GlobalData, a leading data and analytics company, has revealed its league tables for top 10 legal advisers by value and volume in Middle East & Africa for 2021 in its report, ‘Global and Middle East & Africa M&A Report Legal Adviser League Tables 2021’.

According to GlobalData’s M&A report, a total of 1,108 merger and acquisition (M&A) deals were announced in the region during 2021. The deal value for the region increased by 31% from $81.6 billion in 2020 to $106.9 billion in 2021.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Top Advisers by Value and Volume

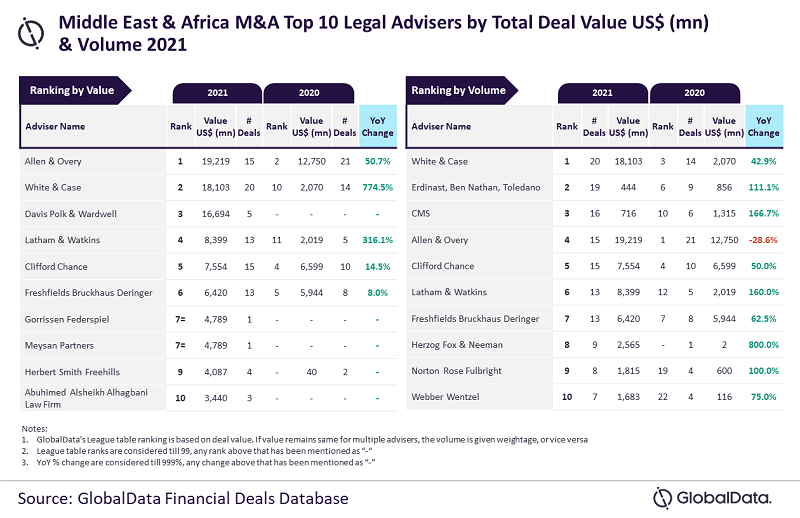

Allen & Overy and White & Case emerged as the top M&A legal advisers in the Middle East & Africa for 2021 by value and volume, respectively.

Allen & Overy advised on 15 deals worth $19.2bn, while White & Case advised on 20 deals worth $18.1bn.

GlobalData lead analyst Aurojyoti Bose said: “White & Case was the only firm to hit 20 deals, some of which were big-ticket transactions. However, despite this impressive achievement, the firm was unable to secure a place in the list of top 10 legal advisers by value. The average deal size of transactions advised by White & Case stood at $905.2m, while Allen & Overy’s, the leader by value, stood at $1.3bn.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhite & Case also took the second spot in terms of value, followed by Davis Polk & Wardwell, with five deals worth $16.7bn, Latham & Watkins, with 13 deals worth $8.4bn and Clifford Chance, with 15 deals valued at $7.6bn.

Erdinast, Ben Nathan, Toledano secured the second place in volume table, with 19 deals worth $0.4bn, followed by CMS, with 16 deals valued at $716m. Allen & Overy got the fourth position by volume, while Clifford Chance took the fifth position.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.