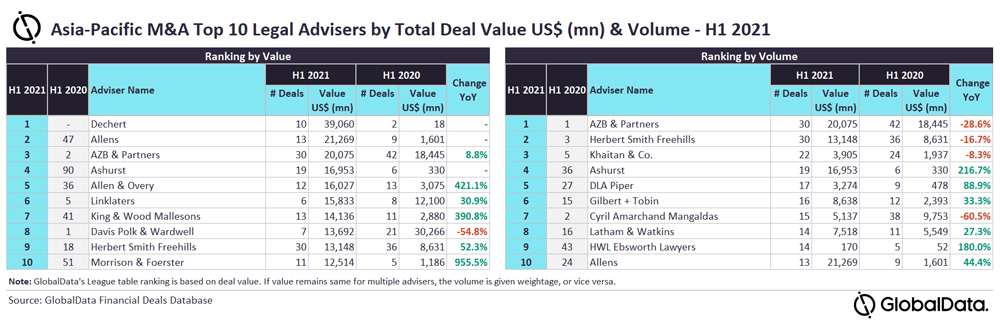

GlobalData, a leading data and analytics company, has revealed its league tables for top 10 legal advisers by value and volume in Asia-Pacific for H1 2021 in its report, ‘Global and Asia-Pacific M&A Report Legal Adviser League Tables H1 2021’.

According to GlobalData’s M&A report, a total of 3,536 M&A deals were announced in the region during H1 2021. The deal value grew by 4.6% from $262bn in H1 2020 to $274bn in H1 2021 in the region.

Top Advisers by Value and Volume

Dechert and AZB & Partners were the top mergers and acquisitions (M&A) legal advisers by value and volume, respectively, in the Asia-Pacific region during the first half (H1) of 2021.

Dechert advised on 10 deals worth $39.1bn, the highest among all the advisers.

AZB & Partners led in volume terms having advised on 30 deals worth $20.1bn.

GlobalData lead analyst Aurojyoti Bose said: “There was a major jump in the value of deals advised by Dechert in H1 2021 compared to H1 2020, which helped it to make its way to the top spot by value. In fact, it was the only firm to cross $30bn mark during H1 2021.

“Interestingly, AZB & Partners, despite advising on three times the number of deals advised by Dechert, had to settle for the third position by value due to its lack of involvement in any megadeal (≥$10bn). Meanwhile, Dechert managed to advise on one megadeal.”

Allens took the second position in terms of value with 13 deals worth $21.3bn followed by AZB & Partners. Ashurst secured the fourth position by value with 19 deals worth $17bn and Allen & Overy with 12 deals worth $16bn.

Herbert Smith Freehills occupied the second position in terms of volume with 30 deals worth $13.1bn followed by Khaitan & Co. with 22 deals worth $3.9bn and Ashurst. DLA Piper occupied the fourth position by volume with 17 deals worth $3.3bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.