GlobalData, a leading data and analytics company, has revealed its league tables for top 10 legal advisers by value and volume in the US for 2021.

According to GlobalData’s M&A report, a total of 14,152 merger and acquisition (M&A) deals were announced in the country during 2021. The deal value for the region increased by 63.1% from $1.2 trillion during 2020 to $1.9 trillion during 2021.

Top adviser by value and volume

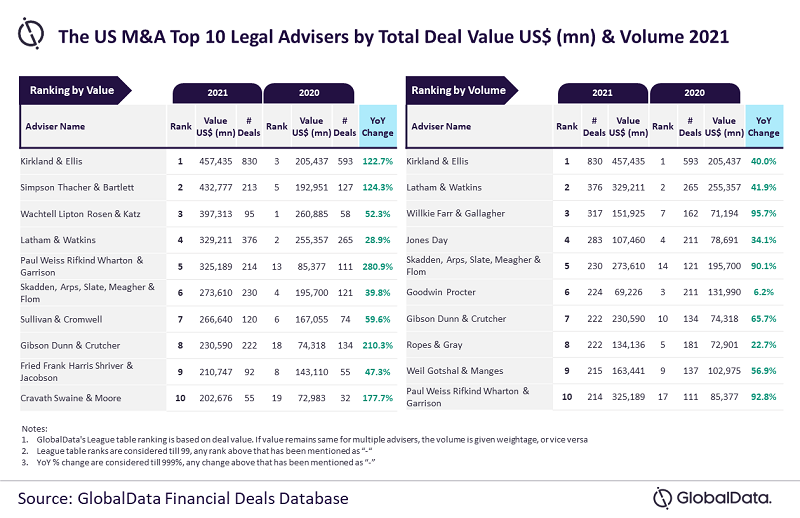

Kirkland & Ellis emerged as the top M&A legal adviser in the US for 2021 by both value and volume.

Kirkland & Ellis advised on 830 deals worth $457.4bn.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis outpaced its peers by a significant margin, in terms of volume, as it was the only firm to advise on more than 800 deals during 2021. Moreover, it was also the only firm to surpass the $450 billion mark in deal value.”

Simpson Thacher & Bartlett took the second position in terms of value, with 213 deals worth $432.8bn, followed by Wachtell Lipton Rosen & Katz, with 95 deals worth $397.3bn, Latham & Watkins, with 376 deals worth $329.2bn and Paul Weiss Rifkind Wharton & Garrison, with 214 deals worth $325.2bn.

Latham & Watkins also secured the second position in terms of volume; followed by Willkie Farr & Gallagher, with 317 deals worth $151.9bn; Jones Day, with 283 deals worth $107.5bn; and Skadden, Arps, Slate, Meagher & Flom, with 230 deals worth $273.6bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.