Citigroup has posted net income of $4.09bn for the first quarter of 2017, a 17% increase compared to $3.50bn in the prior year.

The banking group attributed the rise in income mainly to higher revenues and lower credit costs.

The group’s total revenues for the quarter were $18.12bn, a rise of 3% compared to $17.55bn a year ago. Operating expenses remained largely unchanged at $10.5bn.

Citigroup’s Private Bank revenues increased 9% to $744m. The bank said that the rise was driven by loan and deposit growth and improved spreads.

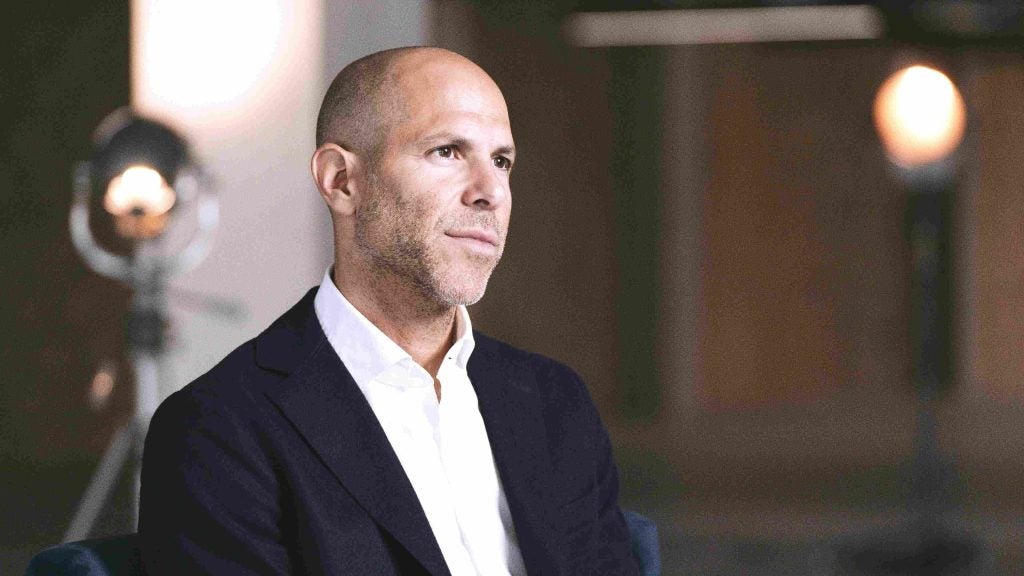

Citi CEO Michael Corbat said: “The momentum we saw across many of our businesses toward the end of last year carried into the first quarter, resulting in significantly better overall performance than a year ago. “

“Through our earnings and the utilization of $800 million in Deferred Tax Assets, we generated $5.5 billion of total regulatory capital before returning $2.2 billion to our shareholders. Our CET 1 Capital ratio rose to 12.8% and we could not be more committed to continuing to increase the capital we return to our shareholders,” Corbat added.