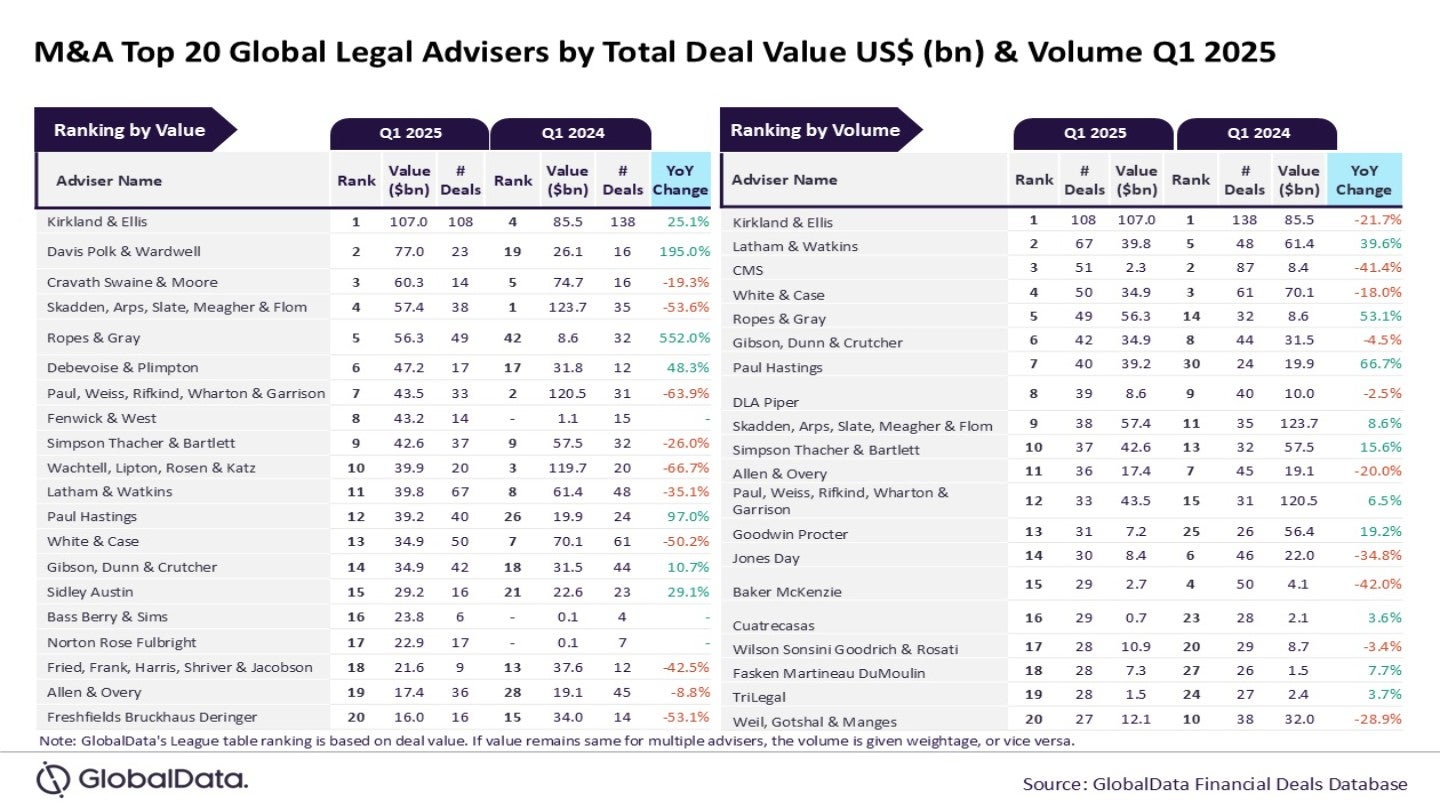

Kirkland & Ellis has been identified as the leading legal adviser in mergers and acquisitions (M&A) for the first quarter of 2025, according to the latest legal advisers league table published by GlobalData.

This ranking is based on the value and volume of M&A deals for which legal advisers provided counsel.

According to GlobalData’s Deals Database, Kirkland & Ellis secured its top position by advising on 108 deals with a total value of $107bn.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis outpaced its peers by a significant margin during Q1 2025 and was the clear winner by deal volume as well as value. It was the only firm with triple-digit deal volume during the review period. Moreover, it was also the only adviser with total deal value surpassing $100bn.

“Kirkland & Ellis registered double-digit jump in total value of deals advised by it during Q1 2025 compared to Q1 2024. Resultantly, it went ahead from occupying the fourth position by value in Q1 2024 to top the chart by this metric in Q1 2025. Kirkland & Ellis advised on 21 billion-dollar deals*, which also included two mega deals valued more than $10bn. Involvement in these big-ticket deals helped Kirkland & Ellis to register improvement in terms of value as well as the ranking by this metric.

In terms of deal value, Davis Polk & Wardwell ranked second, advising on transactions worth $77bn.

Cravath Swaine & Moore followed closely with $60.3bn, while Skadden, Arps, Slate, Meagher & Flom and Ropes & Gray reported deal values of $57.4bn and $56.3bn, respectively.

When considering the volume of deals, Latham & Watkins took the second spot, having advised on 67 transactions. CMS ranked third with 51 deals, followed by White & Case with 50 deals, and Ropes & Gray with 49 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.