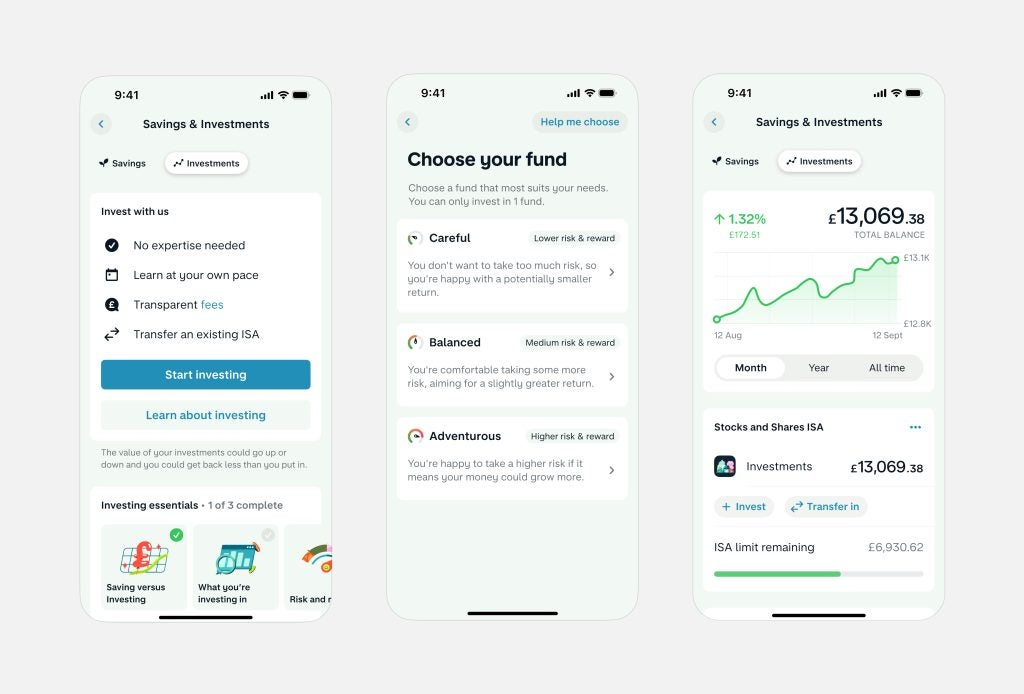

Customers can sign up for a waitlist for the Monzo Investment product, which enables them to select the risk profile which most suits them and invest as little as £1 in one of three multi-asset funds provided by BlackRock.

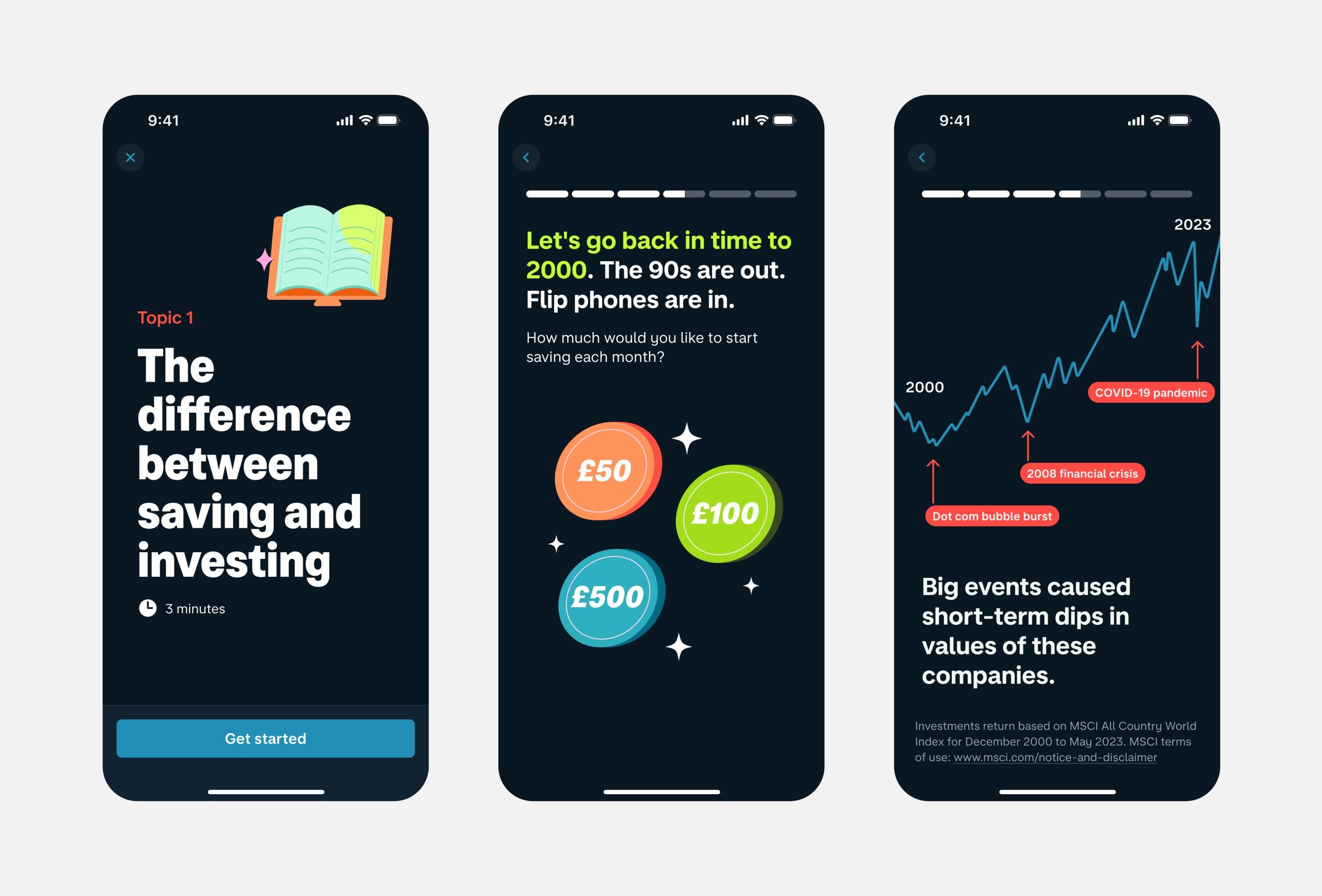

Users receive guidance and information throughout their effortless product journey, providing them the assurance they need to make the right decisions.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Moving forward, users will be directed to a series of screens where they may learn more about the product and select one of three funds that BlackRock has carefully chosen for them based on varying levels of risk.

The three BlackRock-managed funds are:

- Careful

- Balanced

- Adventurous

A low-risk, low-return fund is at the “careful” end of the scale, followed by a “balanced” fund with medium-high risk and reward and an “adventurous” fund that focuses on greater-risk allocations with significantly higher potential returns.

As Monzo develops into the one platform where users can manage their whole financial lives, Monzo Investments is the next chapter.

Why is Monzo getting into investments?

According to a study by Monzo, 57% of individuals said they’d feel better in charge of their finances if they could monitor their spending, savings, and investments in one location, which is now possible through Monzo.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOver the next few weeks, the product will be available to all eligible customers.

Furthermore, it comes at a time when fresh YouGov data indicates that over 70% of the country are unaware of where to turn for a solution that makes investing approachable and easy.

Monzo CEO, TS Anil, said: “I’m so excited to get this product into the hands of customers, at a time we know they want to invest in longer-term financial goals but don’t know where to turn or how to get started. With Monzo, they now have investment expertise at their fingertips, can invest as little as £1 and track progress alongside their saving, spending, and borrowing in the Monzo app. This is an important next step on our mission to make money work for everyone as we put the Monzo stamp on another corner of finance that is perceived as complex and inaccessible. Millions of people in the UK feel investing isn’t for them – it is now.”

Sarah Melvin, head of UK, BlackRock added: “BlackRock is thrilled to have been selected by Monzo to support their customers as they become investors, helping more and more people experience financial wellbeing. We know that for many, taking the first steps into investing can be daunting and it’s often difficult to know where to begin. That’s why I’m so proud and excited to bring our global investment expertise to millions of people in the UK through Monzo’s app, giving them the ability to invest in a simple, affordable, and accessible way.”