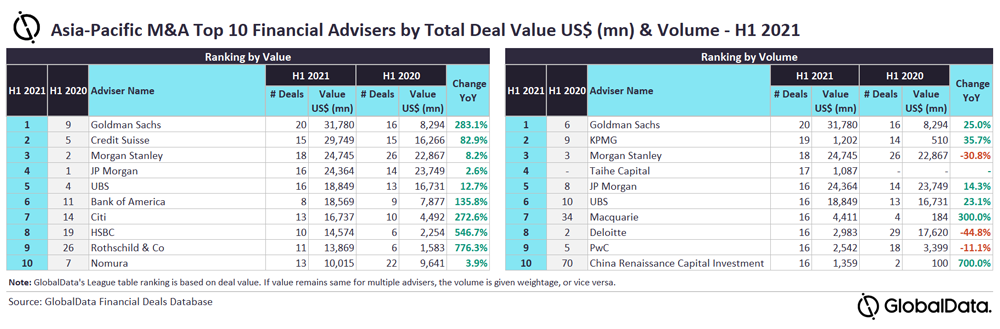

GlobalData, a leading data and analytics company, has revealed its league tables for top 10 financial advisers by value and volume in Asia-Pacific for H1 2021 in its report, ‘Global and Asia-Pacific M&A Report Financial Adviser League Tables H1 2021’.

According to GlobalData’s M&A report, a total of 3,536 M&A deals were announced in the region during H1 2021. The deal value grew by 4.6% from $262bn in H1 2020 to $274bn in H1 2021 in the region.

Top Advisers by Value and Volume

Goldman Sachs emerged as the top mergers and acquisitions (M&A) financial adviser by both value and volume in the Asia-Pacific (APAC) region during the first half (H1) of 2021.

The US-based investment banking major advised on 20 deals worth $31.8bn, the highest value among all the advisers.

GlobalData lead analyst Aurojyoti Bose said: “Goldman Sachs was the only to advise on 20 deals and surpass the $30bn mark during the review period. Moreover, the firm also registered a significant improvement in deal volume as well as value, however the growth was more pronounced in terms of value. Around 50% of the deals advised by Goldman Sachs were billion-dollar deals (≥$1bn).”

Credit Suisse secured the second position in terms of value with 15 deals worth $29.7bn. It was followed by Morgan Stanley with 18 deals worth $24.7bn, JP Morgan with 16 deals worth $24.4bn and UBS with 16 deals worth $18.8bn.

KPMG got the second position in terms of volume with 19 deals worth $1.2bn, followed by Morgan Stanley. Taihe Capital took the fourth position by volume with 17 deals worth $1.1bn, followed by JP Morgan.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.