GlobalData, a leading data and analytics company, has revealed its global league tables for legal advisers by value and volume for Q1-Q3 2021.

Simpson Thacher & Bartlett and Kirkland & Ellis top by both value and volume

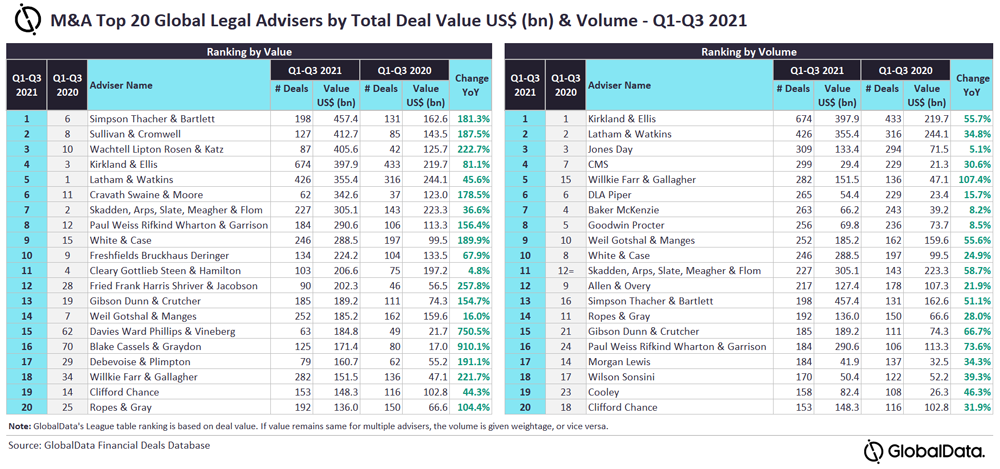

Simpson Thacher & Bartlett and Kirkland & Ellis have topped the list of mergers and acquisitions (M&A) legal advisers for Q1-Q3 2021 by value and volume, respectively.

Having advised on 198 deals valued at $457.4bn, Simpson Thacher & Bartlett recorded the highest value among all the advisers.

Kirkland & Ellis led the volume chart. It advised on 674 deals valued at $397.9bn.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was the clear winner in terms of volume as it was the only advisor to advise on more than 600 deals, leaving behind its peers by a great margin. Apart from leading by volume, it also occupied the fourth position by value.

“Even though Simpson Thacher & Bartlett advised on 200 fewer deals, it managed to beat Kirkland & Ellis to occupy the top spot in terms of value due to involvement in more number of mega deals (≥US$10bn). While Simpson Thacher & Bartlett advised on nine mega deals, Kirkland & Ellis advised on only four such deals. Moreover, the average value of deals advised by Kirkland & Ellis stood at just US$590m, much lesser compared to Simpson Thacher & Bartlett’s average deal value of US$2.3bn.”

Based on an analysis of GlobalData’s Financial Deals Database, Sullivan & Cromwell took the second spot by value, with 127 deals worth $412.7bn. It was followed by Wachtell Lipton Rosen & Katz, with 87 deals valued at $405.6bn.

Latham & Watkins gained the second position in terms of volume with 426 deals worth $355.4bn. It was followed by Jones Day with 309 deals worth $133.4bn, and CMS with 299 deals worth $29.4bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.