According to data gathered by wealth management company Evelyn Partners, the number of families being hit with inheritance taxes or tax fines on gifts made during their lifetime has been rising.

Huge donations can be given at any time, but if the donor passes away within seven years, the gift may be taxable or included in the estate’s value for the purpose of calculating inheritance tax (IHT).

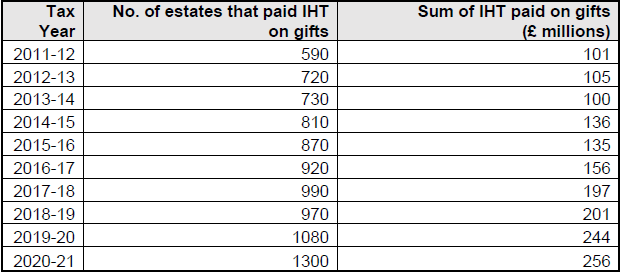

The number of households that paid IHT on gifts made fewer than seven years before death more than doubled, from 590 in 2011/12 to 1,300 in 2020/21, based on HM Revenue and Customs statistics obtained through a Freedom of Information request filed by Evelyn Partners.

Additionally, from £101m ($133m) in 2011–12 to £256m in 2020–21, the total amount of IHT paid on gifts more than doubled, representing a rise of 153% in nominal terms and 119% in real terms.

It appears from the data that beneficiaries had to pay an average of £171,186 in taxes in 2011–12 and £196,923 in taxes in 2020–21 for lifetime gifts.

Ian Dyall, head of estate planning at leading wealth management firm Evelyn Partners, said: “This data suggests that some pretty significant shock tax bills are being delivered to people. Those who receive generous gifts from older relatives need to be aware that they could be liable for a big tax charge if that relative dies within seven years of making the gift.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“These figures show that a growing number of recipients will have had a potentially unexpected IHT bill to pay, when the donor dies, on a gift that they could have received several years ago. How many had the liquid assets available to pay it? How many had invested the money in illiquid assets like a new home?”

Following the Potentially Exempt Transfer (PET) rules, contributions that exceed the yearly gifting allowances in each year take seven years to leave the donor’s estate and are then exempt from IHT.

Dyall continued: “The fact that both the number and size of inheritance tax bills on lifetime gifts more than doubled between 2011/12 and 2020/21 suggests that an increasing number of families are making lifetime gifts – possibly in an effort to reduce the size of their estate as IHT becomes more of a burden.

“With both the nil rate band of £325,000 and the residential NRB of £175,000 in a multi-year freeze, more estates are becoming liable to IHT – but also more assets in each liable estate are taxable.”

Although most recent HMRC statistics show that 4.4% of estates paid IHT in 2021-22, the swift rise in wealth among older individuals indicates that this figure will jump to more than 7% by 2032-33.

By 2032-33, one in every eight people, or 12%, will be afflicted by IHT as a result of their own or their partner’s deaths.