SINGAPORE, 13 October, 2017 – Private Banker International (PBI) has announced the 2017 PBI Top 20 Asia-Pacific Assets under Management (AUM) Rankings at the Private Banker International Global Wealth Summit 2017 in Singapore.

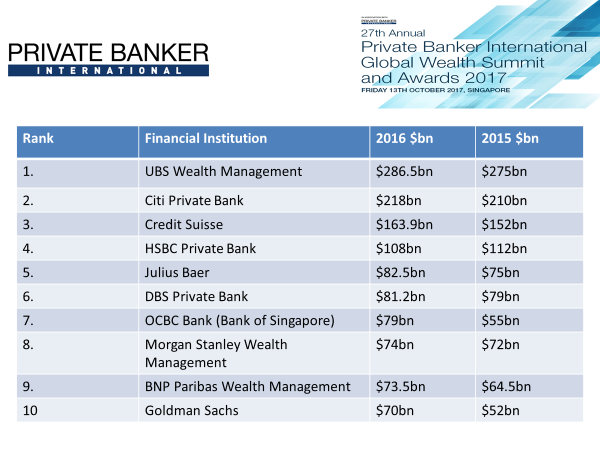

UBS Wealth Management claimed the top position for the fifth year in a row as the largest private bank by AUM for high net worth (HNW) clients in the region, according to the PBI survey.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

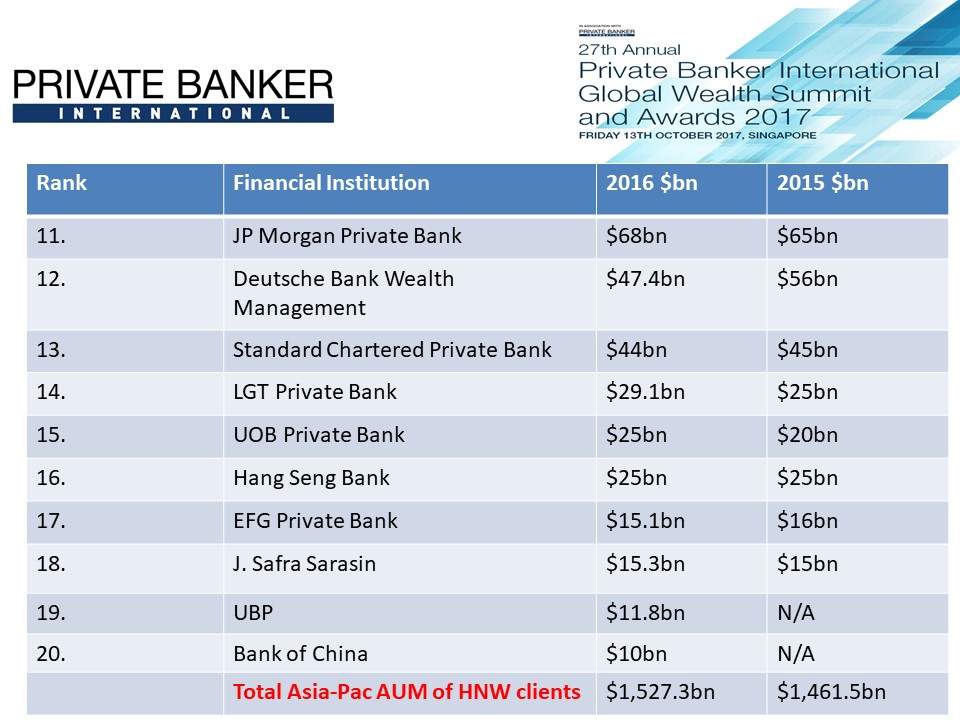

This year’s PBI rankings showed that Asian private banks were back in accumulation mode in 2016, with assets under management at the top 20 institutions reaching USD1527.3bn, up from USD1461.5bn in 2015 and almost on a par with the high of 2014.

This figure is even more impressive when viewed in the context of falling brokerage revenues and clients’ response to regulatory changes.

Total AUM at the top 20 private banks in Asia Pacific rose to USD1,527.3bn in 2016 compared to USD1,461.5bn in 2015. This is a rise of 4.5%.

The PBI study ranked private banks by AUM for high net worth (HNW) clients with investable assets of more than USD1m.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUBS Wealth Management experienced a 4.2% year-on-year (YoY) increase in AUM for HNW clients year-on-year to USD286.5bn in 2016.

There were no changes in ranking among the top four banks from the 2015 survey as Citi Private Bank (with USD218bn in AUM), Credit Suisse (USD163.9bn in AUM) and HSBC Private Bank (USD108bn in AUM) claimed the 2nd 3rd and 4th spots respectively.

Movers and shakers

There were several noteworthy changes across the rest of the rankings in 2016. Julius Baer claimed a spot among the top five banks in the 2016 AUM rankings – up one place from 2015 – with USD82.5bn in AUM for HNW clients.

DBS Private Bank’s AUM for HNW clients rose 2.8% YoY to USD81.2bn in 2016. However, this was not enough to stop it falling to 6th place this year’s rankings – down from 5th in last year’s PBI Asia-Pacific AUM survey.

OCBC Bank’s (Bank of Singapore) rise in this year’s PBI ranking table also should be highlighted.

The bank’s AUM for high net worth (HNW) clients increased substantially from USD55bn in 2015 to USD79bn in 2016, a YoY rise of 43.6%.

This enabled OCBC Bank (Bank of Singapore) to climb the PBI Asia-Pacific AUM rankings from 11th place in 2015 to 7th place in 2016.

Goldman Sachs also stood out because its AUM for high net worth (HNW) clients rose from USD52bn in 2015 to $70bn in 2016 – a rise of 34.6%. In doing this, Goldman Sachs climbed to 10th spot in this year’s PBI table – up two places from last year.

The PBI 2017 survey shows that one fifth of private banks in 2016 saw their AUM of HNW clients dip YoY.

Deutsche Bank Wealth Management recorded the largest YoY decrease with its AUM for high net worth (HNW) clients falling from USD56bn in 2015 to USD47.4bn in 2016.

PBI 2017 Top 20 Asia-Pacific Assets under Management (AUM) of HNW clients ($bn)

Local banks’ performance

Local private banks in the region continued, for the most part, to gain momentum in their YoY AUM figures. OCBC Bank’s (Bank of Singapore) strong performance has been highlighted above. UOB Private Bank’s AUM for high net worth (HNW) clients rose 25% YoY to USD25bn in 2016.

Private Banker International’s editor Ronan McCaughey said: “Acquisitions had a significant impact on this year’s rankings. Number 14 on the 2015 PBI table, Barclays Wealth & Investment Management disappeared following its acquisition by Bank of Singapore, which jumped 11th place in 2015 to 7th place in 2016.

“Meanwhile, the purchase of Coutts International’s activities in Singapore and Hong Kong by Union Bancaire Privée (UBP), one of this year’s two newcomers, pushed ABN AMRO Private Bank off the list.”

McCaughey added: “Looking ahead, the outlook for the Asia-Pacific private banking and wealth management sector is very positive. Asia-Pacific remains the world’s largest HNWI market and wealth creation in China remains a major growth engine.

“This is a time of disruption and opportunity for private banks and wealth managers in Asia-Pacific and the industry is adapting to change.

“Wealth management engagement through digital channels in Asia will continue to rise, but HNW clients will still want the luxury of talking to a relationship manager. The future belongs to those who embrace change, put their clients first and innovate.”

PBI 2017 Top 20 Asia-Pacific AUM rankings methodology

1.The PBI Asia-Pacific Top 20 report – which ranks the top private banks in the region by assets under management for high net worth (HNW) clients – has become a trusted source of information for the private banking industry.

2.Information for the report is drawn from many sources, including publicly available investor information in the first instance, but also articles and interviews from Private Banker International and other reputable media sources.

3.Our preference is for banks to provide verifiable details of their assets under management.

4.If this information is not forthcoming, a ranking has been based on an estimated figure calculated from the above sources.

5.Please note that estimates may be conservative and that we accept no responsibility for under-estimates that occur as a result of a bank failing to respond to requests for information.

6.Our definition of ‘high net worth individual’ is anyone with investable assets in excess of USD1m, in line with current industry standards.

- The figures for this year’s PBI Top 20 Asia-Pacific Assets Under Management (AUM) Rankings were based on figures from Q4 2016 where publicly available and from internal sources

- Where a range of AUM is used, PBI has taken the lower figure in calculating total AUM.

- Exchange rates have been applied for the PBI 2017 Top 20 Asia-Pacific AUM Rankings as at 31 Dec 2016

- This year’s PBI Top 20 Asia-Pacific Assets under Management (AUM) Rankings includes private banks active in Singapore and Hong Kong booking centres.

About Private Banker International

Established over 25 years ago, PBI is an editorially independent and authoritative publication aimed at private banks, wealth managers, family offices, financial services companies, related intermediaries and technology vendors in the private banking and wealth management sector.

Visit: www.privatebankerinternational.com

Private Banker International contact:

Ronan McCaughey, Editor of Private Banker International

Email: Ronan.mccaughey@verdict.co.uk