Financial Advisers

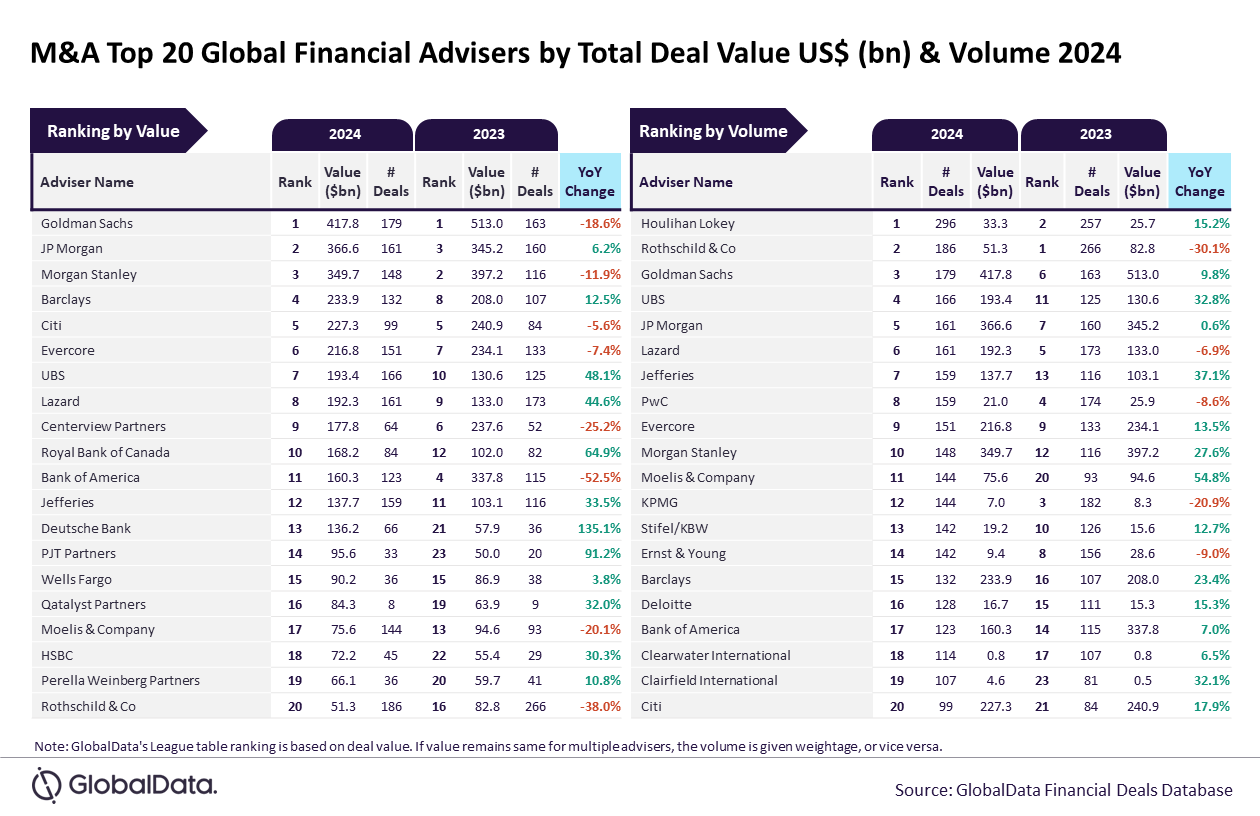

Goldman Sachs and Houlihan Lokey top M&A financial advisers by value and volume in 2024

Goldman Sachs and Houlihan Lokey have emerged as the top mergers and acquisitions (M&A) financial advisers by value and volume, respectively, for 2024 in the latest Financial Advisers League Table, which ranks financial advisers by the value and volume of M&A deals on which they advised, by GlobalData, publishers of RBI.

An analysis of GlobalData’s Deals Database has revealed that Goldman Sachs achieved its leading position in the deal value rankings by advising on $417.8bn worth of deals. Meanwhile, Houlihan Lokey led in terms of volume by advising on a total of 296 deals.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, said:“Goldman Sachs was the top adviser by value in 2023 and also managed to retain its leadership position by this metric in 2024 as well. Although it registered a year-on-year decline in value, Goldman Sachs still remained much ahead of its peers due to its involvement in big-ticket deals. In 2024, Goldman Sachs advised on 88 billion-dollar deals, of which nine were mega deals valued more than $10bn.

“Meanwhile, Houlihan Lokey registered a growth in the total number of deals advised by it in during 2024 compared to the previous year. Resultantly, it went ahead from occupying the second position by volume in 2023 to top the chart by this metric in 2024. In fact, it outpaced its peers by a significant margin and just fell short of only four deals to hit the 300-deal volume mark during the year.”

Rothschild occupied the second position in terms of volume by advising on 186 deals, followed by Goldman Sachs with 179 deals, UBS with 166 deals, and JP Morgan with 161 deals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMeanwhile, JP Morgan occupied the second position in terms of value, by advising on $366.6bn worth of deals, followed by Morgan Stanley with $349.7bn, Barclays with $233.9bn, and Citi with $227.3bn.

Legal Advisers

Kirkland & Ellis top M&A legal adviser in 2024

Kirkland & Ellis has emerged as the top mergers and acquisitions (M&A) legal adviser for 2024 in terms of both value and volume on the latest Legal Advisers League Table, which ranks legal advisers by the value and volume of mergers and acquisition (M&A) deals on which they advised, by GlobalData.

An analysis of GlobalData’s Financial Deals Database has revealed that Kirkland & Ellis achieved the leading position by advising on 576 deals worth $422.3bn.

Aurojyoti Bose, Lead Analyst at GlobalData, said:“Kirkland & Ellis was the clear winner in 2024, outpacing its peers by a significant margin. It was the only firm to advise on more than 500 deals in the year. Moreover, it was also the only adviser with total deal value surpassing $400bn during the year. Interestingly, Kirkland & Ellis was also the top adviser by both value and volume during the previous year as well.

“Kirkland & Ellis registered a double-digit growth in total value and volume of deals advised by it during 2024 compared to 2023. It advised on 89 billion-dollar deals, which also included nine mega deals valued more than $10bn. Involvement in these big-ticket deals helped Kirkland & Ellis to register improvement in terms of value.”

Skadden, Arps, Slate, Meagher & Flom occupied the second position in terms of value, by advising on $354bn worth of deals, followed by Paul, Weiss, Rifkind, Wharton & Garrison with $295.7bn, Cravath Swaine & Moore with $254.4bn, and Latham & Watkins with $254bn.

Meanwhile, CMS occupied the second position in terms of volume by advising on 325 deals, followed by White & Case with 253 deals, Latham & Watkins with 245 deals, and Allen & Overy with 208 deals.