GlobalData, a leading data and analytics company, has revealed its league tables for top ten legal advisers by value and volume in financial services sector for Q1-Q3 2022.

A total of 2,615 merger and acquisition (M&A) deals worth $$286.6bn were announced in the sector during Q1-Q3 2022.

Top advisers by value and volume

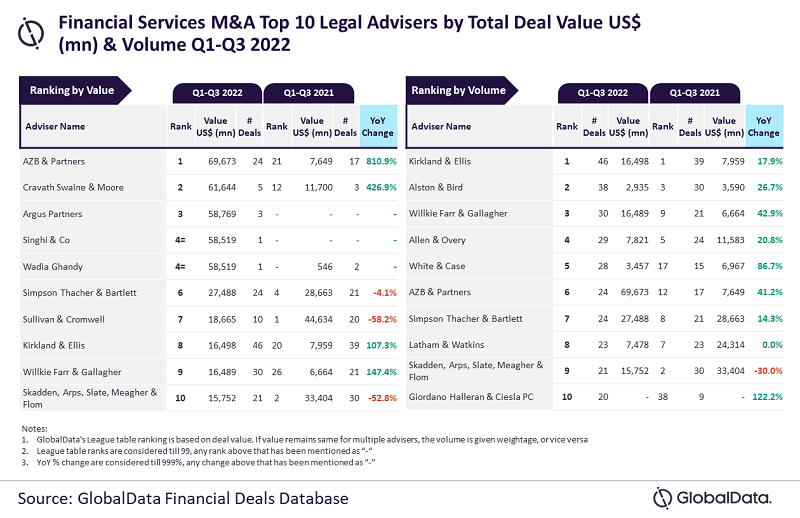

According to GlobalData’s ‘Global and Financial Services M&A Report Legal Adviser League Tables Q1-Q3 2022’, AZB & Partners and Kirkland & Ellis emerged as top M&A legal advisers in the financial services sector for Q1-Q3 2022 by deal value and volume, respectively.

AZB & Partners advised on $69.7bn worth of deals, while Kirkland & Ellis advised on a total of 46 deals.

GlobalData lead analyst Aurojyoti Bose said: “AZB & Partners and Kirkland & Ellis were clear winners in the financial services sector. Kirkland & Ellis was the only firm to advise on more than 40 deals, but was just four shy of reaching the 50 deal mark. AZB & Partners was also just shy, sitting merely $300,000 under the $70 billion mark. Alongside leading by deal volume, Kirkland & Ellis occupied eighth position by value. AZB & Partners, apart from leading by value, occupied sixth position by volume.”

According to the financial deals database of GlobalData, the other high rankers by value included Cravath Swaine & Moore took the second position with $61.6bn worth of deals; followed by Argus Partners with $58.8bn; and Singhi & Co and Wadia Ghandy jointly occupied the fourth position with deals worth $58.5bn.

In terms of volume, Alston & Bird secured the second place with 38 deals; followed by Willkie Farr & Gallagher with 30 deals; Allen & Overy with 29 deals; and White & Case with 28 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names. To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.