GlobalData, a leading data and analytics company, has revealed its league tables for top 10 financial advisers by value and volume in South and Central America for H1 2022.

A total of 587 mergers and acquisition (M&A) deals were announced in H1 2022 in the region, with a total value of $40bn.

Top advisers by value and volume

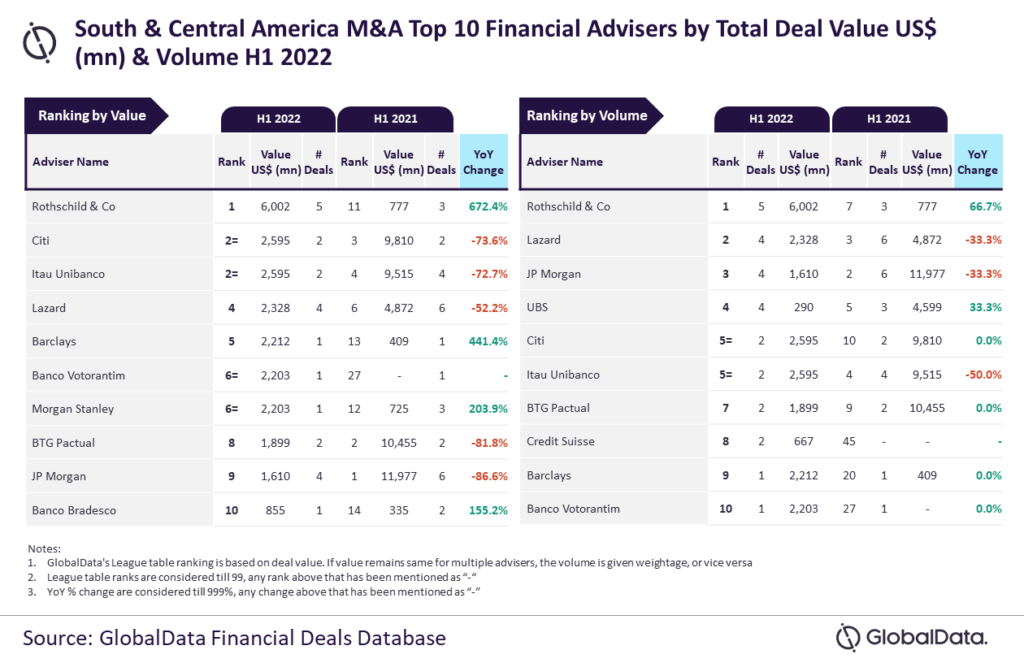

According to GlobalData’s ‘Global and South & Central America M&A Report Financial Adviser League Tables H1 2022’, Rothschild & Co emerged as the top M&A financial adviser in the region for H1 2022 both by value and volume.

Rothschild & Co advised on five deals worth $6bn.

GlobalData lead analyst Aurojyoti Bose said: “While none of the advisers involved in the M&A transactions in South & Central America managed to register double-digit deal volume, only two managed to register volume growth. In fact, Rothschild & Co was among the only two advisers to showcase volume growth. It also witnessed growth in deal value and was the only firm to advise on three billion-dollar deals (≥ $1 billion) during H1 2022.”

The other high rankers by value included Citi in the second position with $2.6bn worth of deals, followed by Itau Unibanco with $2.6bn, Lazard with $2.3bn, and Barclays with $2.2bn.

In terms of volume, Lazard took the second position with four deals, followed by JP Morgan with four deals, UBS with four deals, and Citi with two deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.