Wealth managers see brighter times ahead despite lingering COVID-19 impacts. Wealth managers in GlobalData’s latest industry poll from H1 2021 are cautiously optimistic regarding industry conditions for the rest of 2021.

Wealth management as an industry was spared the brunt of COVID-19 impact in 2020, although the negative economic conditions were not ideal for minting new affluent investors. Inflows remained positive for the vast majority of the industry and profitability was up at the world’s leading wealth managers. For example, UBS reported a pre-tax profit of $4.1bn in 2020 – up 20.4% on an already strong 2019.

Yet the pandemic did dent wealth managers’ confidence, with GlobalData’s 2020 Global Wealth Managers Survey (conducted in Q3 2020) finding 60% anticipating a hit to profits and 69% expecting an increase in customer churn. These were strong majorities for pessimism even after the lifting of the strictest lockdowns.

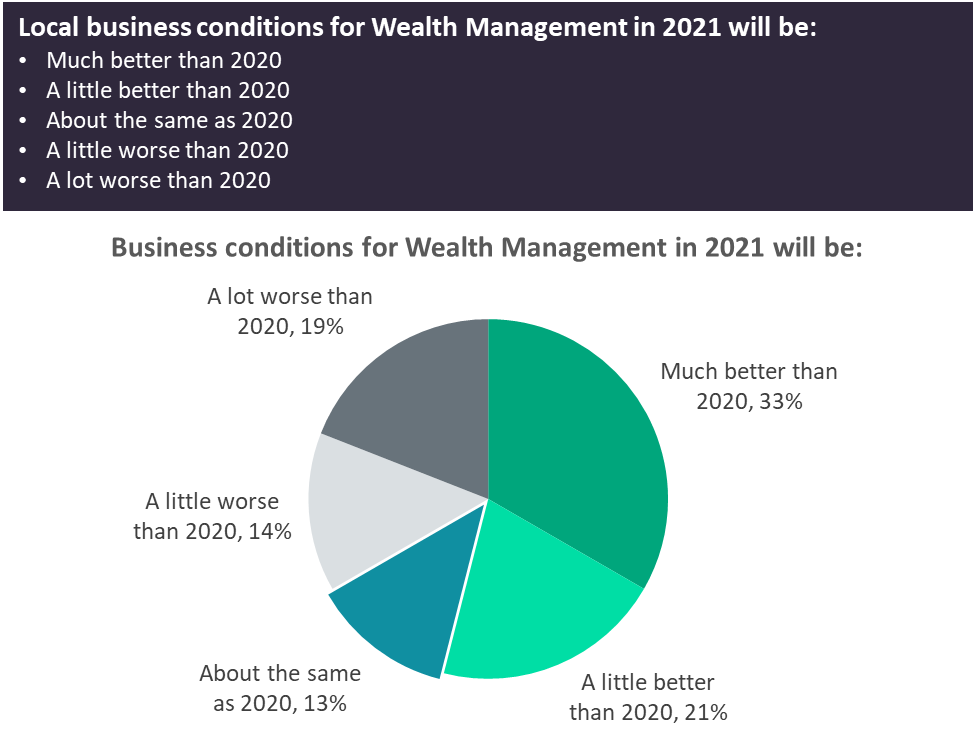

As such, it is striking that 54% of wealth managers in GlobalData’s Industry Poll H1 2021 see brighter conditions ahead – almost double those expressing pessimistic views, as detailed in the chart below. This might not be an industry consensus, but the findings do suggest the wealth space has turned the corner on COVID-19. If profits grew by a fifth in 2020 despite the gloom, just imagine what is in store for 2021.

Wealth managers forward business expectations as of H1 2021