CNL Financial has joined forces with financial technology platform iCapital Network to drive access to alternative investments.

Orlando-headquartered CNL specialises in real estate and alternative investments.

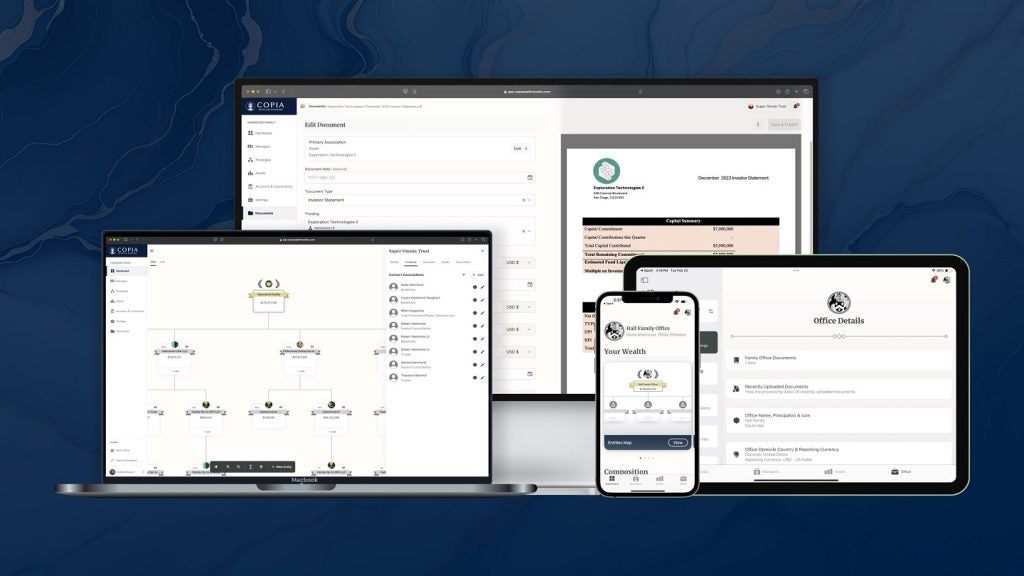

The partnership will see iCapital providing investment diligence and a customised technology platform to the investment management firm. This platform will also provide access to CNL Strategic Capital.

This platform is developed to provide an end-to-end alternative investing solution to support financial professionals and their clients by automating subscriptions, administration, document management and reporting.

It is expected to help financial professionals minimise operational burdens, enhance the user experience while enabling them to offer high level of service to their clients.

CNL Financial Group co-CEO Chirag Bhavsar said: “CNL has a long history of helping financial professionals meet the needs of their clients, both through our innovative alternative investment offerings, but also with the tools and materials we provide.

“This partnership with iCapital is the logical next step in continuing to support and empower financial professionals to provide their clients with the best investor experience possible.”

iCapital Network co-founder and managing partner and head of Client Solutions Dan Vene said: “Financial professionals are actively seeking alternative investments for client portfolios, especially amid the current market and economic environment.

“Integration and automation are key when it comes to easing this investment process for financial professionals and their clients. We are thrilled to partner with CNL on a shared mission to accommodate this demand and allow financial professionals to seamlessly incorporate CNL’s products into their investment menu.”

Last month, iCapital Network announced plans to hire 200 new employees over the next two years for its office in Greenwich, Connecticut.

In January this year, the firm agreed to purchase the assets of alternative investment education and compliance platform AI Insight.

Last year, it raised $146m to support its growth as an independent company.