The need to transact remotely amid COVID related lockdowns is accelerating innovation and technology adoption by financial institutions. Regulatory initiatives focused on maintaining operational resilience are expected to remain prominent in the future.

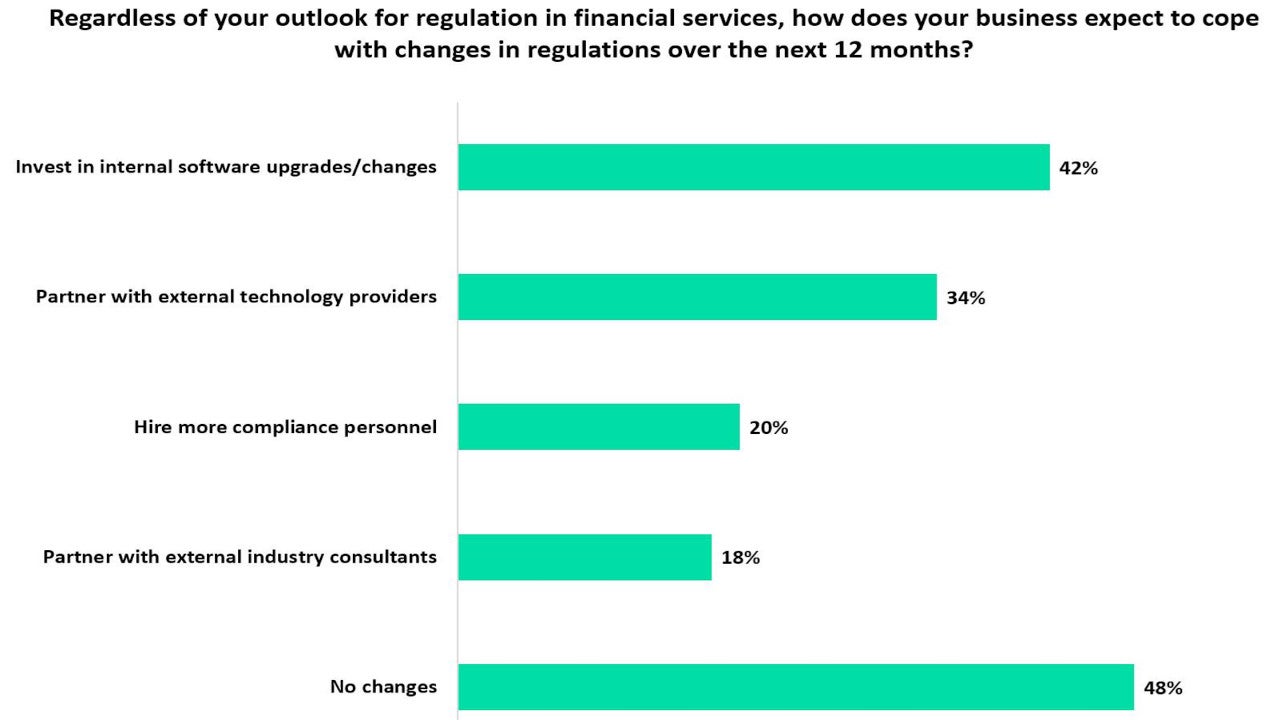

Verdict has conducted a poll to identify the business initiatives retail bankers will take to cope with regulatory changes over the next 12 months.

Investing in internal software upgrades (42%) and partnering with external technology partners (34%) are the steps that a majority plan to take, shows the analysis of the poll results.

Further, 20% plan to hire more compliance personnel and 18% plan to partner with external industry consultants to cope with the regulatory changes.

The analysis is based on 50 responses received from the readers of Retail Banker International, Cards International, Electronic Payments International, and Private Banker International, Verdict network sites, between 22 January and 02 June 2021.

Impact of changes in retail banking regulations

The economic crisis following the COVID-19 pandemic led policymakers globally to draft updated regulations to ensure stability in financial markets and boost credit availability to non-financial private sector.

Apart from keeping a close watch over bank provisioning, regulators are also expected to focus on the use of technologies to ensure adequate risk governance, cybersecurity, fraud prevention, and financial crime controls amid the remote working operating models.

In the US, for example, the Financial Stability Oversight Council has been asked to consider designating cloud computing companies as Systematic Important Financial Markets Utilities. Similarly, the Financial Action Task Force (FATF), the global watchdog of money laundering and terrorist financing, has encouraged the use of digital identity verification during remote account opening.

Financial firms will need to perform a complete risk assessment and update their compliance policies, while providing additional training to employees to ensure their operations are compliant with regulations such as the General Data Protection Regulation in the European Union (EU).