Family offices are increasingly recognising private equity co-investments as a means of generating strong returns while exercising greater control over their portfolios, although this approach is not without its challenges. Paul Golden finds out more…

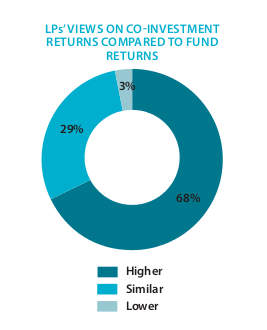

Enthusiasm for private equity co-investment is rising, and recent research explains why. Preqin’s 2017 Global Private Equity & Venture Capital Report found that in excess of two thirds (68%) of investors had generated higher returns from co-investments than from fund investments.

According to a Campden Wealth and and investment firm KKR report, Private Equity and Co-Investing for Family Offices published in June 2017, private equity makes up 21% of a family office portfolio on average – the highest proportion of any asset class. Also, eight in 10 family offices intend to maintain or increase their allocations to this asset class going forward. More than half of respondents to the report also expect to increase their commitment to private equity co-investment, which accounts for 3% of the average family office portfolio. Co-investments, club and office-to-office deals represent 14% of private equity allocations.

According to Jim Burns, head of the individual investor business at KKR, there are four primary factors driving family offices to co-invest in private equity transactions:

- Attractive return potential, especially if offered with no fees

- The ability to diligence a single asset

- J-curve mitigation in the immediate deployment of capital

- If the capital commitment to the transaction is sizable enough, the family office may be able to obtain certain governance rights

He explains that families typically seek clear alignment with the general partner and an ability to create/maximise influence over the ongoing management of the investment.

Drivers of co-investment

As the family office industry becomes more professionalised and other market participants (private equity funds, deal intermediaries) become more familiar with family office investors across a wider spectrum of transaction size, the receptiveness of private equity sponsors, investment bankers and sellers to family office participation in transactions has increased.

Family offices are now investing in a wide range of co-investment transactions, from investing as members of equity syndicates formed for participation in leveraged private equity buyouts to joining the debt syndicates as a lender, to participating in venture capital equity syndicates, according to Daniel Berick, Americas chair of the global corporate practice at Squire Patton Boggs.

“The co-investment strategy allows a family office that is not prepared to make direct investments on its own (whether because of investment concentration concerns, limited internal investment team resources/expertise or access to deal flow) to achieve the potential of a higher return than it might realise from investing solely through the fund as a limited partner,” he says.

“We see family offices that want to co-invest with other family offices, but then someone usually needs to register as a registered investment advisor if a particular family is helping pool the investments and provide reporting,” observes Ken Eyler, who oversees the family office group at Arthur Bell.

If each family directly invests separately, which is possible, the collaborative and efficiency benefits of co-investing are usually lost and there remains a regulatory risk, he adds. “When a family office co-invests with a private equity manager, they appreciate the ability to invest alongside the manager to gain exposure to more deals and reduce regulatory burdens.”

Direct investments are a major focus for family offices – particularly in businesses that may be within the same sector or an adjacent industry as the family’s current or former operating business and primary source of wealth, explains Raelan Lambert, managing director, Pavilion Alternatives Group.

“We have seen some families target investments with managers who have large families as their primary investor base as a means to further develop relationships and share best practices with like-minded families,” she says.

“We have also seen families align themselves with larger families who have more extensive resources to support targeted co-investment vehicles. The best option is for a family to stick with what they know and where they can create a new opportunity or an advantage, which may or may not include co-investing,” adds Lambert.

Arnold & Porter Kaye Scholer investment management practice co-head, Stephen Culhane, notes that co-investments afford family offices the ability to fine tune their private equity portfolios, adding exposure to specific names, sectors or regions and allowing the family office to capitalise on its expertise in particular sectors or verticals.

“This balancing, or overweighting, as applicable can have a meaningful impact on the family office’s ability to outperform particular benchmarks or indices,” he explains.

According to Culhane, indirect participation through an aggregator (usually set up as a limited partnership) has the benefit – to the sponsor – of preserving their control over the deal and reduces the co-investor’s potential exposure to any deal related liabilities.

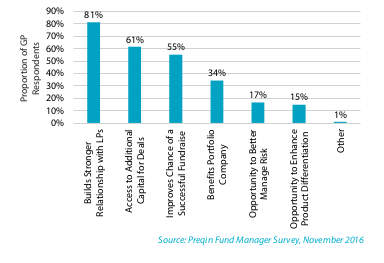

General Partners’ (GP) perceived benefits of offering co-investment rights

Cost reduction and beyond

Suzanne Lupton, director of co-investment at Maven Capital Partners agrees with Lambert’s view that the decision to co-invest is about more than cost reduction.

“We believe that both funds and deal-by-deal co-investing have their place in establishing a balanced family office private equity portfolio. It is fair to say that in making investments on a discretionary basis fees may be lower than a fund. However, this is not truly like-for-like.

“It is also fair to say that some managers do not offer co-investment to a client unless they invest in their fund, or at all. As a result we believe a broad portfolio of direct investments made on a discretionary basis, alongside a number of fund commitments, is the optimum strategy for a family office investor.”

Burns warns that prioritising cost savings to any extreme is a dangerous proposition.

“Family offices must be rigorous in assessing whether they have made the requisite investment in resources to be effective at PE co-investing over time. This requires building a team able to source, diligence and manage a portfolio of co-investments, which means that the family must be willing to deploy sufficient capital to build a diversified portfolio in the same way a private equity fund would provide diversification,” explains Burns.

He suggests that this team needs to be within several hundred basis points as good as a fully established private equity firm on at least 10 and likely more than 20 deals.

“We have also observed a level of cyclicality to co-investing, where families do more when markets are strong, deal flow is plentiful and existing private equity investments are performing well but tend to pull back when markets get choppy, deal flow dries up and the existing private equity investments become more challenged,” concludes Burns.

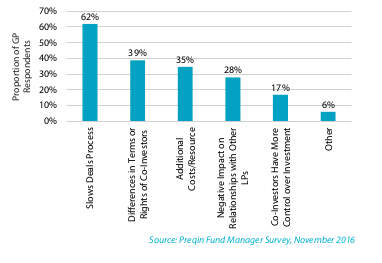

General Partners’ (GP) perceived disadvantages of offering co-investment rights