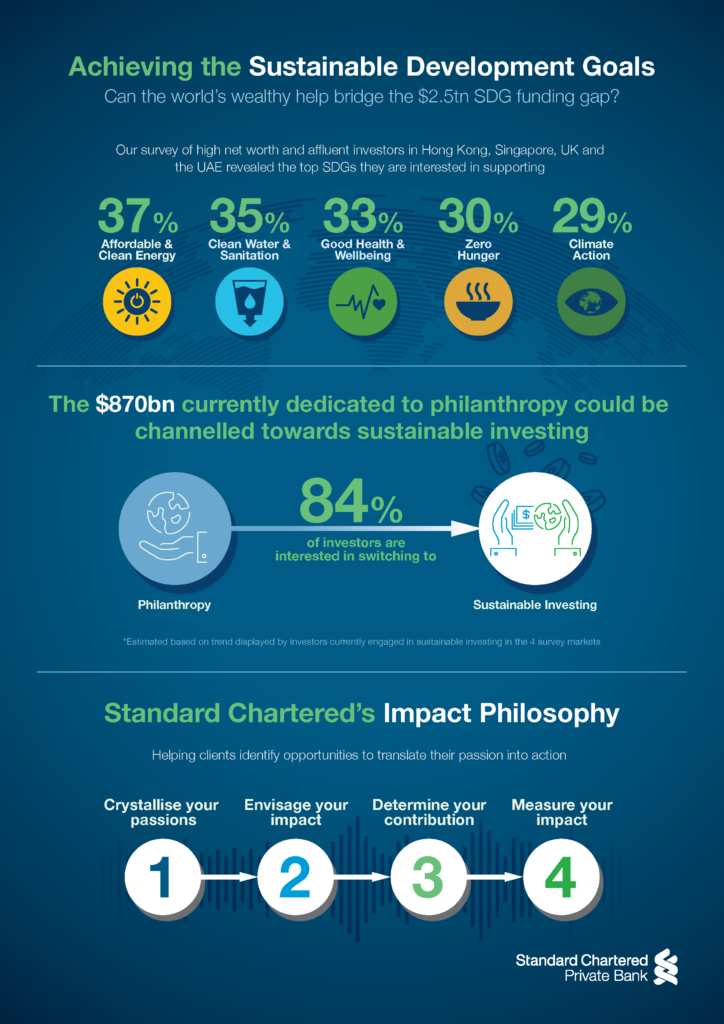

A new survey by Standard Chartered Private Bank has shown that high-net-worth individuals (HNWIs) recognise the increasing importance of sustainable investing, with 84% open to shifting their funds from philanthropy to ESG goals.

Sixteen per cent of AUM from the HNWIs surveyed by Standard Chartered (based in Hong Kong, Singapore, UAE and the UK) is currently allocated towards philanthropy and is estimated to account for $870bn of portfolios worldwide.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The three areas of the United Nations Sustainable Goals (SDGs) thought to be of greatest importance for HNW investors are affordable and clean energy, clean water and sanitation, and good health and well-being.

Going forward, it is predicted that investors will also pay increasing attention to combating hunger and poverty.

Standard Chartered addresses importance of sustainable investing

Sustainable investments are showing increasing importance as investors look to be more selective in navigating volatile markets. However, statistics suggests the hype is yet to truly manifest itself in portfolios.

As of 2014, SDGs were underfunded by $2.5tn, according to the United Nations Conference on Trade and Development World Investment Report.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis is something Standard Chartered is looking to remedy, announcing the launch of Impact Philosophy. This is designed to address the perceived lack of information that HNWIs are provided on sustainable investing.

Impact Philosophy aims to show clients the effect their investment will have, and how success can be measured based on the global Impact Reporting and Investment Standards (IRIS).

Didier von Daeniken, Standard Chartered’s global head of private banking and wealth management, said: The financial system has the potential to be a major catalyst in the sustainability revolution.

“With the risks from major challenges, such as climate change and lack of access to healthcare, becoming ever clearer, our clients are looking to play a more active role as responsible global citizens.

“Our new Impact Philosophy offers a structured roadmap to help them mobilise their capital towards achieving the Sustainable Development Goals.”