Unsurprisingly, the coronavirus pandemic has changed how the private banking and wealth management industries work: a sector highly dependent on relationships can no longer meet people face to face. Has this created an opportunity to adapt and evolve Patrick Brusnahan reports

The sector is entering a ‘new normal’ as it attempts to remain in contact with its clients. The move towards more digital services was arguably inevitable, but digital is now quite inarguably here.

Surprisingly, the global pandemic and digital changed have come at no engagement cost to certain private banks.

In fact, according to a report from Oliver Wyman and Morgan Stanley, After the Storm, digital interaction has increased for leading wealth managers. In some case, it has increased tenfold during the pandemic.

Furthermore, digital research consumption has gone up by four or five times, and there has been a three or fourfold increase in client-facing webinars. Virtual meetings with clients have either doubled or tripled in number at leading wealth managers.

The report states: “The market turmoil prompted by Covid-19 has highlighted the clear value clients place on high-quality human advice. Even prior to the Covid-19 outbreak, more than 85% of HNW investors polled in a proprietary Oliver Wyman survey said they valued the ability to talk with an adviser, versus less than one-third who valued advice delivered via robo-advisers. The surge in complexity, diversity and urgency of client requests during Covid-19 has only underscored the value of having access to human advisers.”

However, private bankers cannot rest on their laurels. While digital has helped during a strange situation, they should not revert to “business as usual”.

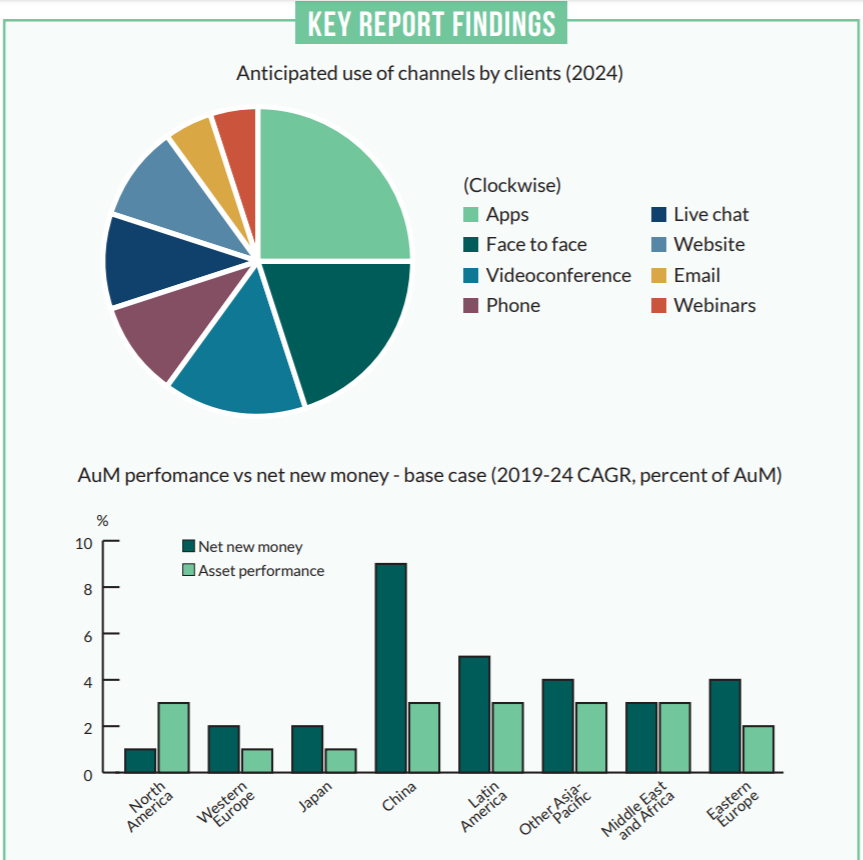

Customers will continue to want interaction in all of its forms and firms should lean into omnichannel, rather than favouring the traditional.

The report adds: “Wealth managers need to develop a clear channel strategy that reflects the client personas they serve, including their needs and channel preferences, and prioritise actions to improve the client experience accordingly.”

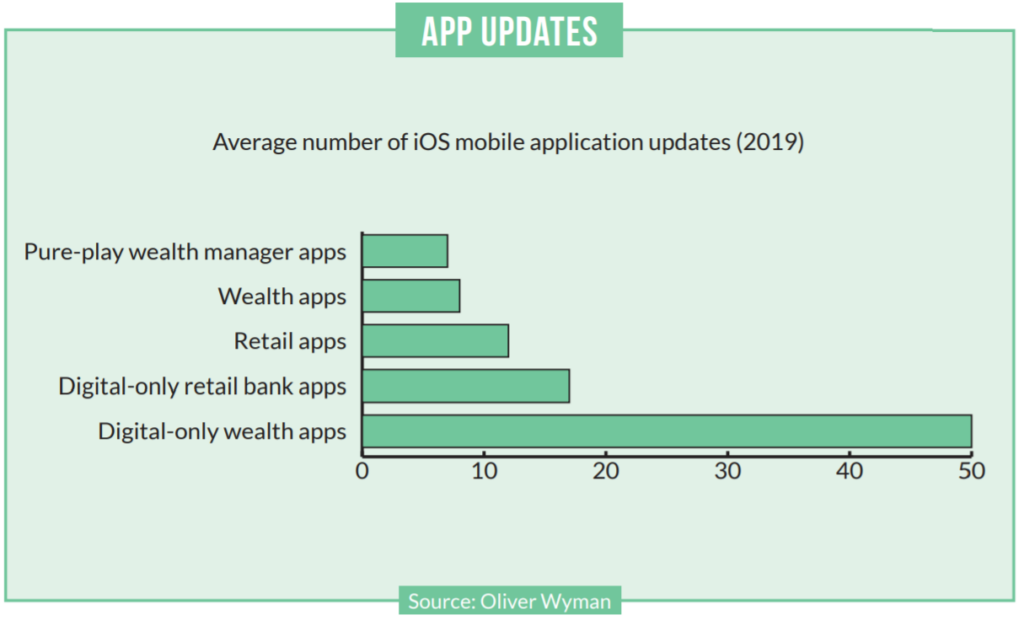

The research found that mobile apps by wealth mangers are updated only half as frequently has retail banking apps, and only 20% as frequently as digital-only challengers.

As margins are put under strain, a full digital transformation may be unfeasible, but a digitally focused strategy needs to be made. Prioritising use cases that are the most valued and engaging for clients is the way forward.

Normality

Normality

Coronavirus has forced many industries to think differently. The financial sector – hardly a stranger to crises – is the middle of developing a way forward.

Speaking to PBI, Kai Upadek, partner at Oliver Wyman, believes that clients will show the way. He says: “What makes Covid-19 different to past crises is very much that this is not a financial crisis. It has equally impacted more or less the entire planet at the same time, and forced everyone into different working procedures. It has basically enforced remote working protocols which, for private banking or wealth management, translated into clients.

“Even clients that many thought before were quite reluctant or resistant to remote interactions were actually this time around quite keen and quite capable of switching through to digital interactions with their respective wealth managers.”

He adds: “We’ve seen digital engagement increasing seven to 10 times across all channels, and that is most certainly something that we thought was surprising as well.

“When we look at the general age demographics of the clients of these wealth managers, they tend to be on average mid-60s, depending on the bank: generally, a demographic that many thought would take longest to fully digitise, simply given those demographics. That’s a key finding for us. It shows there will be a new normal in the sense that clients, who hadn’t previously interacted with their wealth managers digitally, have now proven that they’re capable and willing to do so.”

However, Upadek makes it clear that digital will never replace the relationship manager. Instead, they will be moved to more of a “quarterback” role that helps orchestrate a number of different interaction channels. As a result, the client gains more choice and the bank keeps the client happy.

Strategy

The report provides certain strategies to help firms cope with the “new normal”. One of these is to accept the situation is occurring and move quickly to develop an omnichannel advice-delivery model. However, was this always going to happen?

“We have seen an industry where any wealth manager of global scale had already multiple digitisation initiatives in place,” Upadek explains.

“Many wealth managers have commented that one of the reasons for digitisation drives was operating model efficiency and making sure that each client segment is served profitably. That logic was very much a supply-side logic. Whereas now, obviously, we have that additional demand pool in the industry. It is going to lead to a reprioritisation of some digital use cases that wealth managers themselves may have not necessarily had equally prioritised.”

Upadek understands there will be an acceleration has many wealthy clients are multi-banked. As a general rule, the higher up in the wealth spectrum, the more banking relationships the individuals have. Some firms will be further along the digital journey, and their customers will demand that level from all their providers.

Three main strategies are laid out in the report to defend business economics:

- Tactical cost cuts (short term): there remains room for cuts through the removal of excessive management layers, optimising the number of relationship managers, and reducing front office support;

- Streamlined group service delivery (short to medium term): can be achieved in many second line functions such as finance, human resources, legal, and operations, and

- Transformation the operating model (medium term): overhauls and transformation projects to operating models and associated IT infrastructure driving both cost savings and incremental revenues. However, these are costly and complex.

On the dangers of having an excessively short-term outlook, Upadek says: “Depending on the type of organisation, it will have already exploited some tactical or short-term measures throughout the – in some instances 10-plus-year – cost journeys it has been on already.

“If you look at some leaders in the operating model efficiency space in wealth management, they have literally been focusing on efficiency drivers since the global financial crisis. For those players in particular, there’s still always something you can do more in terms of short term. There’s always headcount and direct spend to consider. The tactical bucket will vary significantly in size, depending on which player you look at.”

The “tactical bucket” and money set aside to deal with these issues can vary wildly from institution to institution.

“At least for a significant subset of the global firms in particular, the tactical bucket is simply not large enough to meaningfully react to Covid-19’s pressures. By default, that means they will simply have no choice but to look at some of the more structural, and hence generally longer-to-implement, costliness,” Upadek explains.

While digital transformation is often perceived to be the silver bullet to banking’s problems, Upadek remains unsure about its effectiveness.

He says: “I’m often times quite sceptical whether these larger-scale operating model transformations will actually deliver on their promises. We’ve all seen over previous years that some of the larger undertakings have stumbled; some have run significantly over cost over time. That is obviously something that investors now have front and centre in their minds when they start questioning management on these larger-scale programmes.

“In order to regain investor confidence that you can deliver on these larger-scale transformations, there are a number of ways to go about it.

“On the one hand side, in the past, wealth managers have not done the best job of keeping investors or shareholders abreast of progress throughout the transformation journey. They’ve announced the programme, and then the next thing reported was either a successful completion or any roadblocks.

“But they haven’t necessarily done a good job of sort of outlining a set of key performance indicators that would allow shareholders to better understand where they stand with those larger-scale transformations and whether there’s any yellow or red lights in the foreseeable future.”

Ultra-high net worth

The report states: “Wealth managers should significantly expand their private market offerings to recapture UHNW wallet lost to disintermediation over previous years. By 2024 we expect illiquid/alternatives UHNW assets to increase to $24trn from $16trn today, representing an annualised growth rate of 8%. The opportunity is lower for HNW, given suitability challenges and reduced HNW interest in alternatives following Covid-19.”

Is it that easy to claim the UHNWIs present in the market?

Upadek concludes: “We think that wealth managers that are part of broader financial services organisations should be in a position where, if they see this as a cross-divisional collaboration opportunity, they can actually put in place a quite compelling intent proposition for their ultra-wealthy investors.

“On one side, they should be able, through their advisory or broader investment banking franchise, to source interesting deals. There are opportunities across a whole host of asset classes.

“When we look at private markets and with many of these assets, banks will already have been in touch throughout with other parts of the banking business, and just not above. So creating access opportunities is very much in the DNA of these groups. At the moment, the proposition doesn’t come together. These access opportunities aren’t necessarily in a structured and scalable way made available to wealth management clients of the same institutions.”