GlobalData, a leading data and analytics company, has revealed its global league tables for top 20 legal advisers by value and volume for Q1-Q3 2022.

Top advisers by value and volume

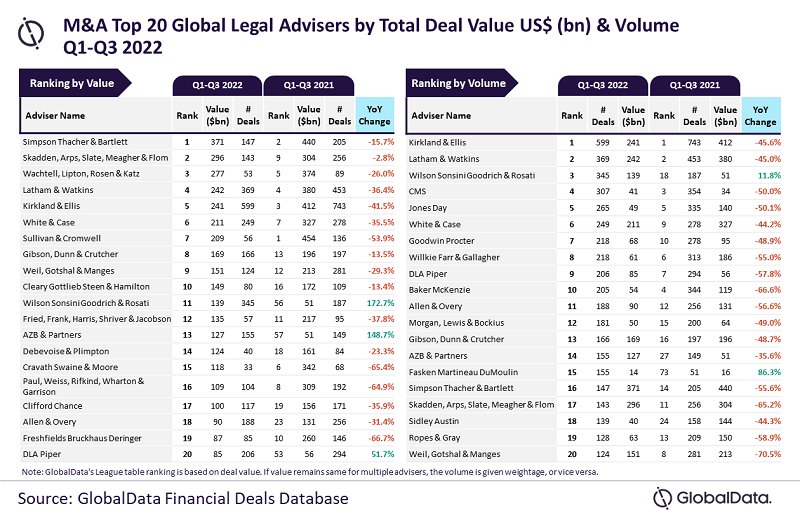

Simpson Thacher & Bartlett and Kirkland & Ellis emerged as top mergers and acquisition (M&A) legal advisers by value and volume during the first three quarters of 2022, respectively.

Simpson Thacher & Bartlett led the value table having advised on deals worth $371bn, while Kirkland & Ellis led the volume table with a total of 599 deals.

GlobalData lead analyst Aurojyoti Bose said: “Simpson Thacher & Bartlett and Kirkland & Ellis were far ahead of their peers in terms of value and volume, respectively. Simpson Thacher & Bartlett advised on nine mega deals valued more than $10 billion, becoming the only firm to surpass the $300 billion mark in total deal value. Meanwhile, Kirkland & Ellis was just shy of one deal to touch the 600 deals volume mark during Q1-Q3 2022.”

As per an analysis of GlobalData’s financial deals database, Skadden, Arps, Slate, Meagher & Flom took the second spot in the value table by advising on $296bn worth of deals, followed by Wachtell, Lipton, Rosen & Katz with $277bn, Latham & Watkins with $242bn, and Kirkland & Ellis with $241bn.

In terms of volume, Latham & Watkins secured the second place with 369 deals, followed by Wilson Sonsini Goodrich & Rosati with 345 deals, CMS with 307 deals, and Jones Day with 265 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.