The UK wealth management industry has historically been largely paper-based, much like others across the globe. However, with technology infiltrating the industry over the past decade or so, UK wealth managers will benefit from hiring or collaborating with tech experts to continue growing assets under management (AUM).

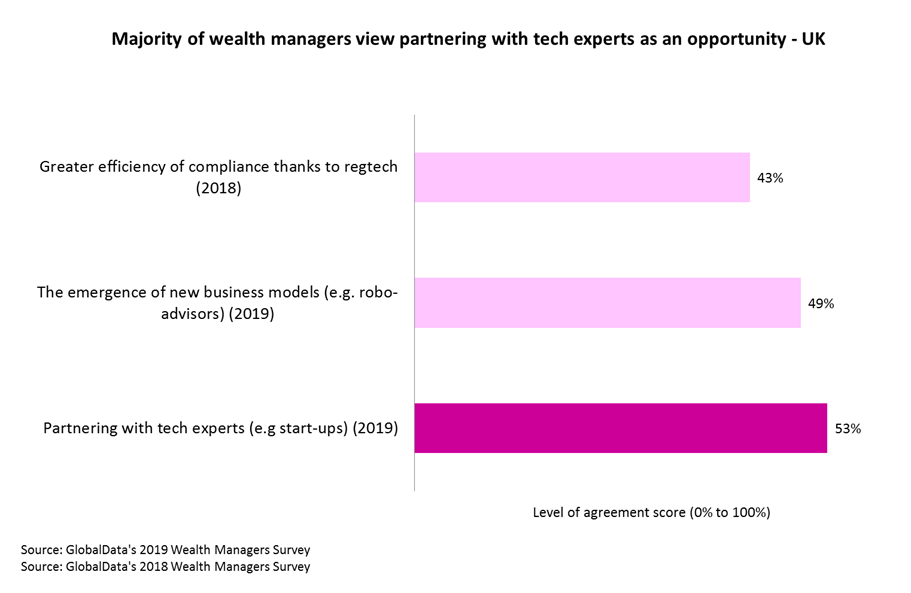

The majority of UK wealth managers in our 2019 Wealth Managers Survey claimed that their biggest threat to future growth is a lack of digital skills among advisers and staff. As such, it comes as little surprise that partnering with tech start-ups is seen as a key opportunity to secure this growth.

Despite this, only a small number of UK wealth managers have taken advantage of the industry’s emerging technology start-ups. JM Finn, one of the UK’s top 40 firms by AUM, bucked the trend early on and partnered with fintech company CREALOGIX over a decade ago, a move that has been instrumental in its growth.

Nevertheless, the majority of traditional UK wealth managers are embracing technology at a snail’s pace, while digital challengers continue to take the industry by storm. These players are using advances in technology such as more evolved algorithms to their advantage and growing at a fast rate.

For example, Nutmeg has utilised this strategy to grow its AUM by 1,292% between 2013 and 2018, the third fastest growth rate during this period. Other UK wealth management firms need to recognise the opportunity that technology brings in order to enjoy similar success.

There is no question that demand for digital is on the rise. According to our Global Channel Analytics, 44% of UK consumers regard mobile as the preferred channel through which to manage their savings, while another 33% selected online, making the branch a distant third.

Clearly, providing a digital option is no longer optional, so wealth managers that lack the required resources or in-house expertise should consider the benefits of partnerships. Alliances with digital start-ups save UK wealth managers a lot of time infrastructure-wise and prevent them having to build their own platforms. Many startups are growing in popularity and come with their own digital capabilities and experts, which is beneficial for UK firms.

UK wealth managers need to move quickly to capitalise on the opportunity of collaborating with tech start-ups. Such partnerships will help meet the increasingly digital needs of consumers, accelerate growth as opposed to building internally, and ensure sustainability in the growing digital age. These benefits mean that evolving with the current climate and embracing technology is a must for longevity.