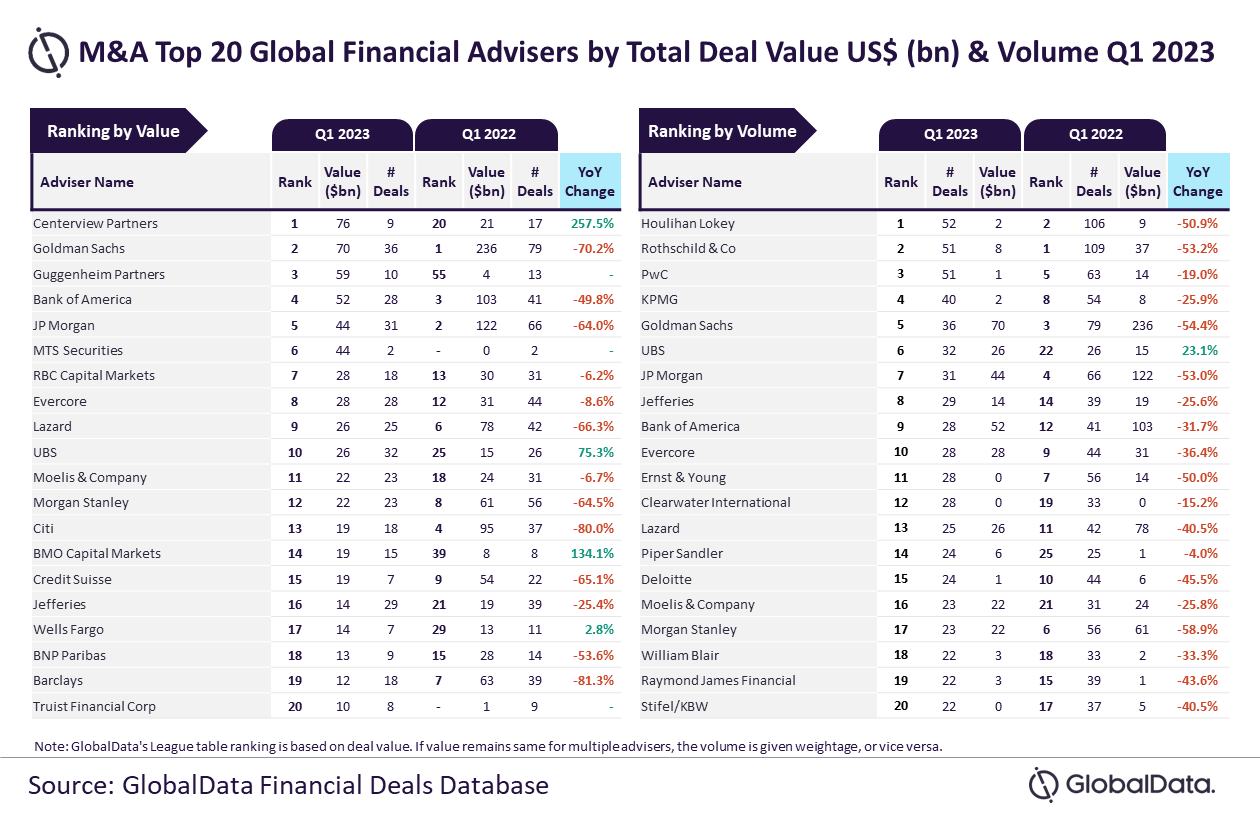

GlobalData, a leading data and analytics company, has revealed its global league tables for top 20 financial advisers by value and volume for Q1 2023.

Centerview Partners and Houlihan Lokey have become the top mergers and acquisitions (M&A) financial advisers by value and volume for Q1 2023, respectively.

As per the financial deals database, Centerview Partners advised on $76bn worth of deals, while, Houlihan Lokey advised on a total of 52 deals.

GlobalData lead analyst Aurojyoti Bose said: “Most of the advisers experienced a fall in deal value as well as volume in Q1 2023 as global deal activity remained subdued during the quarter. However, Centerview Partners emerged as an exception to this trend and registered growth in deal value despite a decline in deals volume.

“In fact, Centerview Partners registered around a four-fold jump in deal value, as all the deals advised by it were billion-dollar deals, which also included two mega deals valued more than $10bn. Involvement in these big-ticket deals helped it top the chart by value.

“Meanwhile, Houlihan Lokey was among the only three advisers who managed to advise on more than 50 deals during Q1 2023. Although it managed to top the list by volume, it faced close competition from Rothschild & Co and PwC.”

Rothschild & Co took the second spot in the volume table by advising on 51 deals, followed by PwC with 51 deals, KPMG with 40 deals, and Goldman Sachs with 36 deals.

Goldman Sachs also got the second position in the value table by advising on $70bn worth of deals, followed by Guggenheim Partners with $59bn, Bank of America with $52bn, and JP Morgan with $44bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.