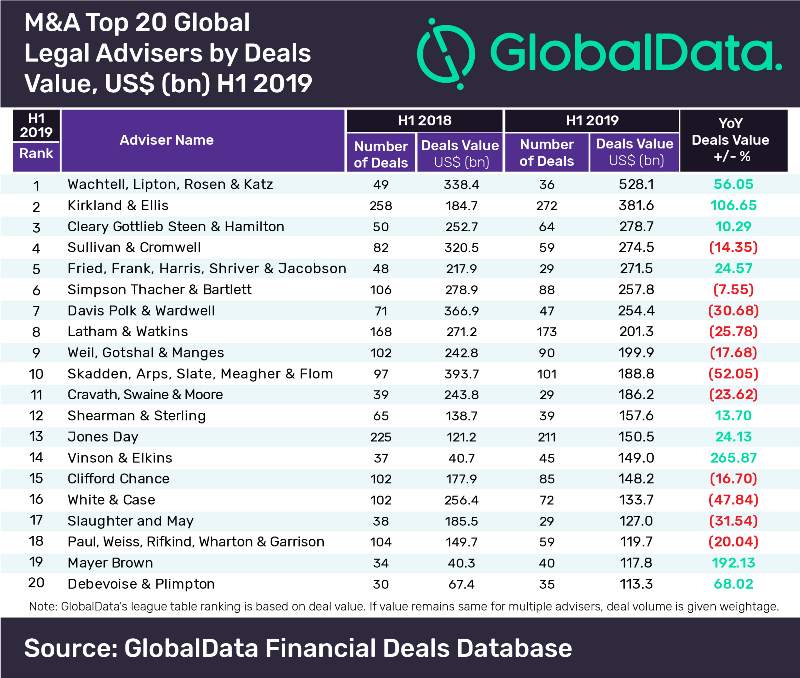

Wachtell, Lipton, Rosen & Katz was the leading legal adviser globally for mergers and acquisitions in H1 2019, according to GlobalData.

The American law firm advised on 36 deals worth $528.1bn (up 56% year-on-year) including the biggest transaction of the period: Bristol-Myers Squibb’s acquisition of Celgene for $89.5bn.

Wachtell, Lipton, Rosen & Katz secured third position in GlobalData’s Q1 2019 rankings, having advised on 15 deals worth $165.1bn.

GlobalData has published a top 20 league table of legal advisers ranked according to the value of announced deals globally.

Kirkland & Ellis took second place in the global league table for H1 2019, with 272 transactions worth $381.6bn (up 106.6% year-on-year).

Ravi Tokala, financial deals analyst at GlobalData, said: “With involvement in multiple mega deals, Wachtell, Lipton, Rosen & Katz was the only legal adviser to cross the US$500bn deal value mark in H1 2019. In terms of volume, Kirkland & Ellis and Jones Day emerged as leaders, with both advising on more than 200 deals each. In addition, 11 of the top 20 advisers witnessed a drop in advised deal value as compared with H1 2018, which is consistent with the drop in overall deals value for the first half of the year.”

Cleary Gottlieb Steen & Hamilton was in third place having advised on 64 transactions worth $278.7bn (up 10.2% year-on-year) and Sullivan & Cromwell took fourth place with 59 deals worth $274.5bn (down 14.3% year-on-year). With 29 deals worth $271.5bn (up 24.5% year-on-year) Fried, Frank, Harris, Shriver & Jacobson took fifth position in the league table.

In terms of deal volume, Kirkland & Ellis topped the table with 272 deals, followed by Jones Day with 211 deals worth US$150.5bn.

In H1 2019, 28,131 deals were recorded, marking a 32.69% increase from H1 2018 and a 15.93% rise from H2 2018.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website