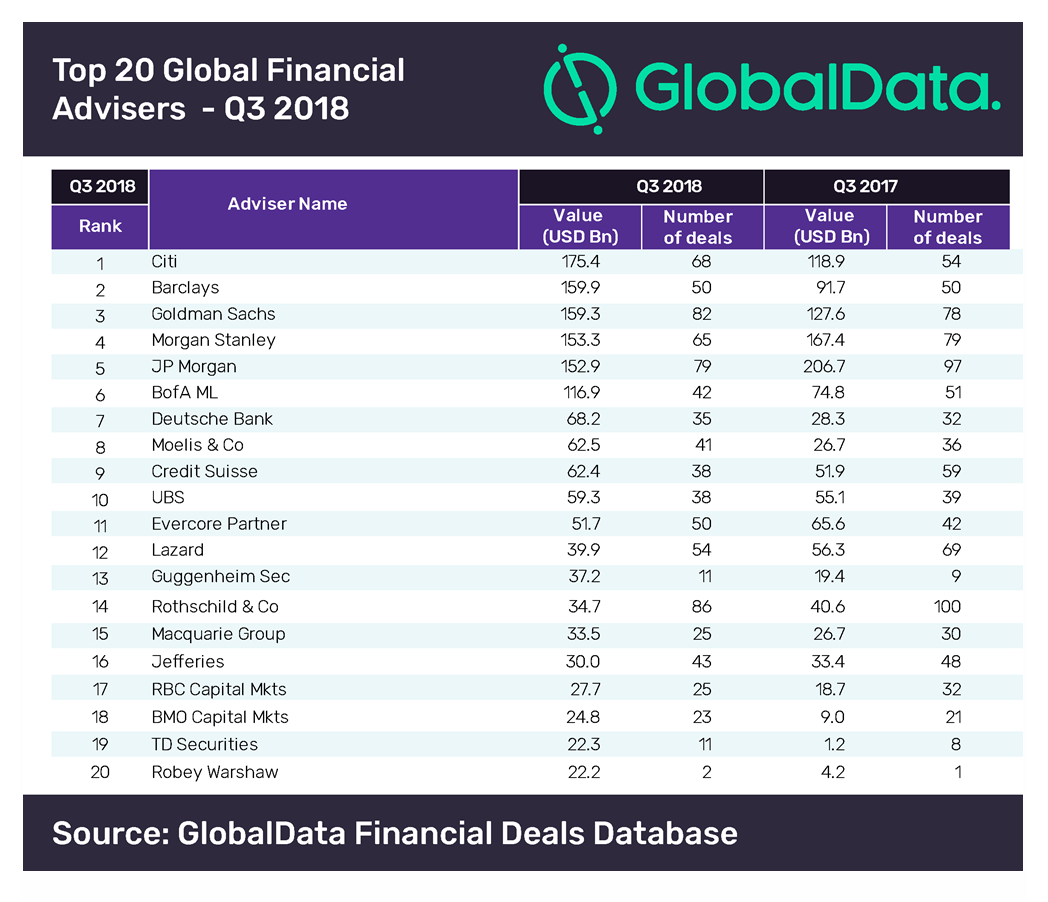

Citi has topped the latest M&A league table of the top 20 financial advisers globally for Q3 2018, compiled by leading data analytics company GlobalData.

The American bank advised on 68 deals worth $175.4bn, including the quarter’s biggest deal recorded globally – Energy Transfer Equity’s $60.4bn stake acquisition in Energy Transfer Partners.

With a mix of some big-ticket and several small-ticket deals, the bank climbed up four positions from Q2 2018 to the top rank in Q3 2018.

When compared to the third quarter of 2017, Citi experienced a 47.46% jump in deal value and a 25.93% surge.

According to GlobalData, which uses its tracking of all merger and acquisition, private equity/venture capital and asset transaction activity around the world to compile the league table, Barclays finished second with a deal value of $159.9bn, closely followed by Goldman Sachs with $159.3bn in Q3 2018.

The two players saw a jump of 74.3% and 24.9% respectively over Q32017.

Among the top 20 legal advisers during the quarter, the 19th-ranked TD Securities saw 1819% growth in value by jumping from $1.2bn in Q32017 to $22.2bn in Q32018.

US banks dominate the top five financial advisers

With 65 deals worth $153.3bn, and 79 deals valued at $152.9bn, Morgan Stanley and JP Morgan secured fourth and fifth positions, respectively.

Interestingly, both the banks saw a drop in value and volume this quarter over the same quarter previous year.

In terms of volume, Rothschild & Co bagged the most number of deals in this quarter – 86, though it recorded a drop in value and volume of 14.41% and 14%, respectively from the same quarter previous year. Goldman Sachs stood second in the volume chart at 82, followed by JP Morgan at 79.

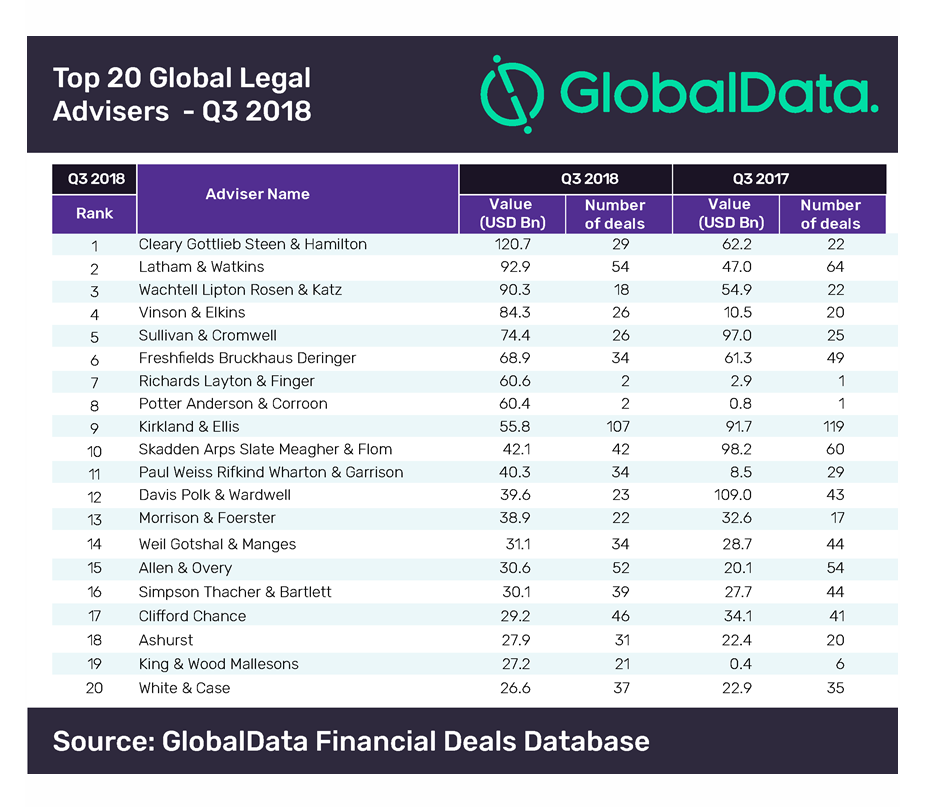

Legal advisers – Cleary Gottlieb Steen & Hamilton tops the list

From its fifth position in Q2 2018, the American law firm climbed up to the top rank in Q3 2018, driven by 29 deals worth $120.7bn, including the biggest transaction of the quarter – Energy Transfer Equity’s $60.4bn stake acquisition in Energy Transfer Partners.

With its involvement in a mix of several big-ticket and small-ticket deals, Cleary experienced a 94% surge in value during Q3 2018 and an almost 32% jump in volume when compared to the same quarter previous year.

Second ranked, Latham & Watkins registered a 97.6% jump in the value of the deals it worked on during Q32018 when compared to Q32017, its volumes dropped by 15.6%.

The Energy Transfer deal had seen the participation of five legal firms – Cleary Gottlieb Steen & Hamilton, Latham & Watkins, Vinson & Elkins, Potter Anderson & Corroon, and Richards Layton & Finger.

Interestingly, Richards Layton & Finger, and Potter Anderson & Corroon made it to the top 20 list with just two deals each, primarily on the back of The Energy Transfer transaction. However, Kirkland & Ellis that topped the table in volume terms with a massive 107 deals to its credit, stood behind them at ninth position.

With 18 transactions worth $90.3bn, Wachtell Lipton Rosen & Katz finished third in the list, while Vinson & Elkins with 26 deals valued at $84.3bn and Sullivan & Cromwell with 26 deals worth $74.4bn held fourth and fifth positions, respectively.