Credit Suisse has become the lead investor in a Series B investment round for Geneva-based fintech Taurus, cementing an already strong relationship.

The Switzerland-based bank has chosen to collaborate with Taurus, a digital asset infrastructure provider located in Geneva, to support its objective of growing into digital assets for private, corporate, and institutional clients.

With Credit Suisse serving as the lead investor in Taurus’ Series B investment round, the firms’ existing collaboration is expanded upon.

With additional investors including Deutsche Bank, Pictet, and the Lebanese Cedar Mundi Ventures, a total of $65m was reportedly raised according to the block.

Existing investors Arab Bank Switzerland and the Swiss real estate company Investis took part in the latest round as well.

Lamine Brahimi, co-founder and managing partner of Taurus, comments: “We are proud to welcome such high-profile investors as Credit Suisse and benefit from their expertise to further develop one of the richest platforms in the industry, covering any type of digital asset, way beyond cryptocurrencies.”

The collaboration helps Credit Suisse to further participate in the expanding digital assets ecosystem, acquire technical expertise, and co-develop and exploit market opportunities deriving from the strategic deployment of distributed ledger technology across enterprises.

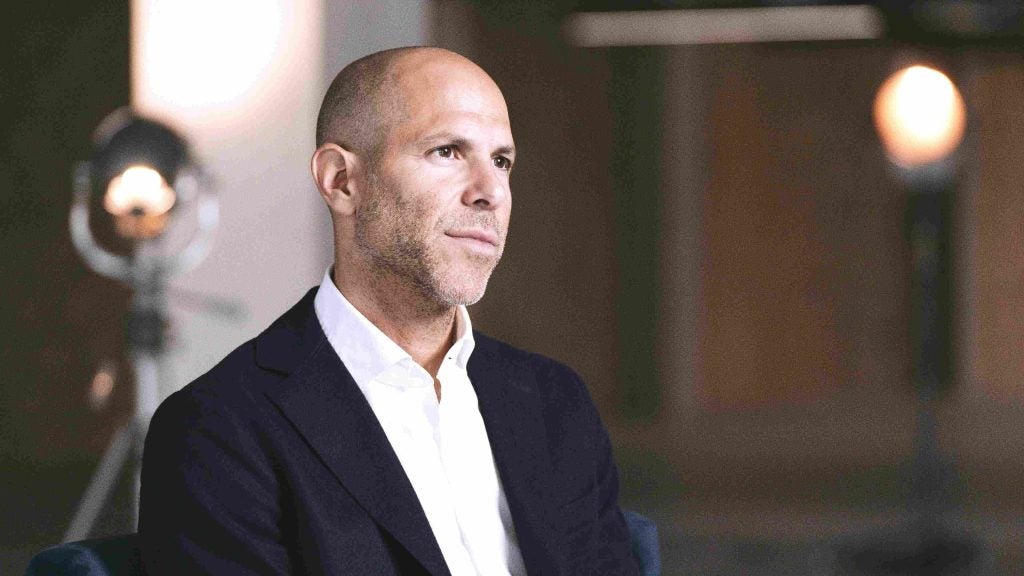

André Helfenstein, CEO Credit Suisse, adds: “The strategic partnership with Taurus is a cornerstone of the Swiss Bank division’s digital assets strategy with the ambition to become the leading Swiss bank in that space.’’

Due to its fully integrated end-to-end solution, extensible technological stack, and helpful Swiss legal and regulatory framework, which enables the company to remain at the forefront of innovation, Taurus is an appropriate partner in this endeavour.

For Credit Suisse clients who prefer digital assets, this partnership will open intriguing possibilities across the life cycle, possibly including solutions that go beyond standard banking services. By working with interested clients and other industry participants, as well as regulatory agencies and national banks, Credit Suisse hopes to significantly improve the Swiss digital asset market.