GlobalData, a leading data and analytics company, has revealed its league tables for top 10 financial advisers by value and volume in Asia Pacific for Q1 2022.

A total of 1,904 merger and acquisition (M&A) deals were announced in the region during Q1 2022.The deal value for the region increased by 38% from $126.8bn in Q1 2021 to $175bn in Q1 2022, based on GlobalData’s Financial Deals Database.

Top advisers by value and volume

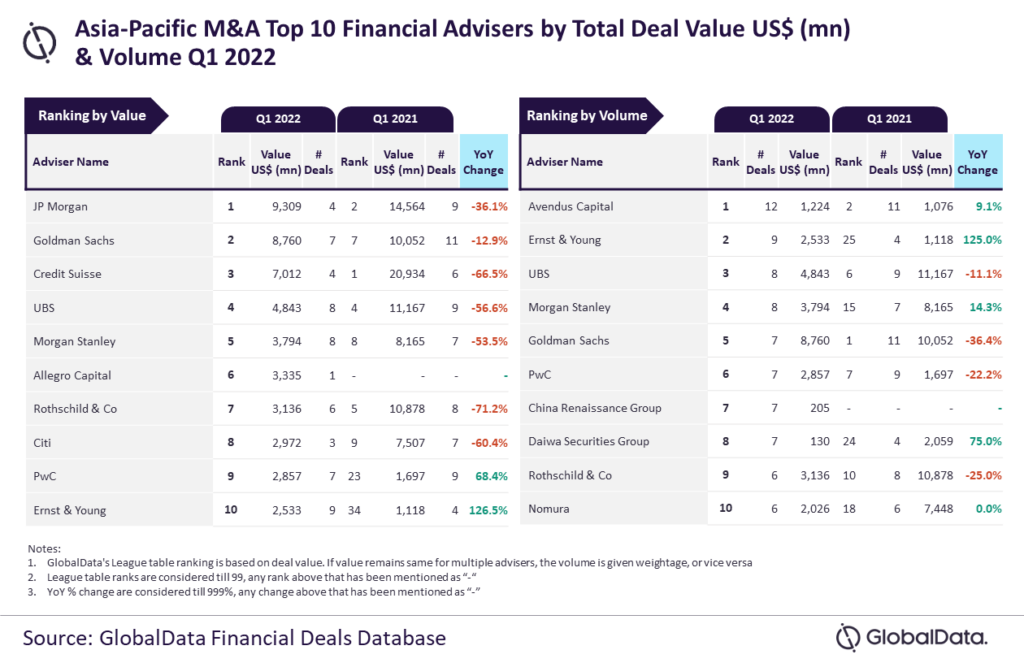

According to GlobalData’s ‘Global and Asia-Pacific M&A Report Financial Adviser League Tables Q1 2022’, JP Morgan and Avendus Capital were the top M&A financial advisers in the APAC region for Q1 2022 by value and volume, respectively. JP Morgan advised on four deals worth $9.3bn, the highest among all the advisers. Meanwhile, Avendus Capital led in volume terms having advised on 12 deals worth $1.2bn.

GlobalData lead analyst Aurojyoti Bose said: “Avendus Capital was the only firm that managed to advise on double-digit deal volume during Q1 2022. However, it lagged behind in terms of value and did not feature in the top 10 list by this metric due to involvement in relatively low-value transactions.

“Similarly, despite leading by value JP Morgan did not feature among the top 10 advisors by volume. However, the company managed to top by value due to its involvement in high-value transactions. While the average size of deals advised by JP Morgan stood at $2.3bn, it stood at $102m for Avendus Capital.”

Goldman Sachs took the second spot in the value table with seven deals worth $8.8bn followed by Credit Suisse with four deals worth $7bn, UBS with eight deals worth $4.8bn and Morgan Stanley with eight deals worth $3.8bn.

Ernst & Young with nine deals worth $2.5bn got the second place in the volume table, followed by UBS, Morgan Stanley and Goldman Sachs.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.