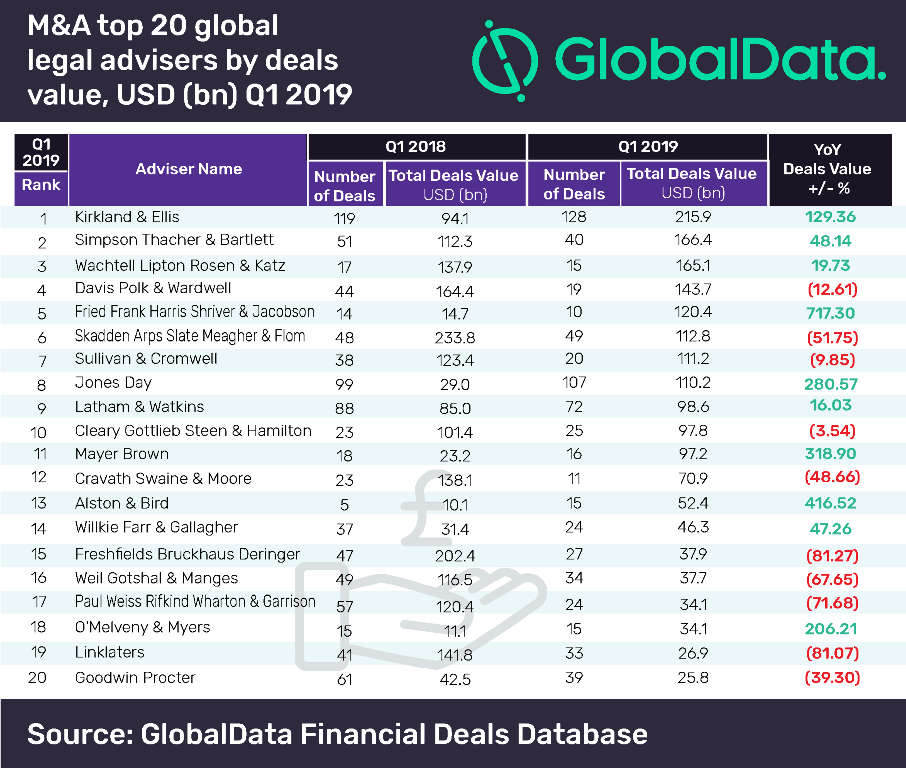

Kirkland & Ellis was the leading financial adviser globally for mergers and acquisitions in Q1 2019, according to GlobalData.

The American law firm advised on 128 deals worth $215.9bn (up 129% year-on-year) including the biggest transaction of the quarter: Bristol-Myers Squibb’s acquisition of Celgene for $89.5bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Kirkland & Ellis ranked in 12th position in GlobalData’s full-year ranking of legal advisors for global mergers and acquisitions.

GlobalData has published a top 20 league table of legal advisers ranked according to the value of announced deals globally.

Simpson Thacher & Bartlett took second place with 40 transactions worth $166.4bn (up 48.1% year-on-year).

Ravi Tokala, financial deals analyst at GlobalData, said: “All the top five positions in the legal adviser league table are held by the US-headquartered law firms, clearly indicating the kind of supremacy the US-based advisers command in global M&A sphere.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWachtell Lipton Rosen & Katz was in third place having advised on 15 transactions worth $165.1bn (up 19.7% year-on-year) and Davis Polk & Wardwell took fourth place with 19 deals worth $143.7bn (down 12.6% year-on-year). With ten deals worth $120.4bn (up 717.3% year-on-year) Fried Frank Harris Shriver & Jacobson took fifth position in the league table.

In terms of deal volume, Kirkland & Ellis topped the table with 128 deals, followed by Jones Day with 107 deals worth $110.2bn.

In Q1 2019, 13,576 deals were recorded globally, marking a 37% increase year-on-year, and a 3.7% rise from Q4 2018.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website