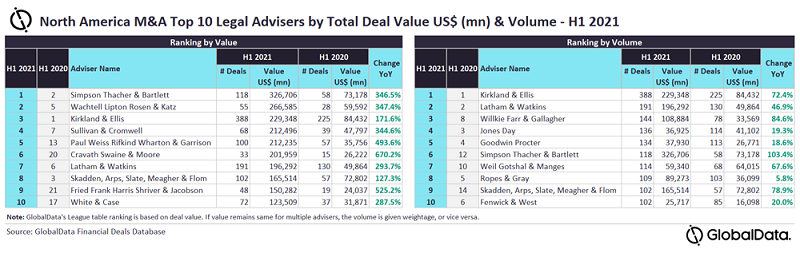

GlobalData, a leading data and analytics company, has revealed its league tables for top 10 legal advisers by value and volume in North America for H1 2021 in its report, ‘Global and North America M&A Report Legal Adviser League Tables H1 2021’.

According to GlobalData’s M&A report, a total of 7,982 M&A deals were announced in the region during H1 2021, while deal value increased by 258% from $258bn in H1 2020 to $1.1tn in H1 2021 in the region.

Top Advisers by Value and Volume

Simpson Thacher & Bartlett and Kirkland & Ellis were the top mergers and acquisitions (M&A) legal advisers in North America for H1 2021 in terms of value and volume, respectively.

Simpson Thacher & Bartlett advised on 118 deals valued at $326.7bn, which was the highest value among all the advisers.

In terms of volume, Kirkland & Ellis led the chart, having advised on 388 deals valued at $229.3bn.

GlobalData lead analyst Aurojyoti Bose said: ““Kirkland & Ellis was the only firm to advise on more than 300 deals during H1 2021, thereby outpacing its peers by a great margin in volume terms. However, it lagged behind in terms of deal value and lost the top position by value due to its involvement in fewer big-ticket deals.

“Meanwhile, Simpson Thacher & Bartlett, despite advising on even less than one-third of the number of deals advised by Kirkland & Ellis, occupied the top position by value due to its involvement in a higher number of big-ticket deals. While Simpson Thacher & Bartlett managed to advise on eight megadeals (valued greater than or equal to $10bn), Kirkland & Ellis advised on three such deals.”

Wachtell Lipton Rosen & Katz occupied the second position in terms of value with 55 deals worth $266.6bn. It was followed by Kirkland & Ellis.

Sullivan & Cromwell took the fourth position in terms of value with 68 deals worth $212.5bn. This was followed by Paul Weiss Rifkind Wharton & Garrison with 100 deals worth $212.2bn.

Latham & Watkins got the second position by volume with 191 deals worth $196.3bn. It was followed by Willkie Farr & Gallagher with 144 deals worth $108.9bn, Jones Day with 136 deals worth $36.9bn and Goodwin Procter with 134 deals worth $37.9bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.