Financial services professionals worldwide are bracing for a significant boost in bonuses in 2025, with an average expected increase of 50% compared to 2024, according to a global study by careers platform eFinancialCareers.

The optimism spans major financial centres and sectors, but concerns about job security persist.

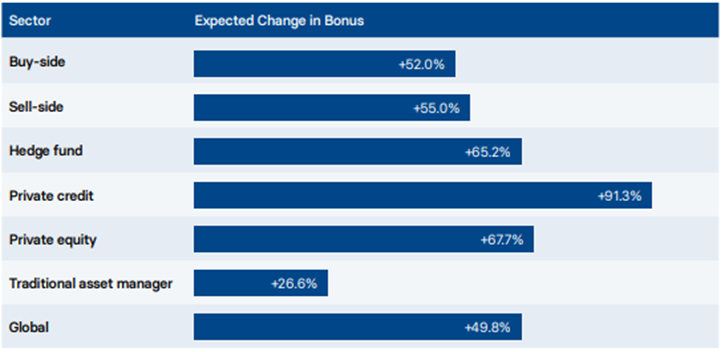

Professionals in private credit are the most bullish, predicting a 91% rise in bonuses, followed by those in private equity (68%) and hedge funds (65%). Traditional asset managers, however, expect a more modest 27% increase.

Table 1: Expected changes in YoY bonuses

The UK leads the way among markets, with expectations of a 43% bonus hike following the relaxation of the country’s bonus cap, outpacing Europe (40%) and North America (38%).

Meanwhile, the Gulf region stands out for its optimism, with professionals forecasting a 78% increase, but 50% remain uneasy about job security—a sentiment echoed globally by 42% of respondents.

Despite rising compensation, feelings of job insecurity are growing. Nearly half of respondents in the Gulf region and a significant portion globally feel vulnerable, marking a 9% rise in such concerns from the previous year.

Table 2: Bonus expectations by region

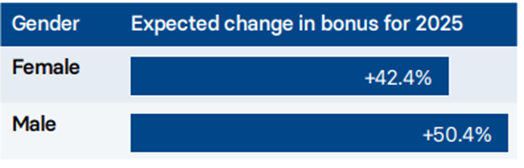

Moreover, the study also highlights a narrowing gender gap in bonus expectations. Men remain more optimistic, anticipating higher bonuses than women, but the difference has decreased to 8% from 11% in 2024.

Table 3: Bonus predictions by gender

Although bonuses in the January 2024 round were modest—up 2.9% in the UK, 5.8% in North America, and 0.9% in Europe—the recovery of investment banking revenues has sparked hopes of a more robust financial year ahead.

Peter Healey, CEO of eFinancialCareers, explains the high expectations: “The level of optimism is fairly surprising given the uncertain environment across the globe. Q3 earnings showed bumper growth across most major players and so this will be influencing how bullish individuals feel which is reflected in these predictions. That optimism seems to be shared across most major sectors, locations, and demographics.

“Throughout 2024, investment banking revenues have recovered, and our findings demonstrate that there is hope that this is the start of a recovery that will continue into 2025.”