Goldman Sachs has recorded net revenues of $15.39bn and net earnings of $5.49bn in Q2 2021.

Net revenues were up 16% for the quarter year-on-year, attributed to higher net revenues in asset management, investment banking, and consumer & wealth management, but 13% lower than Q1 2021.

For H1 2021, net revenues were $33.09bn and net earnings were $12.32bn.

Diluted earnings per common share (EPS) was $15.02 for the second quarter of 2021 compared with $0.53 for the second quarter of 2020 and $18.60 for the first quarter of 2021, and was $33.64 for the first half of 2021 compared with $3.66 for the first half of 2020.

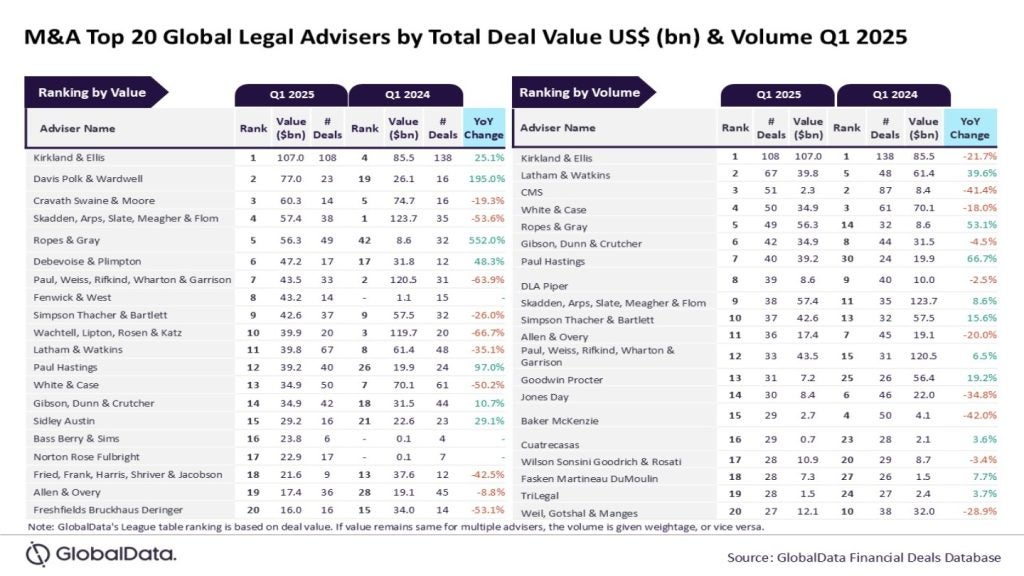

Furthermore, according to the firm, it ranked first worldwide in announced and completed mergers and acquisitions, worldwide equity, and equity-related offerings, common stock offerings, and initial public offerings for the year-to-date.

Asset management delivered 33% of quarterly net revenue, totalling $5.13bn, thanks to record quarterly net revenues from Equity Investments. This was more than double the amount earned year-on-year.

Assets under supervision increased $101bn during the quarter, including long-term net inflows of $22bn to reach $2.31trn. Firmwide Management and other fees collected a record $1.84bn for Q2 2021.

Goldman Sachs wealth management in Q2 2021

The consumer and wealth management arm of Goldman Sachs delivered 11% of the net revenue in Q2 2021, a total of £1.75bn. In that number, $1.38bn came directly from wealth management

Year-on-year, net revenues increased 28% for the arm and up 25% for wealth management specifically.

David M. Soloman, chairman and chief executive, said: “Our second quarter performance and record revenues for the first half of the year demonstrate the strength of our client franchise and our continued progress on our strategic priorities. While the economic recovery is underway, our clients and communities still face challenges in overcoming the pandemic. But, as always, I am proud of the dedication and resilience of our people, who have worked tirelessly to help our clients navigate the ever-changing market environment.”