Moonfare, a global digital private equity investment platform with operations in Singapore and Hong Kong, has set a new high by capping the extension of its Series C funding round at $15m.

This raises the total money received in the Series C investment round to more than $130m.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Following the merger of Insight Partners in November 2021, Vitruvian Partners and Swiss private bank Bordier & Cie acquired control of Moonfare in March 2022.

As a new institutional investor, 7 Global Capital (7GC) has joined Moonfare’s Series C investment round. 7GC is a well-established venture capital business that invests in companies with the potential to dominate their respective internet and consumer technology sectors.

Former investments include Hims & Hers, Roofstock, Jio, Jackpocket, and more.

“We’re excited by this investment, particularly considering valuations of the most valuable VC-backed companies have fallen by half over the past few months.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“We experienced overwhelming demand from shareholders and institutional parties wanting to participate in this extension round, demonstrating that Moonfare is solidifying its mission to democratise access to private equity,” says Moonfare chief executive officer and founder Steffen Pauls.

“Individual investors and their advisors are increasingly seeking refuge in private equity, especially in current volatile public markets. We aim to meet this demand by giving an even broader range of like-minded investors access to our curated low-minimum private market funds.

“We will offer new products, expand into new markets, and strengthen our senior management team with seasoned private equity experts. We are well equipped to meet our growth plans for this year,” he explains.

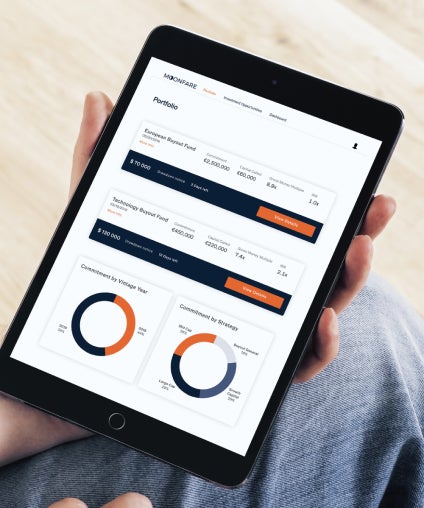

Qualified shareholders in top-tier private equity and venture capital funds such as KKR, Carlyle, EQT, and Insight Partners can interact with Moonfare at modest minimums and through a simple digital approach.

In the fiscal year ending December 2022, the company increased its assets under management by over 60% to more than $2.3bn.

During the same period, the number of Moonfare investors climbed by 40% to 3,393, while the number of registered users more than doubled to over 48,000.

Moonfare has multiplied the number of funds available on its platform from 40 to 69 (a 73% increase) and added two new asset classes, Impact and Philanthropy, to fulfil this expansive requirement.

In 2022, the company expanded into nine new markets, including Scandinavia, Portugal, Israel, and the United States, and opened four new offices in Singapore, New York, Zürich, and Paris.