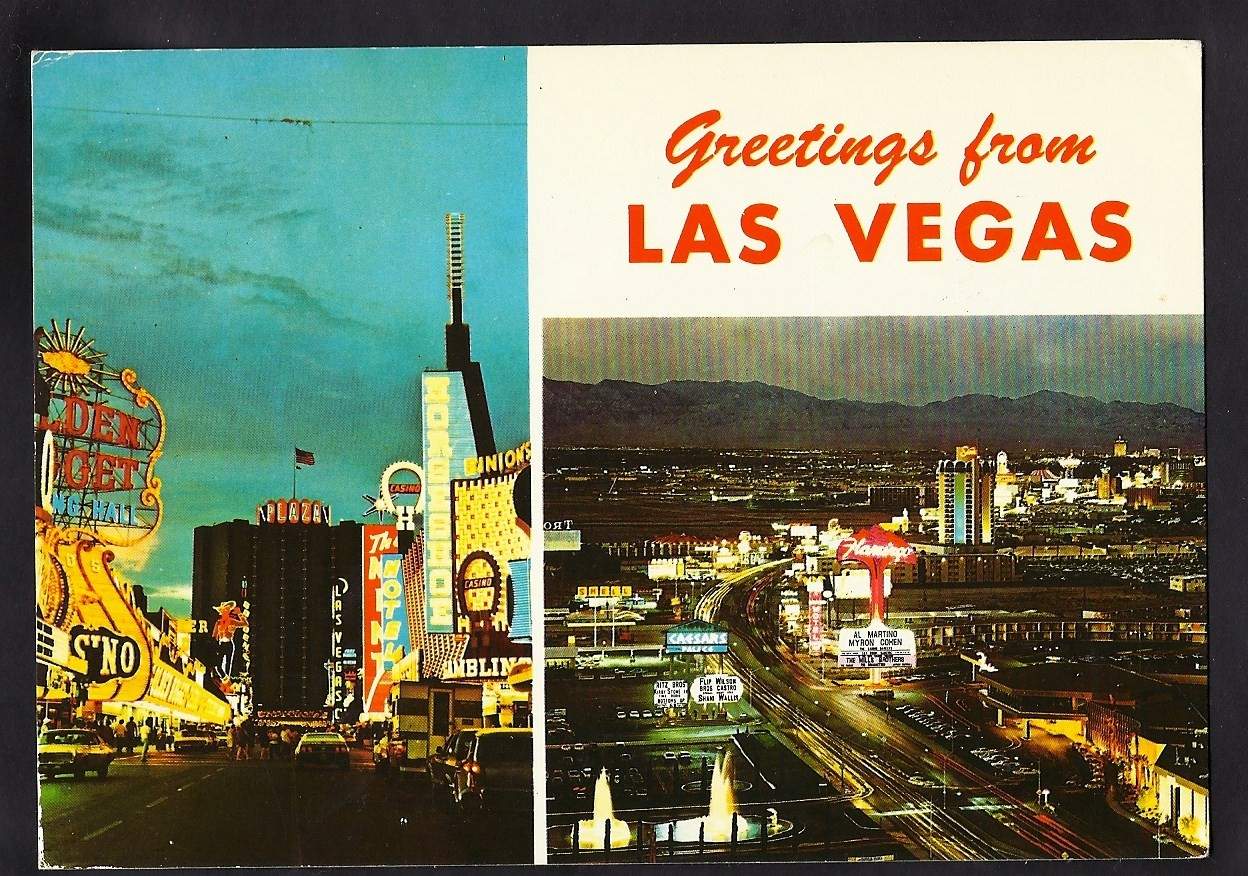

Veale also anticipated generating returns from both capital appreciation and ongoing yield, while recent allocations have mainly concentrated in tier two areas, for instance commercial buildings in Las Vegas and Illinois as well as buying a portfolio of residential mortgages from a regional US bank.