GlobalData, a leading data and analytics company, has revealed its league tables for top 10 financial advisers by value and volume in Middle East & Africa region for Q1-Q3 2021 in its report, ‘Global and Middle East Africa M&A Report Financial Adviser League Tables Q1-Q3 2021’.

According to GlobalData’s M&A report, a total of 787 M&A deals were announced in the region during Q1-Q3 2021. The deal value for the region increased by 17.9% from $67bn during Q1-Q3 2020 to $79bn during Q1-Q3 2021.

Top Advisers by Value and Volume

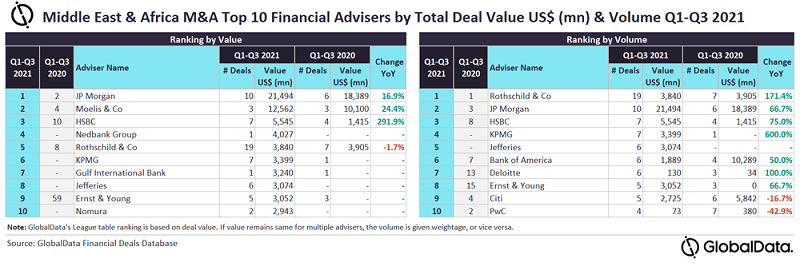

JP Morgan and Rothschild & Co were the top mergers and acquisition (M&A) financial advisers in the Middle East & Africa region for Q1-Q3 2021 by value and volume, respectively.

JP Morgan advised on ten deals worth $21.5bn, which was the highest value among all the advisers.

Meanwhile, Rothschild & Co led in volume terms having advised on 19 deals worth $3.8bn.

GlobalData lead analyst Aurojyoti Bose said: “JP Morgan’s involvement in in four billion-dollar deals (deals more than or equal to US$1bn) helped the firm to secure the top position by value. A pivotal deal that the firm was involved in was the sale of Saudi Aramco’s 49% stake in Aramco Oil pipelines to EIG Global Energy for US$12.4bn.

“Meanwhile, Rothschild & Co held the top spot in terms of deal volume, but lagged in terms of deal value due to its involvement in low-value transactions. The firm had to settle for the fifth position by value.”

Moelis & Co occupied the second position in terms of value with three deals worth $12.6bn, followed by HSBC with seven deals worth $5.5bn and Nedbank Group with one deal worth $4bn. Rothschild & Co occupied the fifth position in terms of volume.

JP Morgan occupied the second position in terms of volume, followed by HSBC. KPMG ranked fourth by volume with seven deals worth $3.4bn and Jefferies occupied the fifth position with six deals worth $3.1bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.