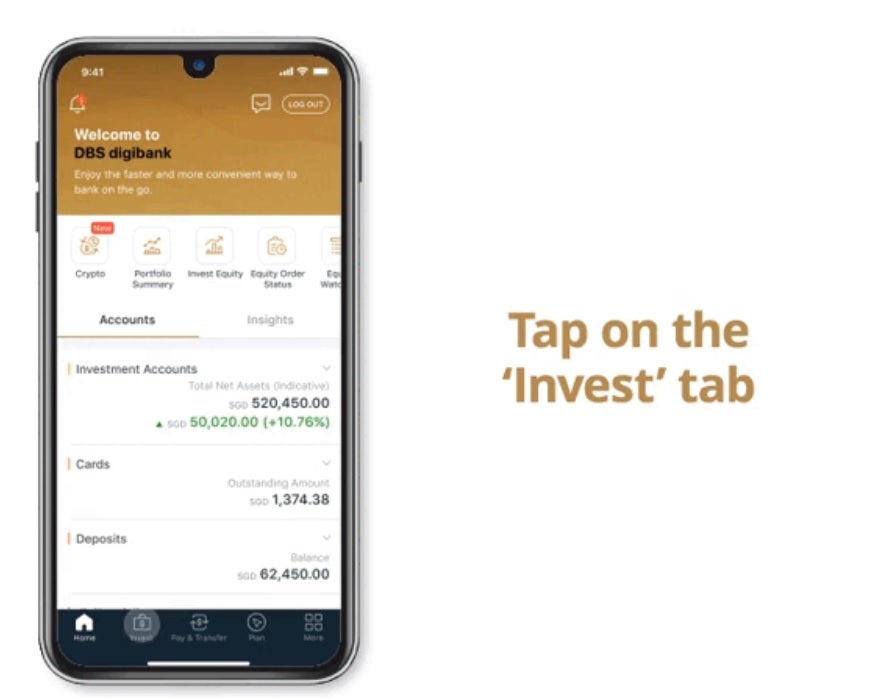

Singapore-based financial services group DBS has introduced a crypto trading interface through DBS digibank for its affluent clients.

The self-directed functionality will be available to the firm’s accredited wealth investors to trade cryptocurrencies on DBS Digital Exchange (DDEx).

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

With the move, DBS seeks to provide investors with easy access to crypto trading on DDEx.

Earlier, the company offered this service only to corporate and institutional investors, family offices as well as the customers of DBS Private Bank and DBS Treasures Private Client.

Initially, around 100,000 clients in Singapore will be able to avail services from DBS’ digital asset infrastructure.

Using the new interface, DBS’ accredited wealth clients will be able to trade four cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum and XRP, with a minimum investment of $500.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe latest move builds on a scenario where the number of DBS wealth clients opting for self-directed options is growing. It is estimated that currently nine out of ten equity transactions are carried out digitally, noted DBS.

DBS Bank group executive of Consumer Banking and Wealth Management Sim S. Lim said: “As a trusted partner that helps our clients to grow and protect their wealth, we believe in staying ahead of the curve and providing access to the solutions they seek.

“Broadening access to DDEx is yet another step in our efforts to provide sophisticated investors looking to dip their toes in cryptocurrencies with a seamless and secure way to do so.”

DBS seeks to digitalise its user onboarding process next year.

In May this year, DBS Bank (Hong Kong) announced a partnership with Shenzhen Rural Commercial Bank (SRCB) to deliver Wealth Management Connect (WMC) Southbound solutions to investors in China’s Greater Bay Area.