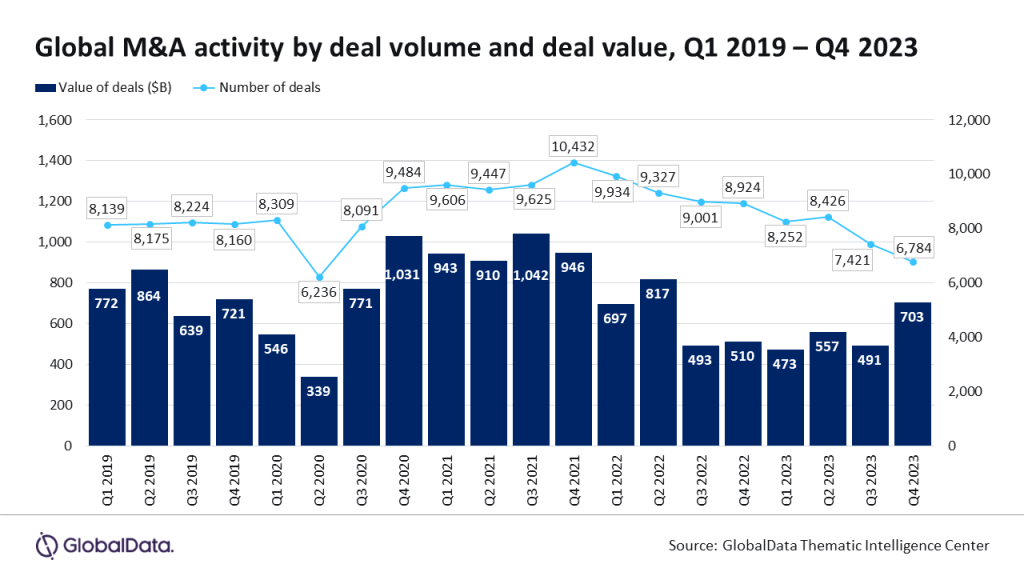

According to GlobalData, an established data and analytics organisation, these trades totalled $2.2trn, a 12% decline from the previous year, owing to price hikes and rising interest rates worldwide, which caused a dip in the global economy.

The total number of M&A deals decreased by 17% from 37,186 in 2022 to 30,883 in 2023, based on GlobalData’s most recent study, “Global M&A Deals in 2023 – Top Themes by Sector – Thematic Intelligence.”

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The market slump in 2023 also had an influence on the number of megadeals worth more than $1bn, which fell to its lowest level since 2019, with just 432 in 2023 compared to 816 in 2021.

Out of the top 500 M&A agreements in terms of deal value, 49 deals were driven by the topic of environmental, social, and governance (ESG), which has become the most prevalent issue in terms of deal volume.

Priya Toppo, thematic intelligence analyst at GlobalData, stated: “An ongoing trend is the dominance of North America in M&A deal activity. In 2023, it recorded 12,416 deals worth $1.15trn, making it the most active region in the global M&A market. Meanwhile, all regions including Europe, APAC-excluding China, South America and Middle East and Africa saw a drop in deal value in 2023 compared to the previous year, except China.”

Even though there was a general decrease in deal activity, 2023 saw some noteworthy transactions.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor example, ExxonMobil acquired Pioneer Natural Resources, a producer of low-cost, low-carbon-intensity oil and natural gas, for $65bn, and Chevron paid $60bn to acquire Hess, an energy company that explores for and produces crude oil and natural gas.

Toppo added: “Given the slump in global M&A deal activity in 2023, the outlook for M&A 2024 remains subdued. With inflationary pressures easing and interest rates having peaked, GlobalData expects a recovery over the course of the year. Mega deals will continue to face hurdles, especially in the US, where antitrust concerns have been a focus of regulators.

“As businesses navigate the rapidly changing global landscape, integrating ESG principles into M&A strategies has become a necessity for long-term success. However, the M&A market will rebound throughout 2024 as interest rates fall and acquisitions remain a key element of corporate strategy.”