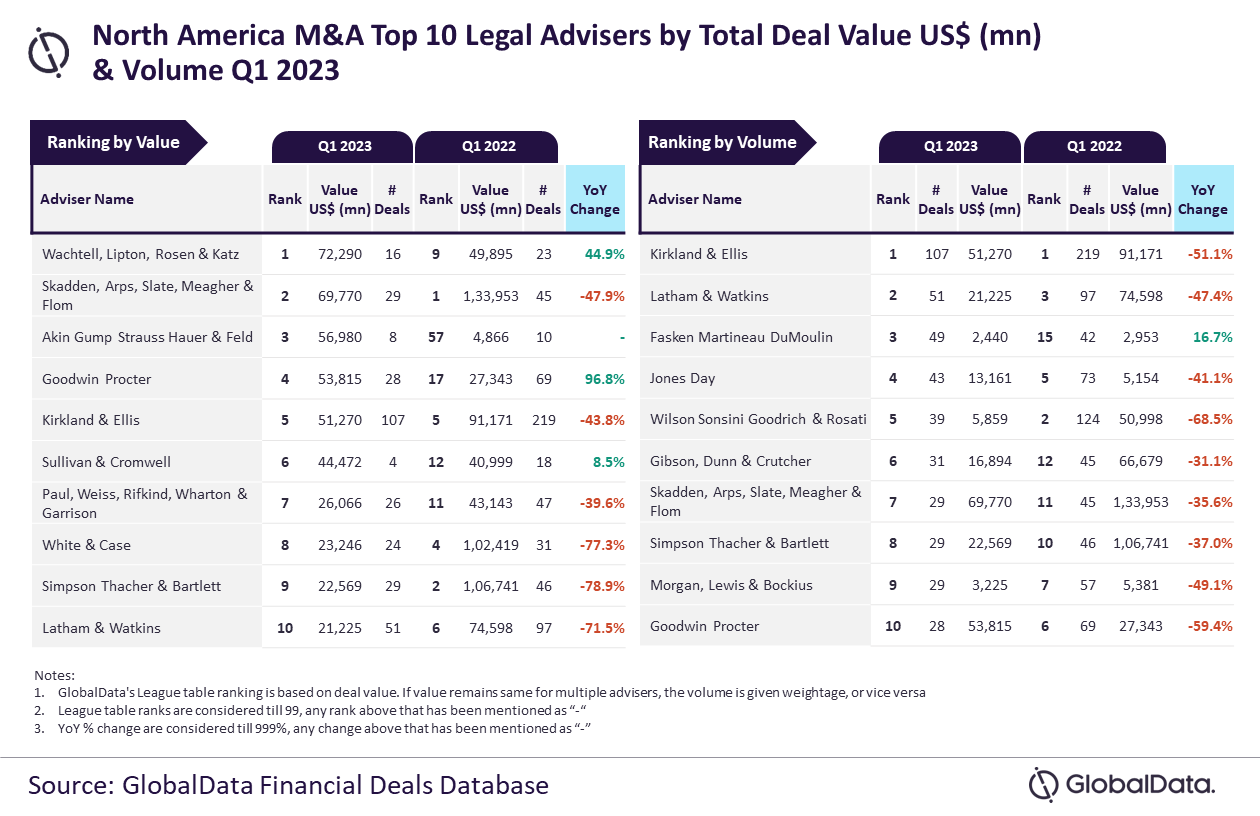

GlobalData, a leading data and analytics company, has revealed its league tables for top ten legal advisers by value and volume in North America for Q1 2023.

Wachtell, Lipton, Rosen & Katz and Kirkland & Ellis emerged the top mergers and acquisitions (M&A) legal advisers in the region for Q1 2023 by value and volume, respectively.

As per the financial deals database, Wachtell, Lipton, Rosen & Katz advised on $72.3bn worth of deals, while Kirkland & Ellis advised on a total of 107 deals.

Kirkland & Ellis also occupied the fifth position by value in the quarter. It managed to advise on 16 billion-dollar deals, which also included one mega deal worth over $10bn.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was also the top adviser by volume in Q1 2022 and managed to retain its leadership position by this metric in Q1 2023 as well, despite registering a significant drop in deals volume. Interestingly, it was the only firm to advise on more than 100 deals during Q1 2023, outpacing its peers by a significant margin.

“Meanwhile, Wachtell, Lipton, Rosen & Katz, despite not featuring among the top 10 advisers by volume, managed to top the chart by value. Involvement in the Pfizer-Seagen M&A deal worth $43 billion primarily helped Wachtell, Lipton, Rosen & Katz to occupy the top position by value in Q1 2023.”

Skadden, Arps, Slate, Meagher & Flom got the second place in the value table by advising on $69.8bn worth of deals, followed by Akin Gump Strauss Hauer & Feld with $57bn, Goodwin Procter with $53.8bn, and Kirkland & Ellis with $51.3bn.

Latham & Watkins secured the second place in terms of volume with 51 deals, followed by Fasken Martineau DuMoulin with 49 deals, Jones Day with 43 deals, and Wilson Sonsini Goodrich & Rosati with 39 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.