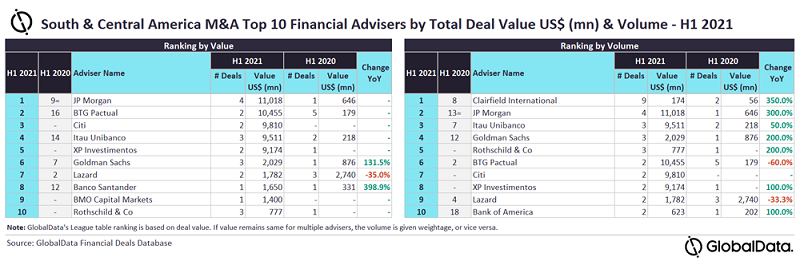

GlobalData, a leading data and analytics company, has revealed its global league tables for top 10 financial advisers in South & Central America by value and volume for H1 2021 in its report, ‘Global and South & Central America M&A Report Financial Adviser League Tables H1 2021’.

According to GlobalData’s M&A report, a total of 485 M&A deals were announced in the sector during H1 2021, while deal value for the sector increased by 270% from $20bn in H1 2020 to $74bn in H1 2021.

Top advisers by value and volume

JP Morgan and Clairfield International were the top mergers and acquisitions (M&A) financial advisers in South & Central America for H1 2021 by value and volume, respectively.

JP Morgan advised on four deals worth $11bn, which was the highest value among all the advisers.

Clairfield International led in volume terms having advised on nine deals worth $174m.

GlobalData lead analyst Tokala Ravi said: “JP Morgan and BTG Pactual were among the only two advisors to cross $10bn during H1 2021 and occupied the top spots by value. However, there was close competition for the top spot among the top five advisors as all these three firms also managed to advise on some of the billion-dollar deals valued more than or equal to $1bn.

“Despite there being a spike in South & Central American targeted deals, no advisors were able to touch double-digit volume. Moreover, Clairfield International, which advised on the highest number of deals, did not even feature among the top 10 advisers by value due to its involvement in low-value transactions.”

BTG Pactual occupied the second position in terms of value, with two deals worth $10.5bn. It was followed by Citi with two deals worth US$9.8bn and Itau Unibanco with three deals worth $9.5bn.

JP Morgan occupied the second position in terms of volume, followed by Itau Unibanco and Goldman Sachs, with three deals worth $2bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.