GlobalData, a leading data and analytics company, has revealed its league tables for top ten legal advisers by value and volume in financial services sector for 2022.

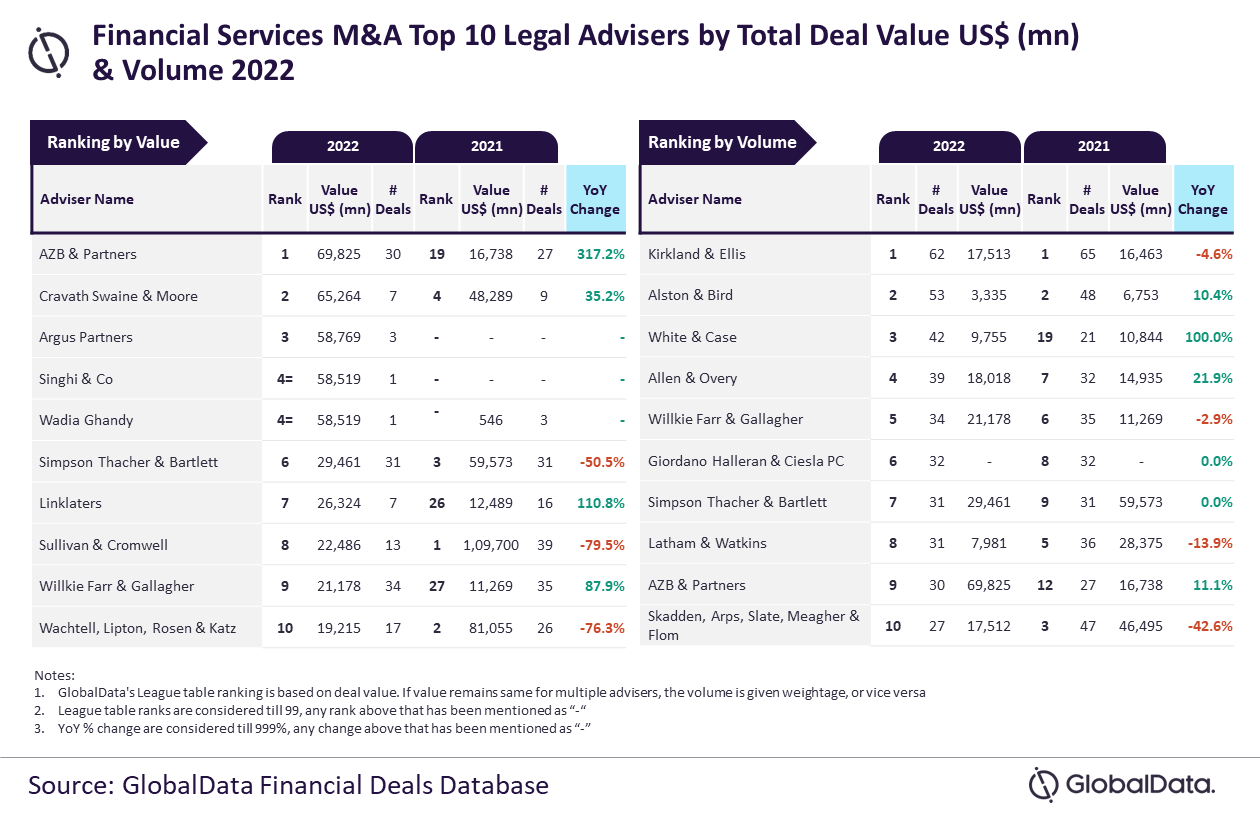

AZB & Partners and Kirkland & Ellis emerged as top M&A legal advisers in the financial services sector for 2022 by deal value and volume, respectively.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

AZB & Partners advised on $69.8bn worth of deals, while Kirkland & Ellis advised on a total of 62 deals.

GlobalData lead analyst Aurojyoti Bose said: “The total value of deals advised by AZB & Partners jumped by a massive 317.2% in 2022 compared to the previous year. Resultantly, its ranking by value also improved significantly. Meanwhile, Kirkland & Ellis, despite witnessing decline in deals volume in 2022 compared to 2021, managed to retain its leadership position by this metric.”

According to the financial deals database of GlobalData, the other high rankers by value included Cravath Swaine & Moore took the second position with $65.3bn worth of deals; followed by Argus Partners with $58.8bn; and Singhi & Co and Wadia Ghandy jointly occupied the fourth position with deals worth $58.5bn.

In terms of volume, Alston & Bird secured the second place with 53 deals; followed by White & Case with 42 deals, Allen & Overy with 39 deals, and Willkie Farr & Gallagher with 34 deals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names. To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.