GlobalData, a leading data and analytics company, has revealed its global league tables for top 10 financial advisers in financial services sector by value and volume for Q1-Q3 2021 in its report, ‘Global and Financial Services M&A Report Financial Adviser League Tables Q1-Q3 2021’.

According to GlobalData’s M&A report, a total of 2,804 merger and acquisition (M&A) deals were announced in the sector during Q1-Q3 2021, while deal value for the sector increased by 55.9% from $272bn during Q1-Q3 2020 to $424bn during Q1-Q3 2021.

Top advisers by value and volume

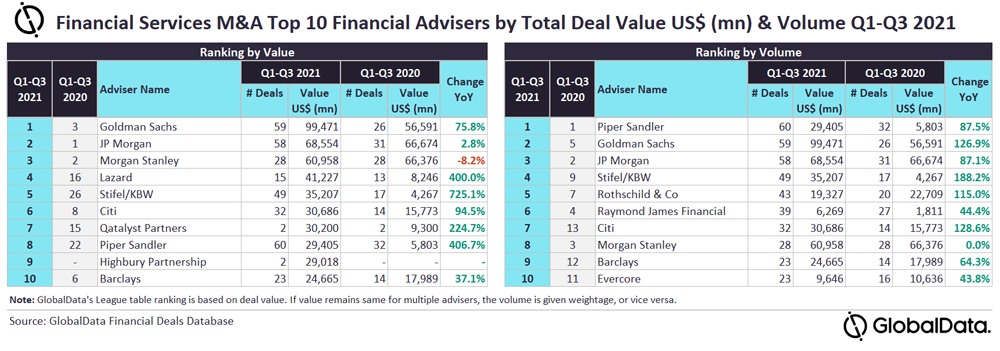

Goldman Sachs and Piper Sandler were the top M&A financial advisers in the financial services sector for Q1-Q3 2021 by value and volume, respectively.

Goldman Sachs advised on 59 deals worth $99.5bn, while Piper Sandler advised on 60 deals worth $29.4bn.

GlobalData lead analyst Aurojyoti Bose said: “Although Goldman Sachs experienced tough competition in terms of deal volume, the firm was way ahead by value due to its involvement in several big-ticket deals.

“In fact, Goldman Sachs was the only financial adviser that managed to advise on deals that were just shy of $100bn during Q1-Q3 2021, thereby outpacing its peers by a significant margin. The firm advised on 24 deals valued more than or equal to $1bn, which also included one mega deal valued more than or equal to $10bn.”

JP Morgan took the second position in terms of value with 58 deals worth $68.6bn. It was, followed by Morgan Stanley with 28 deals worth $61bn, Lazard with 15 deals worth $41.2bn and Stifel/KBW with 49 deals worth $35.2bn.

Goldman Sachs secured the second position in terms of volume. It was followed by JP Morgan and Stifel/KBW. Rothschild & Co got the fifth position by volume with 43 deals worth $19.3bn.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.