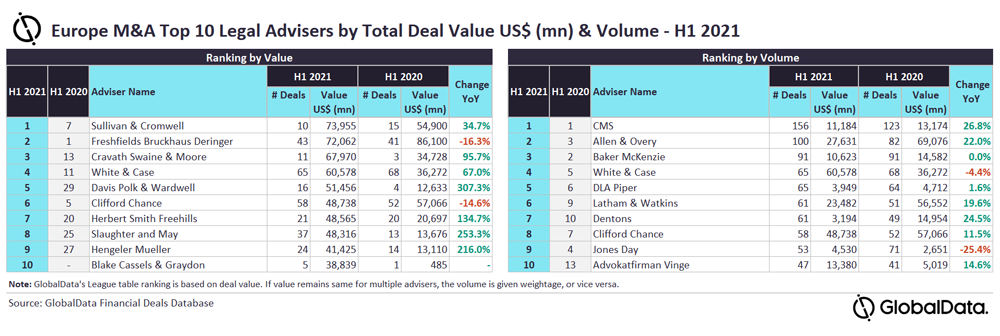

GlobalData, a leading data and analytics company, has revealed its league tables for top 10 legal advisers by value and volume in Europe for H1 2021 in its report, ‘Global and Europe M&A Report Legal Adviser League Tables H1 2021’.

According to GlobalData’s M&A report, a total of 5,722 M&A deals were announced in the region during H1 2021. The deal value grew by 51% from $336bn in H1 2020 to $507bn in H1 2021 in the region.

Top Advisers by Value and Volume

Sullivan & Cromwell and CMS were named the top mergers and acquisitions (M&A) legal advisers in Europe for H1 2021 by value and volume, respectively.

Sullivan & Cromwell advised on ten deals worth $74bn, which was the highest value among all advisers.

CMS led in volume terms having advised on 156 deals worth $11.2bn.

GlobalData lead analyst Ravi Tokala said: “CMS was the only adviser that managed to advise on more than 150 deals during H1 2021, outpacing its peers by a great margin. However, it lagged behind in terms of value due to its involvement in low-value transactions, and did not feature among the top ten by value.

“Meanwhile, Sullivan & Cromwell, which advised on just ten deals, managed to top the list by value due to its involvement in some big-ticket deals. While the average deal size of transactions advised by Sullivan & Cromwell stood at $7.4bn, it was just $71.7m for CMS.”

Freshfields Bruckhaus Deringer occupied the second position in terms of value with 43 deals worth $72.1bn. It was followed by Cravath Swaine & Moore with 11 deals worth $68bn and White & Case with 65 deals worth $60.6bn.

Allen & Overy took the second position by volume with 100 deals worth $27.6bn. It was followed by Baker McKenzie with 91 deals worth $10.6bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.