British asset management firm Schroders has posted an operating profit of £723m for the year 2022, which represents a decline of 14% from £841m a year ago.

For the year ended 31 December 2022, the company profit before tax dipped 23% to £587m from £764m a year earlier.

Net operating revenue for the year was £2.3bn, up 1% compared with £2.27bn in 2021.

Net operating income declined 2% year-on-year to £2.47bn while operating expenses rose by 4% to £1.75bn.

Asset under management at the end of 2022 stood at £737.5bn as against £766.7bn in the previous year.

The company’s basic operating earnings per share dipped 13% to 37.4 pence from 43 pence a year ago.

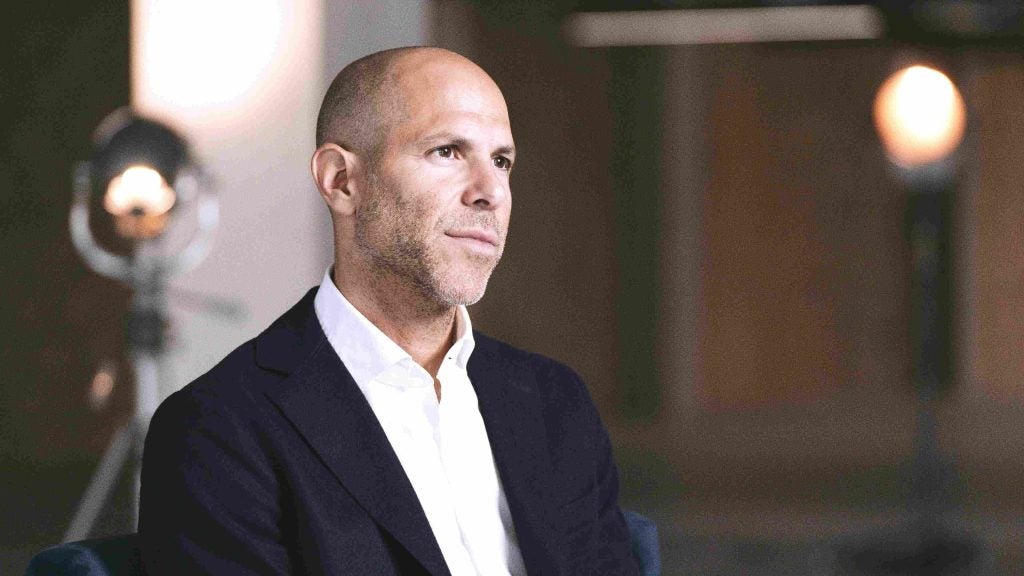

Schroders group chief executive Peter Harrison said: ”The market challenges of 2022 provided a stress test for our strategy. I am encouraged by our resilient performance and that our strategy is working.

“The businesses we have been building in recent years – across wealth management, private assets and solutions – performed strongly. They are all playing an increasingly important part in our growth and now represent 53% of the group’s AUM.”

The company noted that its private assets business Schroders Capital achieved fundraising of £17.5bn in the year.

Furthermore, the group’s wealth management advice division registered organic growth of 6.6%.

The company’s Board has proposed a final dividend of 15 pence per share, taking the total dividend to 21.5 pence per share.