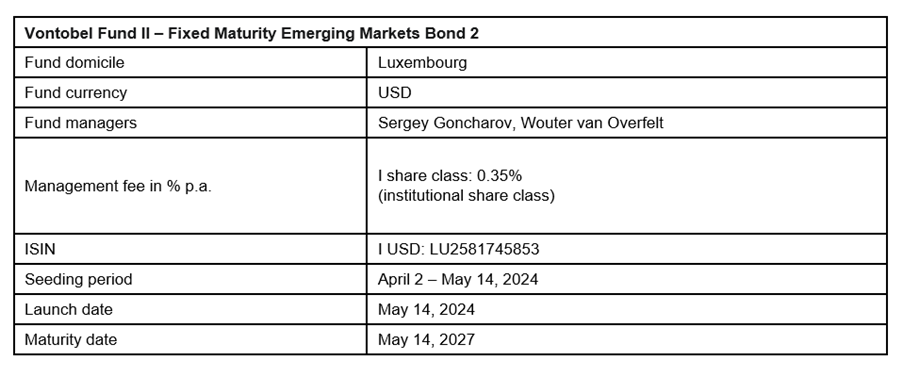

Vontobel has launched a three-year fixed maturity emerging market bond fund that allows investors to capitalise on higher yields.

In comparison to similar bonds in established countries, the Vontobel Fund II – Fixed Maturity Emerging countries Bond 2 aims to provide a higher spread, yield, and coupon.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Hard currency developing market bonds are the fund’s primary investment type.

Based on market dynamics, the fund, which has a set maturity of three years, intends to achieve a target yield to maturity of 7% and an average investment-grade rating.

The fund’s seeding period will start on 2 April 2024, and run until 14 May 2024.

Moreover, the fund is led by a team of experts with over three decades of expertise investing in emerging market bonds, and it has raised $1.5bn in fixed maturity strategies over the last five years.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIts primary goal is to maximise the spread on short-maturity emerging market bonds, whilst the team aims to provide attractive risk-adjusted returns with low volatility.

Sergey Goncharov, portfolio manager, stated: “Choosing a three-year maturity aligns with current market conditions, which are favourable for emerging market bonds. With an expected downward trend in US interest rates, investors have the opportunity for an attractive risk-return ratio over a fixed time horizon, locking in higher yields.”

Austria, France, Germany, Liechtenstein, Luxembourg, Switzerland, the United Kingdom, Italy, and Spain are among the countries where the fund is registered for distribution.

Furthermore, earlier last month, Vontobel joined forces with EFG and Chartered Investment to produce, expand and distribute structured products.

The collaboration includes white-labelling services for structured products at every stage of their value chain.

Structured products issued by EFG International Structured Finance (Luxembourg) will be accessible on Deritrade beginning in the first week of April 2024.